How Trump’s actions impacted defense shares over the past week

Trump's Statements Shake Up U.S. Defense Stocks

This week, President Donald Trump stirred up the investment landscape for American defense companies. He initially criticized these firms for slow production and inadequate maintenance of military hardware, while also highlighting their large payouts to shareholders through dividends and stock repurchases. Despite these critiques, Trump later unveiled a proposal for a $1.5 trillion defense budget for 2027, a significant increase from the $901 billion allocated for 2026.

Market Reaction

Following Trump's remarks, shares of major defense contractors such as Lockheed Martin, General Dynamics, Northrop Grumman, and RTX (Raytheon's parent company) initially declined. However, optimism returned to the sector as investors anticipated the potential for more substantial government contracts in the future.

Key Points from Trump's Critique

-

Dividends and Stock Buybacks:

Trump posted on Truth Social that while the U.S. produces unmatched military equipment, defense companies are prioritizing large shareholder payouts over reinvesting in their facilities and technology. He stated, "This will no longer be tolerated," and pledged to halt dividends and buybacks for defense firms until these issues are addressed.

-

Executive Compensation:

Trump also called out what he described as excessive executive pay in the defense sector. He insisted that leaders must focus on building new, modern production facilities and maintaining advanced equipment. Until these improvements are made, he proposed capping executive compensation at $5 million—a figure he noted is far less than current pay levels.

-

Defense Budget Proposal:

Trump argued that, given the current global climate, the U.S. military budget for 2027 should be increased to $1.5 trillion. He believes this investment is necessary to create a "Dream Military" that ensures national safety and security.

Stock Performance Snapshot

- Lockheed Martin rebounded 4.6% after a previous 4.8% drop.

- Northrop Grumman gained 3.5% following a 5.5% decline.

- General Dynamics rose 2.4% after a 4.2% loss the day before.

- RTX, which owns Raytheon, increased by 0.7% after a 2.5% decrease.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SUI Weathers Extended Shutdown with Minimal Price Impact

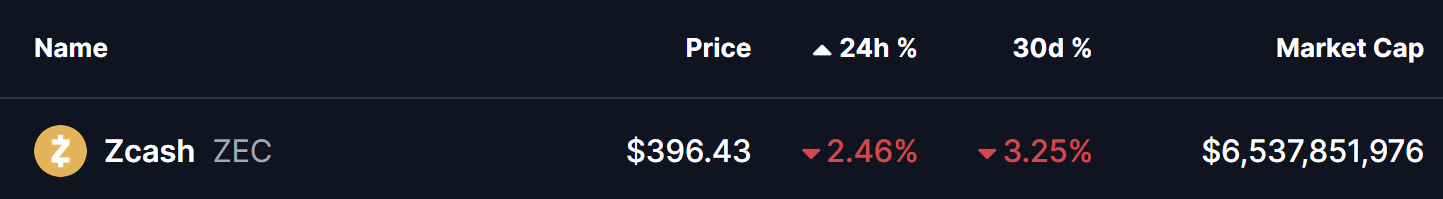

Is Zcash (ZEC) In Bears Control? This Emerging Bearish Pattern Formation Suggest So!

South Korea to negotiate with the US for favourable chip tariff terms, official says