Crude Prices Surge Due to Increased Energy Consumption and Index Fund Purchases of Oil Futures

Oil and Gasoline Prices Surge on Positive Economic Signals

February WTI crude oil (CLG26) climbed by 1.77% today, while February RBOB gasoline (RBG26) advanced 2.57%.

Both crude oil and gasoline prices experienced significant gains following stronger-than-expected US economic data, which points to robust energy demand. Additionally, the upcoming annual adjustment of commodity indexes is expected to drive increased buying of oil futures, further supporting crude prices. However, a stronger US dollar—reaching a four-week high—and recent developments such as the US easing some sanctions on Venezuelan oil exports, along with President Trump's announcement that Venezuela's interim government will release up to 50 million barrels of high-quality oil to the US, have introduced some downward pressure.

Latest Updates from Barchart

Crude oil prices are benefiting from expectations that the annual rebalancing of major commodity indexes will prompt substantial purchases of oil futures. Citigroup estimates that the BCOM and S&P GSCI indexes—the two largest in the sector—will attract $2.2 billion in new futures contracts over the coming week as part of this process.

Recent US economic indicators have been favorable for the energy sector. December saw Challenger job cuts drop 8.3% year-over-year to 35,553, the lowest in 17 months. Initial weekly jobless claims increased by 8,000 to 208,000, which is still better than the anticipated 212,000, reflecting a resilient labor market. Additionally, nonfarm productivity for the third quarter rose by 4.9%, nearly matching expectations and marking the largest increase in two years.

On Wednesday, crude prices faced downward pressure after the US Energy Department announced plans to gradually ease sanctions, allowing Venezuelan oil and petroleum products to reach international markets. This move could increase global oil supply, with Venezuela currently ranking as OPEC's twelfth largest producer.

Worries about energy consumption have also weighed on crude prices, especially after Saudi Arabia reduced the price of its Arab Light crude for February deliveries to customers for the third consecutive month.

Morgan Stanley has forecasted that the global oil surplus will grow further and reach its peak by mid-year, which could push prices down. The bank lowered its first-quarter crude price projection to $57.50 per barrel from $60, and its second-quarter estimate to $55 from $60 per barrel.

Additional Market Insights

According to Vortexa, the volume of crude oil stored on tankers idle for at least a week dropped by 3.4% to 119.35 million barrels for the week ending January 2.

China's appetite for crude remains strong, providing price support. Kpler data indicates that China's crude imports in December are expected to rise by 10% month-over-month, reaching a record 12.2 million barrels per day as the country rebuilds its reserves.

OPEC+ recently reaffirmed its decision to halt production increases in the first quarter of 2026. At its November 2025 meeting, the group announced a production hike of 137,000 barrels per day for December, but will pause further increases in early 2026 due to a projected global surplus. The International Energy Agency (IEA) predicted in October that the global oil surplus could hit a record 4 million barrels per day in 2026. OPEC+ is working to restore the 2.2 million barrels per day cut made in early 2024, with 1.2 million barrels per day yet to be reinstated. In December, OPEC's crude output increased by 40,000 barrels per day to 29.03 million barrels per day.

Over the past four months, Ukrainian drone and missile strikes have targeted at least 28 Russian refineries, restricting Russia's ability to export crude and tightening global supplies. Since late November, Ukraine has intensified attacks on Russian tankers, with at least six incidents reported in the Baltic Sea. New US and EU sanctions targeting Russian oil companies, infrastructure, and tankers have further limited Russian exports.

Last month, the IEA projected that the global crude surplus will expand to a record 3.815 million barrels per day in 2026, up from a four-year high of over 2 million barrels per day in 2025.

OPEC also revised its third-quarter global oil market outlook last month, shifting from a deficit to a surplus as US output surpassed expectations and OPEC increased production. The organization now anticipates a 500,000 barrel per day surplus for Q3, compared to the previous month's forecast of a 400,000 barrel per day deficit. The EIA also raised its 2025 US crude production estimate to 13.59 million barrels per day, up from 13.53 million previously.

The latest EIA report revealed that as of January 2, US crude oil inventories were 4.1% below the five-year seasonal average, gasoline stocks were 1.6% above average, and distillate inventories were 3.1% below the seasonal norm. US crude production for the week ending January 2 slipped 0.1% to 13.811 million barrels per day, just under the record set in early November.

Baker Hughes reported that the number of active US oil rigs rose by three to 412 in the week ending January 2, rebounding from a 4.25-year low of 406 rigs in late December. Over the past two and a half years, the US rig count has dropped sharply from a 5.5-year high of 627 rigs recorded in December 2022.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

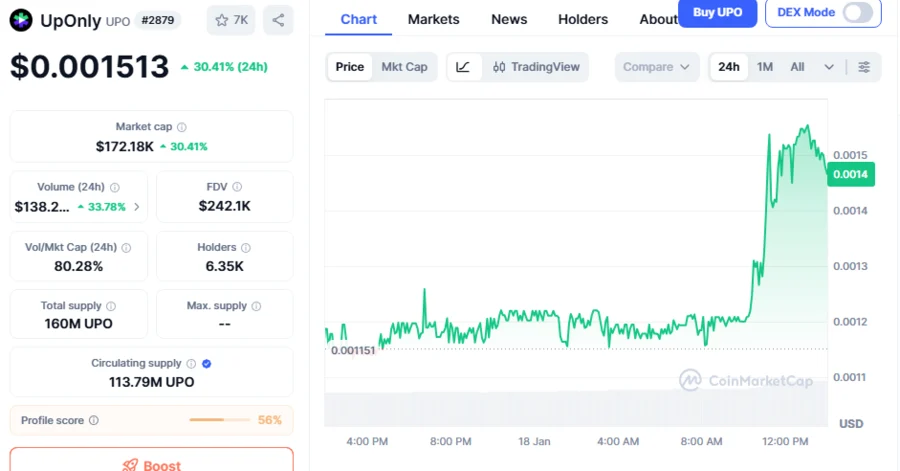

UPO Climbs Above $0.001500, Sets to Explode Amid Incoming Mega Pump, Whale Accumulation: Analyst

Ethereum staking just hit a $118B record at 30% of all coins, but one whale might be skewing the signal

Bullish Analyst Tom Lee Says, ‘Ethereum Will Outperform Bitcoin,’ Explains His Expectations