How is Baker Hughes Co Viewed by the Market?

Baker Hughes Co Short Interest Update

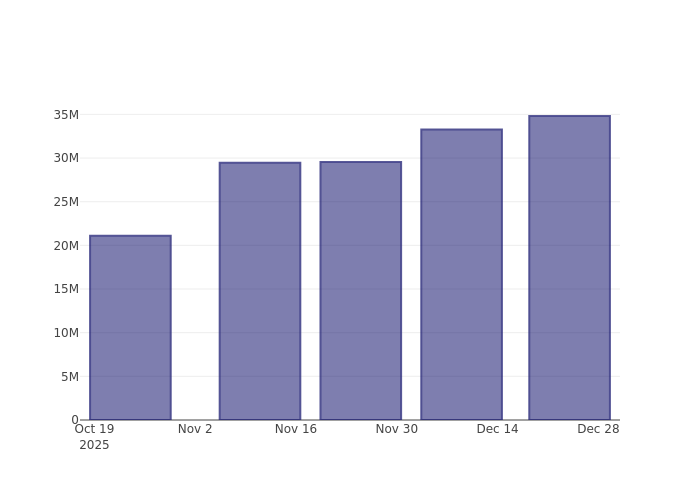

Recently, the proportion of Baker Hughes Co (NYSE: BKR) shares sold short has climbed by 4.82% compared to the previous report. Current exchange data shows that 34.82 million shares are being shorted, representing 4.57% of the company’s available float. At the current trading pace, it would take traders an average of 5.13 days to buy back all these shorted shares.

Understanding Short Interest

Short interest refers to the total number of shares that have been borrowed and sold by traders who anticipate a decline in the stock’s price, but have not yet repurchased them. Short selling allows investors to profit if the stock price drops, but exposes them to losses if the price rises instead.

Monitoring short interest is valuable because it reflects investor sentiment toward a stock. A rising short interest typically signals increasing pessimism, while a decline may indicate growing optimism among investors.

Baker Hughes Co Short Interest Trend (Last 3 Months)

The chart above illustrates that the percentage of Baker Hughes Co shares sold short has increased since the previous update. While this does not guarantee a near-term decline in the stock price, it is important for investors to recognize the growing volume of short positions.

How Baker Hughes Co Compares to Its Peers

Comparing a company’s short interest to that of similar businesses is a common practice among analysts and investors. Peers are typically companies with comparable industry focus, size, age, and financial structure. You can identify a company’s peer group by reviewing its 10-K filings, proxy statements, or conducting your own research.

According to Benzinga Pro, the average short interest as a percentage of float among Baker Hughes Co’s peers is 8.34%. This means Baker Hughes Co currently has a lower short interest than most comparable companies.

Baker Hughes Co Stock Snapshot

- Symbol: BKR

- Company Name: Baker Hughes Co

- Current Price: $50.17

- Change: +2.72%

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zero Knowledge Proof: The $100M Self-Funded Powerhouse Targeting a Historic $1.7B Presale Auction

How crypto is being devoured by TradFi, killing Satoshi’s dream by rewarding centralization

Trump Considers Wall Street’s Rieder for Leading Fed Position

Indian crypto industry calls for favorable tax treatment in 2026 budget