Here's how the Trump 2.0 tariffs have become even more complicated — and the extent to which the Supreme Court might reverse them

US Tariff System Grows Even More Complicated in 2026

As 2026 begins, US importers are facing an unprecedented level of complexity in the nation’s tariff system. The amount of paperwork and regulatory hurdles has surged, especially with the return of Trump to the presidency.

The primary resource for importers, the Harmonized Tariff Schedule of the United States, serves as the definitive guide for determining tariff obligations. The latest edition for 2026 now exceeds 4,500 pages—over 100 pages longer than last year and a staggering 800 pages more than in 2017, when Trump first assumed office.

This ballooning document is just one sign of the mounting challenges businesses face, compounded by uncertainty as the Supreme Court deliberates which parts of these new regulations will withstand legal scrutiny.

With a Supreme Court ruling expected as soon as Friday, market volatility is already on the rise. Beyond the sheer complexity, the financial impact is significant: the Yale Budget Lab estimates that the average tariff rate for consumers stands at 16.8%.

President Trump addresses House Republicans on Tuesday in Washington, D.C. (Alex Wong/Getty Images)

Key Areas of Increased Tariff Complexity

Both businesses and US ports—where tariffs are assessed—have long argued that the growing intricacy of tariff regulations, in addition to the costs themselves, is becoming an ever-greater burden.

Scott Lincicome, vice president at the Cato Institute’s Trade Policy Studies, recently analyzed the issue and concluded that navigating the US tariff system has shifted from being relatively straightforward to overwhelmingly complex, imposing enormous economic costs on businesses.

According to Lincicome, there are now 17 distinct tariff measures affecting major US imports, compared to just three in 2017.

Much of the recent change is found in Chapter 99 of the tariff schedule, which starts on page 3,320 and details "temporary modifications established pursuant to trade legislation"—largely a result of Trump’s executive actions over the past year.

The document meticulously catalogs a vast array of products—from ignition coils to hydraulic backhoes—each linked to specific statistical codes and corresponding tariff rates.

Lincicome also highlighted that while the direct cost of tariffs is substantial, the regulatory burden is equally significant, though less frequently discussed.

Supreme Court Decision Could Reshape Tariff Policy

All eyes are now on the Supreme Court as it considers the legality of Trump’s use of emergency tariff powers. The outcome could have dramatic effects on financial markets.

The case, Learning Resources, Inc. v. Trump, revolves around the International Emergency Economic Powers Act (IEEPA) of 1977, which grants the president broad authority during economic emergencies but does not explicitly mention tariffs as a tool.

At stake is a significant portion of government revenue—over $200 billion in duties have been collected since early 2025, with the Tax Foundation estimating that about 55% of that comes from tariffs whose legality is now under question.

Regardless of the Supreme Court’s decision, much of the tariff complexity will remain. Tariffs imposed under other laws, including those affecting steel, automobiles, furniture, and lumber, accounted for the remaining 45% of last year’s tariff revenue and are not being reviewed by the Court.

Shipping containers at the Port of Los Angeles in December 2025. (Juliana Yamada/Los Angeles Times via Getty Images)

If the Court rules against Trump, hundreds of entries in the tariff schedule may need rapid revision—there were more than 30 updates in 2025 alone—creating further short-term challenges for businesses. Trump’s administration has pledged to swiftly introduce new tariffs should the current ones be invalidated.

Senator Maria Cantwell speaks with small business owners about tariff impacts outside the Supreme Court in Washington, D.C., September. (Beiyi Seow/AFP via Getty Images)

Potential for Refunds and Legal Battles

The possibility of refunds is also on the table. Should the Supreme Court find that certain duties were collected unlawfully, billions could be returned to affected companies. Many businesses have been preparing for this outcome since arguments began in November, despite ongoing uncertainty.

Costco (COST) recently made headlines as the largest company to join lawsuits against the Trump administration, aiming to secure eligibility for potential refunds.

However, experts warn the refund process will likely be lengthy and complicated. Henrietta Treyz of Veda Partners advised clients that any refund process would involve numerous lawsuits and delays, making a quick resolution unlikely—even if the Supreme Court overturns the tariffs.

Ben Werschkul reports from Washington for Yahoo Finance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

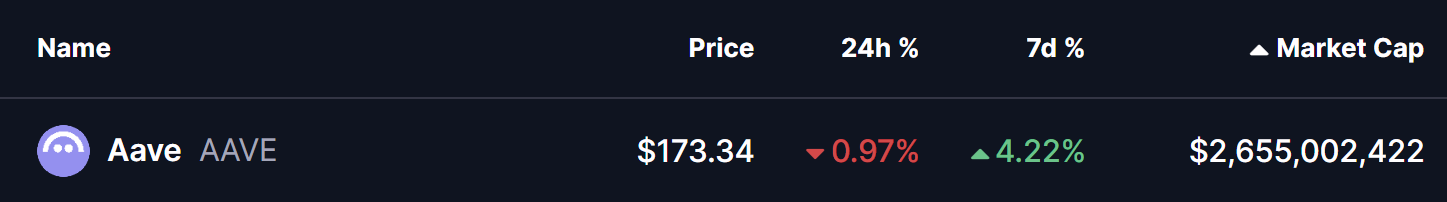

Is Aave (AAVE) Setting Up for a Potential Breakout Next Week? Key Emerging Pattern in Focus

Altcoin XRP Setting Up for the C Wave Push, Ripple’s Native Asset Prepares for Bullish Ascent

Sequoia to join GIC, Coatue in Anthropic investment, FT reports