What are the broader market trends as we approach Friday’s trading session?

Friday Market Overview: Key Themes and Developments

-

The US December employment report is set for release later Friday morning, which will likely spark intense discussions among commentators—often split along political lines rather than focusing on economic fundamentals.

-

Before dawn on Friday, the commodity sector was generally trending upward, with metals and energy commodities leading the gains.

Related Updates from Barchart

-

The next major data release anticipated by many in the industry is the USDA's January WASDE report, scheduled for Monday.

Morning Recap: Focusing on the Broader Economic Picture

Friday morning’s market conversations largely centered on macroeconomic trends, despite some voices urging attention to more minor, distracting details. The suggestion seemed to be that it’s easier to ignore the broader context, but with significant government data releases imminent, keeping an eye on the big picture is timely.

At 8:30 ET on Friday, the December US employment report will be published, including figures for job growth, unemployment, and hourly earnings. Consensus estimates suggest 73,000 new jobs (up from November’s 64,000), an unemployment rate of 4.5% (compared to 4.6%), and a 0.3% increase in wages (versus 0.1% previously). My main interests in this data are: 1) how actual results compare to forecasts, 2) the extent of revisions to prior reports, and 3) the inevitable, often politically charged, debates among analysts.

There is also speculation about a potential Supreme Court ruling on the president’s tariffs, though historically, presidential actions have not been heavily influenced by court or congressional opinions. Meanwhile, the main topic in energy markets has been this week’s rally in Brent and WTI crude oil prices.

Corn Market Update

Overnight into Friday, corn prices edged lower, with the March contract down 0.75 cent after a narrow trading range and about 12,000 contracts traded. The next significant event for grains is Monday’s WASDE report from the USDA, which typically triggers notable market activity. However, seasoned investors recognize that these reports, while influential in the short term, do not alter the underlying supply and demand fundamentals.

As of Thursday night, the National Corn Index ($CNCI) stood at $4.0966, placing it in the lower 41% of its price range since 2019 and below the previous five-year end-of-month lows. The data continues to show that US corn supplies exceed demand. Additionally, the May-July futures spread at the end of December covered 30% of full commercial carry, up from 25% at November’s close.

Soybean Market Insights

Soybeans were modestly higher at the time of writing, with the March contract up 4.75 cents after a session high of 7.75 cents and trading volume of 12,500 contracts. Notably, CME data showed an increase in total open interest by 4,630 contracts, despite declines in January, March, and May contracts, while July open interest rose by nearly 6,300 contracts.

The May-July futures spread widened by 1.5 cents on Thursday, closing at 13.0 cents and covering 48% of full commercial carry, suggesting that commercial traders are rolling short positions forward, anticipating weaker demand for US soybeans next summer. At December’s end, this spread covered 49%, up from 29% at November’s close, indicating growing confidence in Brazil’s 2026 crop. The National Soybean Index ($CNSI) was $9.9023 on Thursday night, up about 21 cents for the month and above its previous five-year end-of-January low.

Wheat Market Overview

Wheat prices were slightly lower before dawn Friday, with the March HRW contract down 3 cents on light volume. The nearby SRW contract was off 2 cents, and March HRS was down 0.5 cent. Overall, trading activity was subdued across wheat markets.

Fundamentally, the wheat sector remains unchanged, with noncommercial traders adjusting positions but no significant shifts in supply and demand. Thursday night’s National Cash Indexes were $4.6297 (CSWI), $4.6039 (CRWI), and $5.5534 (CRSI), all below their respective five-year end-of-January lows and also trailing the ten-year averages. The takeaway: low cash prices reflect that supply continues to outpace demand in the US wheat market.

Additional Notes

- Commentary referenced on CNBC’s Squawk Box Europe.

- Many industry commentators and analysts place significant weight on government data releases.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Best Crypto to Buy: PEPE Consolidates, Etherna Pepe Stalls, While ZKP Targets 100x–10,000x

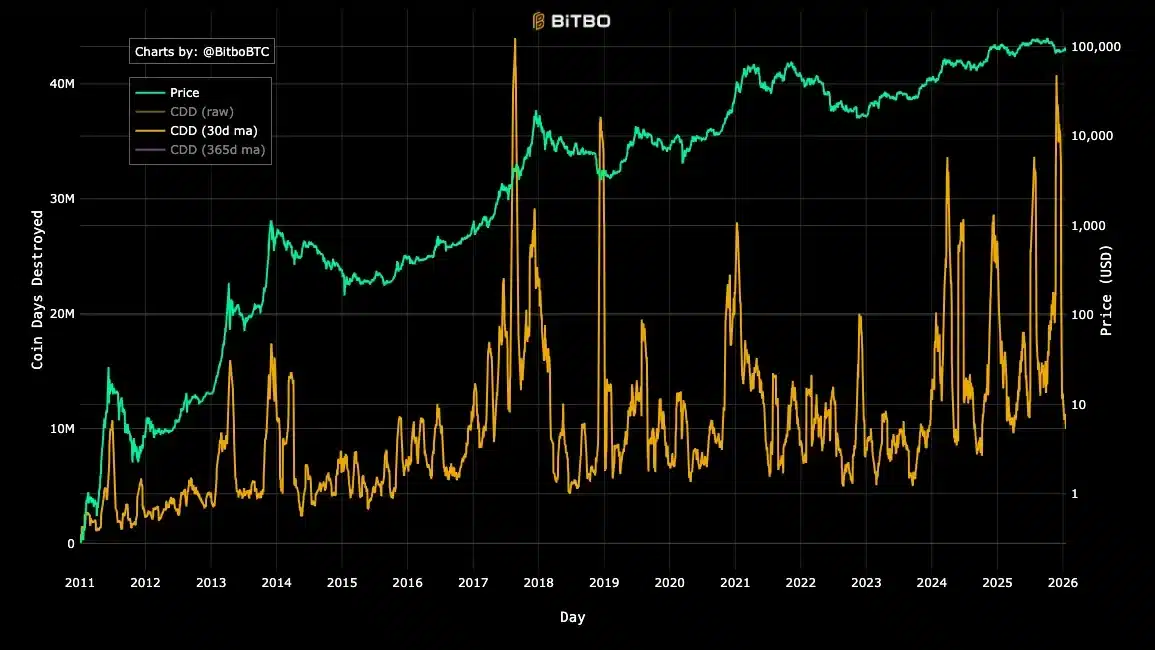

A 12-year Bitcoin OG is selling – But the market isn’t panicking

Mark Cuban's investment has played a significant role in reshaping Indiana's football program