Andreessen Horowitz’s impressive new $15 billion fund highlights the areas where the firm identifies the most significant potential

Andreessen Horowitz Secures Over $15 Billion in New Funding

Andreessen Horowitz has recently amassed more than $15 billion in fresh capital.

Take a moment to reflect on that figure. While such sums are not unheard of in the venture capital world, it remains a significant amount. This milestone highlights how a16z, once a disruptive newcomer in 2009, has evolved into one of the most prominent and debated names in venture capital. The firm’s reputation extends beyond its early investments in companies like Skype, Facebook, and a16z also pioneered a new approach to branding within the VC space during the 2010s—a strategy that has since become standard practice.

How the $15 Billion Will Be Allocated

- The fifth growth fund receives $6.75 billion.

- The fifth biotech and healthcare fund is allocated $700 million.

- Both the second apps fund and the second infrastructure fund are each given $1.7 billion.

- American Dynamism, a major force in the defense technology sector, is assigned $1.176 billion—a figure that may seem modest given the current surge in defense tech interest.

An additional $3 billion is directed toward a category labeled “other venture strategies.” According to an a16z representative, this includes a mix of not-yet-launched fund strategies and opportunities such as institutional separately managed accounts (SMAs), which are increasingly popular among wealthy individuals and family offices seeking exposure to tech investments.

A16z’s Influence and Ambitions

In recent years, a16z has become a polarizing presence in the tech industry, notably for its public support of Trump ahead of the 2024 election. The firm’s latest fundraising effort also carries geopolitical implications. In a blog post, cofounder Ben Horowitz stated that the intention is to back technology that is “dynamic, innovative, and fiercely competitive with China.” (The firm declined requests for interviews with Horowitz or cofounder Marc Andreessen.)

Context: Is $15 Billion Really Surprising?

Deploying $15 billion is no small feat, but is it truly unexpected? Not really. Venture capital firms are raising increasingly large funds to keep pace with the artificial intelligence boom—global dealmaking in 2025 reached $512.6 billion, according to PitchBook. Other firms have also recently closed substantial rounds, such as Lightspeed’s $9 billion raise.

Historically, this is not without precedent. During the height of the zero-interest-rate policy (ZIRP) era in 2022, Insight Partners raised $20 billion, and Tiger Global secured $12.7 billion. Looking further back, SoftBank famously raised $100 billion for its Vision Fund before the pandemic.

The Future of a16z

For some time, a16z has signaled its ambition to become a dominant force in venture asset management. The real question is how the firm will define success: Will it be measured by financial returns, lasting cultural and political influence, or sheer scale of capital deployment?

See you next week,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

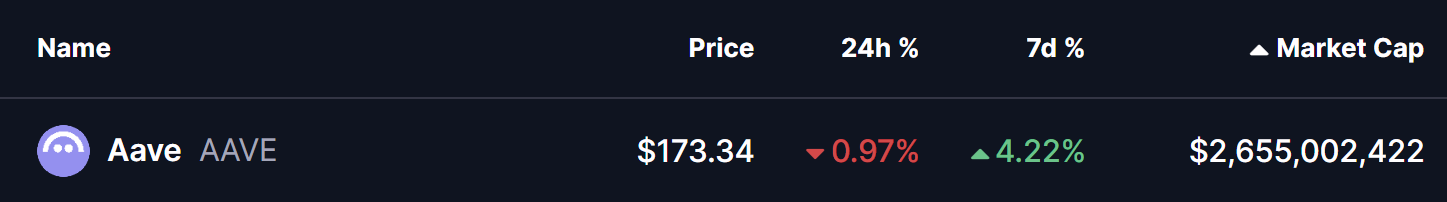

Is Aave (AAVE) Setting Up for a Potential Breakout Next Week? Key Emerging Pattern in Focus

Altcoin XRP Setting Up for the C Wave Push, Ripple’s Native Asset Prepares for Bullish Ascent

Sequoia to join GIC, Coatue in Anthropic investment, FT reports