VanEck projects Bitcoin at $2,9 million and a presence in global reserves.

- VanEck sees Bitcoin as a non-sovereign reserve.

- BTC could reach $2,9 million by 2050.

- Central banks can allocate 2,5% to Bitcoin.

VanEck has presented a long-term projection that places Bitcoin in a broader role within the global financial system by 2050. According to a recent report from the asset manager, the leading cryptocurrency could reach a price close to US$2,9 million per unit, driven by an estimated average annual return of 15% over 25 years.

The study starts from the premise that Bitcoin would significantly expand its adoption in international trade. In the baseline scenario outlined by the analysts, the network could process between 5% and 10% of global trade payments, establishing itself as a relevant means for international settlements and large-scale value transfers.

Beyond commercial use, VanEck believes that Bitcoin could assume the role of a non-sovereign reserve asset. In this context, the cryptocurrency would represent approximately 2,5% of the reserves held by central banks around the world. This hypothesis considers a gradual diversification of official reserves, which are currently concentrated mainly in fiat currencies and sovereign bonds.

The report was authored by analysts Matthew Sigel and Patrick Bush, who emphasize the structural nature of the thesis. According to them, Bitcoin should not be analyzed solely from the perspective of short-term movements, but as a protective instrument against risks associated with the current monetary regime. "Bitcoin is not a tactical asset; it functions as a long-term hedge against the negative consequences of a monetary regime," the analysts stated in the document.

VanEck also details alternative scenarios for Bitcoin's performance in the coming decades. In a more conservative projection, the price could remain around US$130 by 2050. In an extremely optimistic scenario, which considers accelerated adoption and deeper integration into the global financial system, the valuation would exceed US$50 million per unit.

Despite the volatility observed in recent periods, the report points out that long-term forecasts continue to attract the attention of institutional investors. The asset manager emphasizes that strengthening Bitcoin's strategic role would depend on increased adoption by central banks, companies involved in international trade, and other relevant market participants.

VanEck already works in the development of cryptocurrency-related products and continuously monitors the sector. Its estimates for 2050 complement other long-term analyses that position Bitcoin as a potential component of global reserves and value preservation strategies on an international scale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SUI Weathers Extended Shutdown with Minimal Price Impact

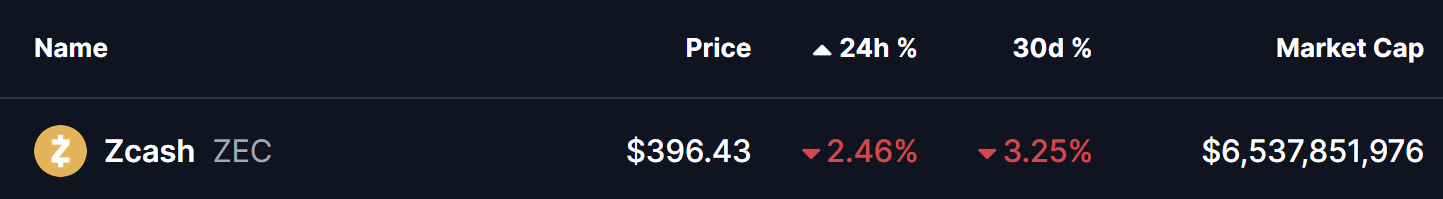

Is Zcash (ZEC) In Bears Control? This Emerging Bearish Pattern Formation Suggest So!

South Korea to negotiate with the US for favourable chip tariff terms, official says