Final inflation report for 2025 will provide insight following data interruptions

December Inflation Report: A Year in Review

The upcoming December consumer price index (CPI) report will provide a comprehensive look at a year when inflation gradually moderated, even though many Americans continued to struggle with elevated living costs.

While gasoline prices declined throughout 2025, electricity bills continued to rise. Although rent increases slowed, most families still found it challenging to afford groceries.

Economists predict that the January 12 release will show prices increased by approximately 2.8% over the past year. Despite inflation dropping from the peaks seen in 2022 and 2023, price growth in 2025 remained more persistent than many experts had anticipated, staying above the Federal Reserve’s 2% goal for the entire year.

David Stubbs, Chief Investment Strategist at AlphaCore Wealth Advisory, commented, “Inflation isn’t at the level the Fed desires, but it’s not a crisis either.”

According to the New York Fed’s December 2025 Survey of Consumer Expectations, many people expect prices to keep rising in 2026, with short-term inflation expectations climbing to 3.4%. Respondents also anticipate greater difficulty managing debt in the coming months.

Some analysts believe these expectations are influenced by ongoing affordability challenges and a “K-shaped” economy, where wealthier households see their assets grow and maintain spending, while lower-income families face stagnant wage growth that fails to keep up with productivity gains.

For certain households, tax refunds in 2026 may offer some financial relief. Changes such as a higher standard deduction and expanded credits, combined with unchanged withholdings, are expected to result in larger refunds this year.

Looking Ahead: Improved Data Collection

This December’s CPI report is anticipated to provide a more accurate snapshot of inflation, following disruptions to data collection caused by the longest government shutdown in U.S. history late last year.

Wells Fargo economists noted in a January 8 report, “Most, though not all, of the previous data distortions should be corrected in the December release.”

They expect a stronger rebound in goods prices compared to services after holiday discounts, but also foresee a recovery in service prices, especially in areas sensitive to seasonal changes like travel and lodging.

Key Drivers of Inflation

Mike Skordeles, head of U.S. economics at Truist, explained that trade uncertainty contributed to inflation last year, as consumers rushed to purchase items such as cars and electronics before new tariffs were implemented, driving up prices amid limited supply.

Stephen Kates, a financial analyst at Bankrate, highlighted housing, wages, and energy costs as the main factors influencing the CPI, noting that changes in these areas can affect the prices of many other goods and services.

Kates added that with housing inflation slowing, wage growth lagging behind productivity, and lower gas prices, these trends suggest inflation could continue to cool into 2026.

Will the Federal Reserve Lower Rates Again?

Federal Reserve officials will closely examine the December CPI data ahead of their next meeting at the end of January.

The Labor Department’s December jobs report, released on January 9, showed a drop in unemployment from November to December, which has reduced the likelihood of another rate cut this month, according to Skordeles.

Most forecasters do not anticipate another rate cut following three consecutive reductions late last year. Instead, policymakers are expected to wait and observe how previous rate changes influence the broader economy.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

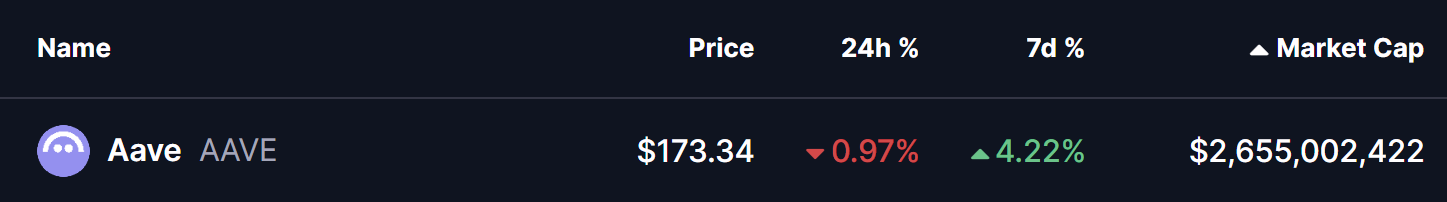

Is Aave (AAVE) Setting Up for a Potential Breakout Next Week? Key Emerging Pattern in Focus

Altcoin XRP Setting Up for the C Wave Push, Ripple’s Native Asset Prepares for Bullish Ascent

Sequoia to join GIC, Coatue in Anthropic investment, FT reports