Stablecoins are now a preferred way for people to actually spend money!

As payment cards powered by stablecoins catch steam, the idea of using crypto for everyday transactions is the realest it’s ever been. Will the pace turn into a faster sprint in the year ahead?

In real wallets

Industry leaders are increasingly pushing for stablecoin-powered cards as the next big thing this year.

Case in point, Dragonfly managing partner Haseeb Qureshi recently posted on X that this is because they bring blockchain efficiency to traditional payments.

He said,

“All they know is that all of a sudden, they can pay people and buy stuff in dollars, any time, anywhere, and it all “just works.”

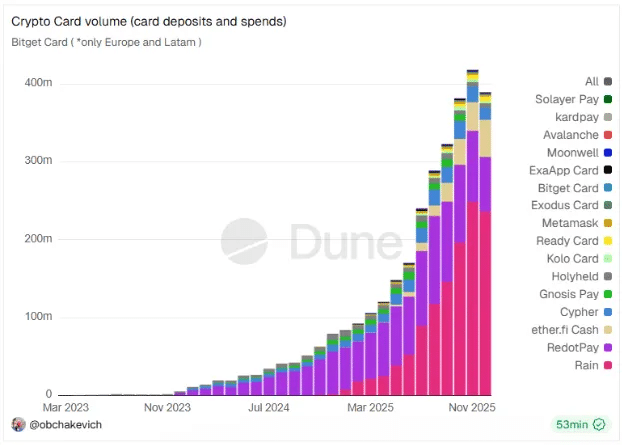

Startups like Rain at higher speeds, with card usage and payment volumes rising by 400% overall in the past year.

By supporting dollar-pegged stablecoins these platforms allow users to spend at their convenience. This supports industry growth as a whole.

Usage grows even if the market isn’t

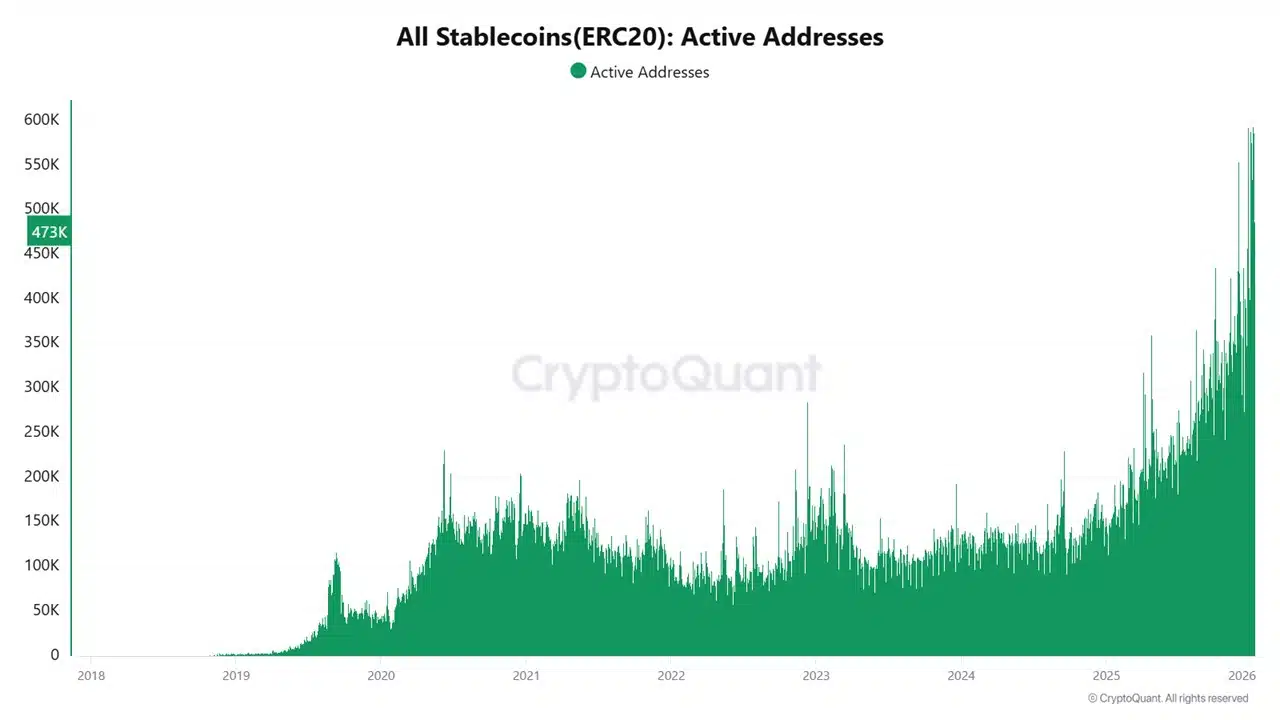

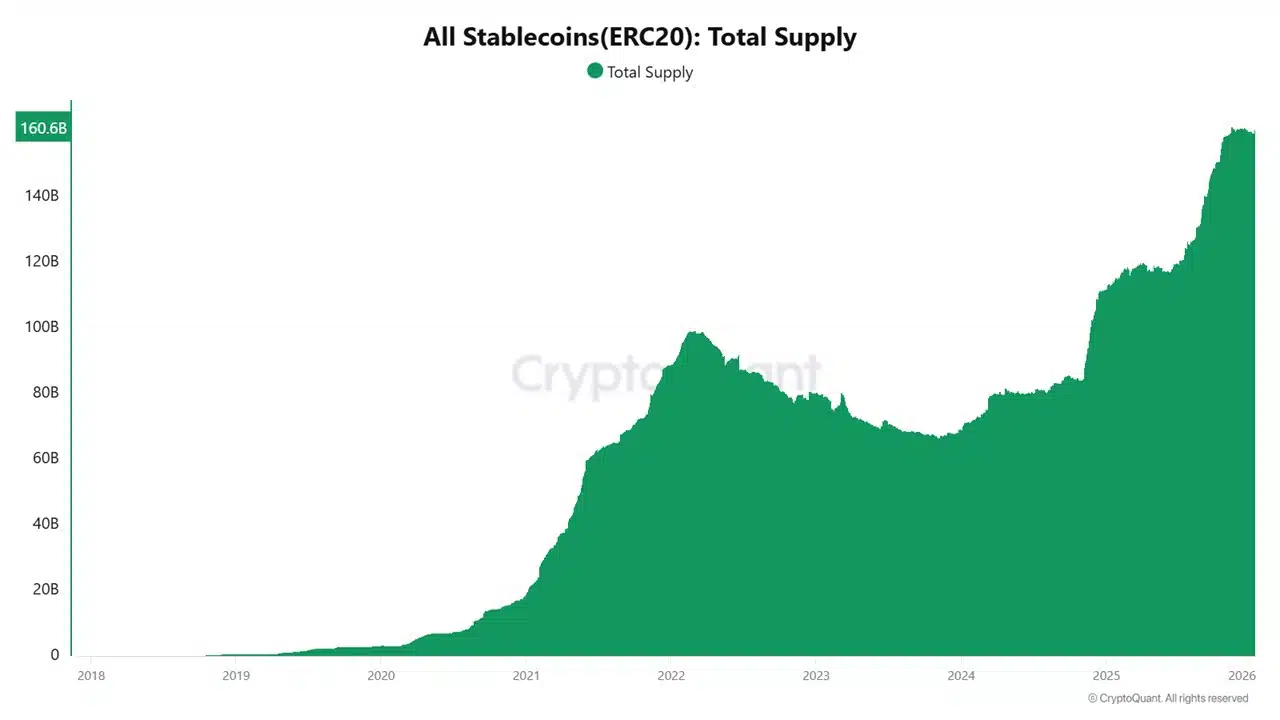

Even while crypto prices are stuck in a range, ERC20 stablecoin active addresses are at near record highs! This comes along with a steadily rising total supply.

The consistency is stunning—even during pullbacks, neither usage nor supply dropped in any way that matters.

Growth is strongest in underbanked and high-inflation regions; these are areas where stablecoins power cross-border transfers and business payments.

It’s paying off… literally

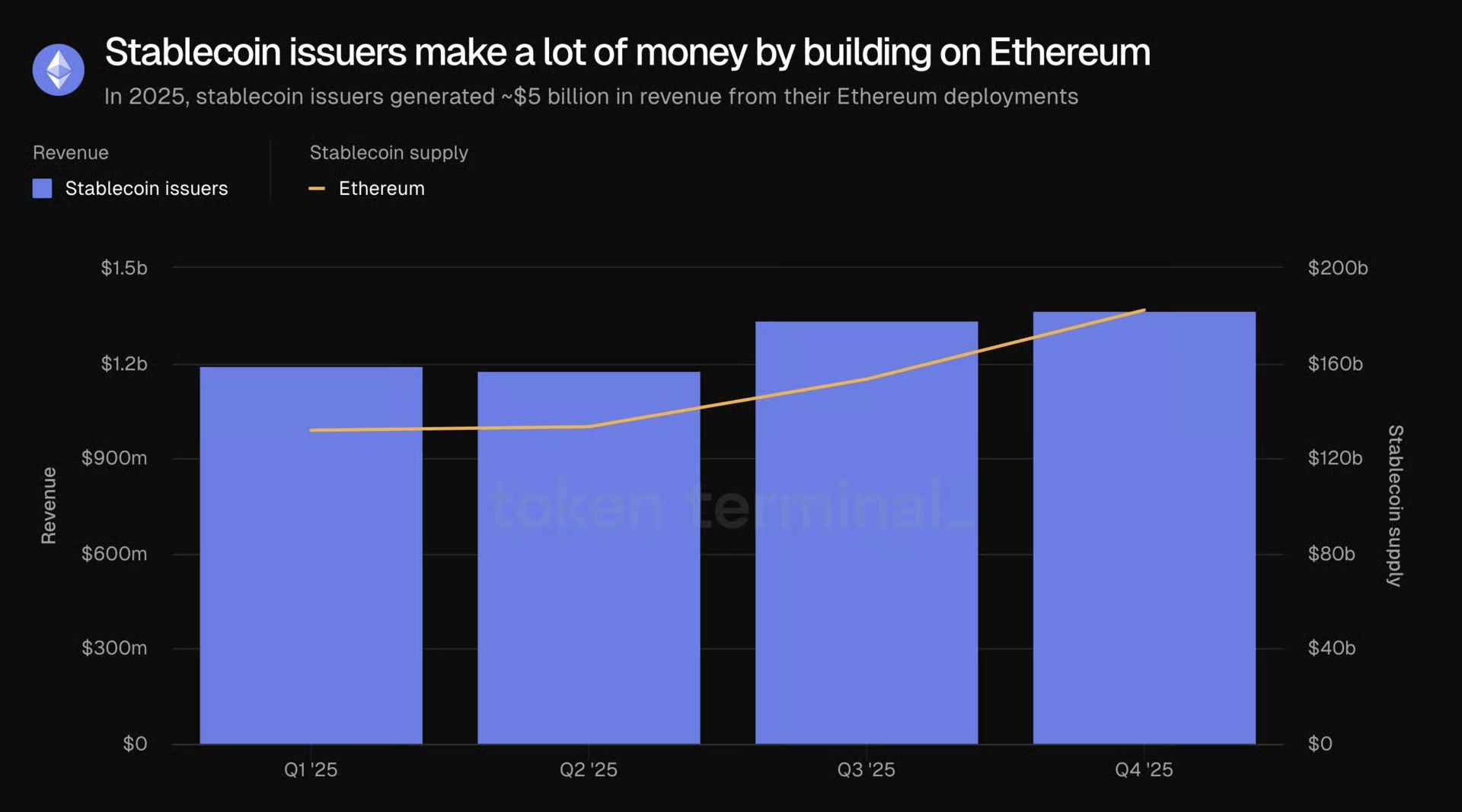

In the midst of all these ever-growing numbers, issuers are generating serious revenue by building on Ethereum [ETH].

In 2025 alone, stablecoin issuers pulled in roughly $5 billion from their Ethereum deployments. Revenue went up along with stablecoin supply throughout the year!

Users continue to transact on Ethereum, issuers go where the users are, and revenue follows activity. It’s a clean feedback loop, and it works for all those who are involved.

AMBCrypto previously reported that U.S. lawmakers are debating potential changes to stablecoin yield rules as part of bipartisan negotiations. This is on a crypto market structure bill scheduled for markup on the 15th of January.

While discussions are ongoing, the outcome could influence how stablecoin issuers structure rewards and payments going forward.

Final Thoughts

- Stablecoin payments are going mainstream, with card usage jumping 400% YoY.

- As issuers generate $5 billion on Ethereum, upcoming policy decisions could alter the current pace.