Iran Enables Crypto Payments for Advanced Weapons Exports

Quick Breakdown

- Iran’s Ministry of Defence Export Center (Mindex) accepts crypto alongside barter and rials for arms sales to sidestep Western sanctions.

- Catalogue features Emad ballistic missiles, Shahed drones, Shahid Soleimani warships, and air defence systems for clients in 35 countries.

- Online portal with chatbot assures buyers of delivery despite sanctions, marking a nation-state’s first in crypto military deals.

Iran’s state-run arms exporter has launched cryptocurrency payment options for foreign military contracts, a bold strategy to circumvent U.S. and European financial restrictions. The Financial Times on January 1, 2026, that Mindex, the Ministry of Defence Export Center, promotes deals settled in digital currencies, with the policy active for about a year. This development positions crypto as a tool for high-stakes geopolitical trade, potentially reshaping sanctioned economies’ access to advanced weaponry.

JUST IN: 🇮🇷 Iran offers to sell advanced weapons systems, ballistic missiles, drones and warships to foreign governments for crypto, FT reports.

— Watcher.Guru (@WatcherGuru) January 1, 2026

Mindex’s digital arms marketplace takes shape

Mindex maintains client ties across 35 nations and showcases a robust inventory, including short-range air defence systems, anti-ship cruise missiles, rockets, and small arms. Prospective buyers navigate an online portal and virtual chatbot, where an FAQ directly tackles sanctions concerns: “Given the general policies of the Islamic Republic of Iran regarding circumvention of sanctions, there is no problem in implementing the contract.” In-person inspections in Iran are available pending security approval, and payments can occur in buyers’ home countries. While prices remain undisclosed, usage terms during conflicts are negotiable, underscoring flexibility for crypto-funded acquisitions.

Sanctions drive Crypto’s role in Iran’s Arsenal deals

Western officials have long warned against transacting with Iran via traditional finance, risking exclusion from global systems. The U.S. Treasury sanctioned Iran-linked crypto networks in September 2025 for shadow banking tied to the Revolutionary Guards. Iran ranked 18th in global arms exports per SIPRI data in 2024, bolstered by Russia’s reduced capacity post-Ukraine invasion.

Domestically, crypto adoption surges with 5 million traders and 11.8% inbound volume growth in 2025, despite setbacks like the $80-90 million Nobitex hack. This arms-crypto pivot highlights blockchain’s dual-use potential in evading oversight. This arms-crypto pivot underscores blockchain’s dual potential: evading oversight for Iran’s geopolitical trade and, as seen with Exodus and MoonPay’s stablecoin partnership, driving mainstream adoption for simple, real-world payments and transfers globally.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

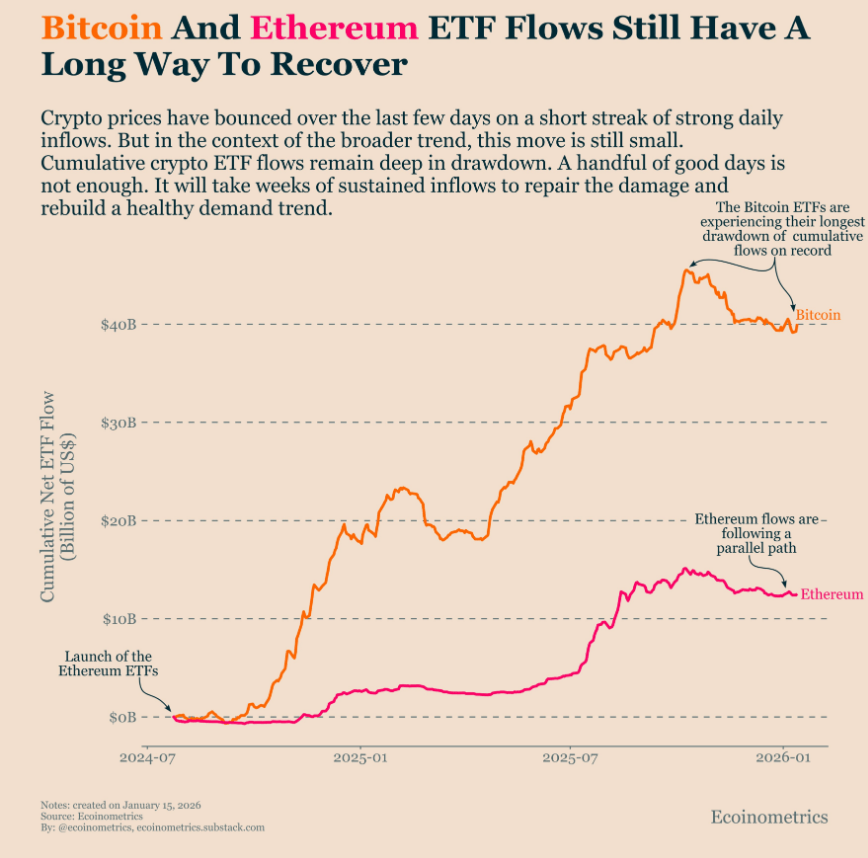

What’s Driving The $1.42 Billion Comeback In Spot Bitcoin ETFs?

Zero Knowledge Proof Eyes 5000x Returns: Why Experts Suggest Moving Beyond SOL & XRP Charts Today

China’s EV champions ready to crack U.S. and Canada as Carney cuts punitive tariffs

Hoskinson Says Real Cardano Run Starts in 2026 as Several Bullish Signs Support His Statement