Grayscale Moves to Bring Decentralized AI Into Regulated Markets With Bittensor Trust Filing

Quick Breakdown

- Decentralized AI is gaining momentum in crypto as blockchain networks challenge centralized control of data, models, and machine learning infrastructure.

- Bittensor uses token-based incentives to reward contributors of compute, data, and AI models, positioning TAO as a core asset in the decentralized AI economy.

- Institutional interest is rising, with crypto investment firms exploring regulated products tied to decentralized AI protocols, signaling growing market maturity.

Decentralized artificial intelligence is emerging as one of crypto’s most closely watched frontiers, as blockchain networks increasingly challenge the dominance of centralized AI systems controlled by large technology firms, . Built on open participation, tokenized incentives, and transparent governance, decentralized AI aims to reshape how machine learning models are developed, shared, and monetized across global networks.

At the center of this shift is Bittensor, a crypto-native protocol designed to coordinate AI development without relying on proprietary data silos or centralized infrastructure. The network allows contributors to supply computing power, datasets, and machine learning models, rewarding high-value contributions through on-chain mechanisms. This approach positions decentralized AI as both a technological and economic alternative to traditional AI platforms.

According to CrowdfundInsider, Grayscale Investments has filed a preliminary registration statement with the SEC to launch an exchange-traded product focused on Bittensor. The proposed trust, to trade under GTAO, would provide regulated exposure to TAO. The S-1 filing on Dec. 30,…

— Wu Blockchain (@WuBlockchain) January 2, 2026

Bittensor’s role in the decentralized AI ecosystem

Bittensor operates as an open-source, permissionless network where intelligence is treated as a market-driven resource. Participants compete and collaborate to improve AI outputs, with rewards distributed based on performance and usefulness rather than corporate control. Its native token, TAO, underpins staking, governance, and incentive distribution, aligning network growth with contributor value.

The model has drawn attention amid broader concerns about AI centralization, data monopolies, and opaque model training practices. By embedding economic incentives directly into protocol design, decentralized AI networks like Bittensor aim to accelerate innovation while maintaining transparency and collective ownership. TAO’s market capitalization, fluctuating between $2 billion and $3 billion, reflects rising interest in AI-focused crypto assets despite ongoing volatility.

Crypto investment firms signal growing interest

Institutional interest in decentralized AI has begun to surface across the crypto investment landscape. Late in December, Grayscale Investments submitted a preliminary registration statement to U.S. regulators related to a trust product offering exposure to TAO. The move signals increasing recognition of decentralized AI as a distinct crypto sector rather than a speculative niche.

If approved, the proposed product would offer investors regulated access to decentralized AI infrastructure without direct token custody. Meanwhile, Grayscale that macroeconomic pressures and institutional momentum point to a pivotal 2026 for digital assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Next Crypto to Explode: DeepSnitch AI Crushes XAI And GLMR With 100x Upside As Belgium Banking Giant Fuels Bull Run

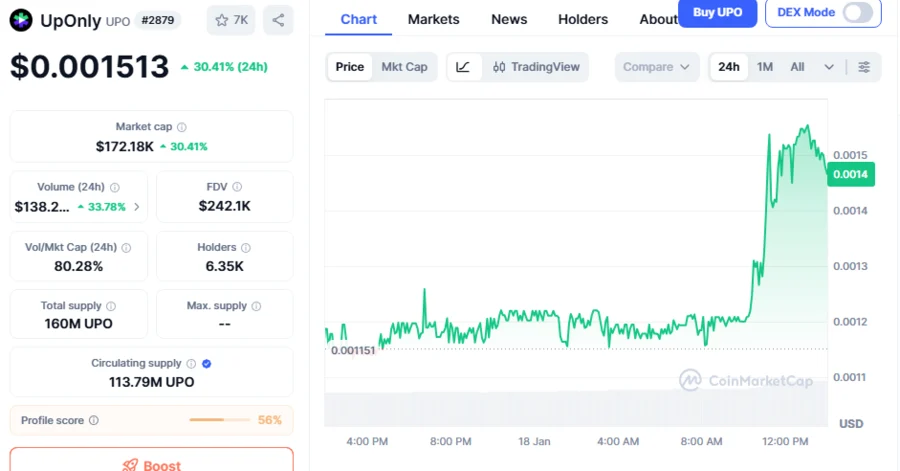

UPO Climbs Above $0.001500, Sets to Explode Amid Incoming Mega Pump, Whale Accumulation: Analyst

Ethereum staking just hit a $118B record at 30% of all coins, but one whale might be skewing the signal