Best CD yields for January 12, 2026 (Secure rates as high as 4.1% APY)

Current CD Rates Remain Elevated

Certificate of deposit (CD) rates are still significantly higher than the national average. With the Federal Reserve having lowered its benchmark interest rate three times in 2025, deposit account rates have started to feel the impact. This could be one of the final opportunities to secure a CD at today’s elevated rates. Explore the basics of CDs and discover where to find the top CD rates available now.

Top CD Rates Available Now

As of January 12, 2026, the most competitive CD rate is 4.1% APY. This rate is currently being offered by LendingClub for its 8-month CD and by Sallie Mae Bank for its 11-month CD.

Below are some of the leading CD rates from our trusted partners.

Comparing National Average CD Rates

For those considering a CD, the current rates are among the highest you’ll find, especially when compared to the national averages, which are much lower. It’s important to note that online banks and credit unions typically provide better rates than traditional banks.

Further reading: What is a good CD rate?

Here’s a summary of average CD rates by term as of December 2025, according to the FDIC:

The highest national average for a 1-year CD is 1.63%. Overall, today’s average CD rates are among the best seen in nearly 20 years, largely due to the Federal Reserve’s strategy of maintaining higher interest rates to address inflation.

Related Topics

- What’s the typical minimum balance for a certificate of deposit (CD)?

- High-yield savings account vs. CD: Which is right for you?

- Understanding CD terms: How long should you lock in your money?

Tips for Securing the Best CD Rates

If you’re planning to open a CD, selecting one with a strong APY and a term that fits your financial strategy is essential. Consider these strategies to find the most favorable CD rates and accounts:

- Compare multiple options: Review CD rates from a range of banks and credit unions before making a decision. Online comparison tools can help you quickly evaluate your choices.

- Look at online banks: Because they have lower operating costs, online banks often provide higher CD rates than traditional institutions.

- Check minimum deposit requirements: Some of the best rates may require a larger initial deposit, so ensure your planned investment meets the minimum needed to qualify.

- Examine account terms: Beyond the interest rate, review the CD’s terms for early withdrawal penalties and automatic renewal policies. Certain CDs, such as no-penalty CDs, allow you to access your funds early without a fee.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Genius Terminal Hits Record $650M Single-Day Volume as EVM Chains Drive Surge

SUI Weathers Extended Shutdown with Minimal Price Impact

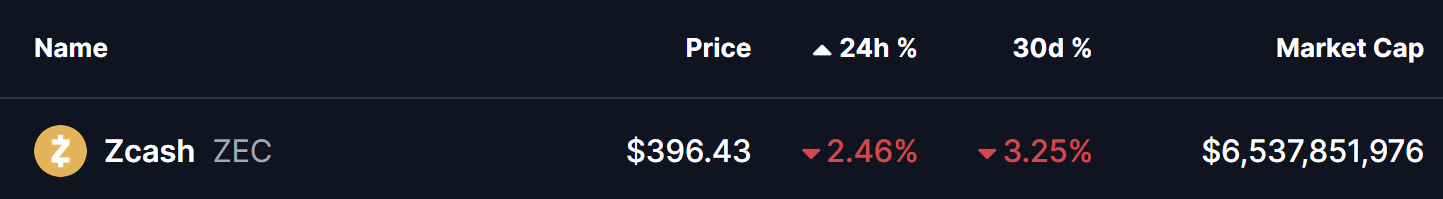

Is Zcash (ZEC) In Bears Control? This Emerging Bearish Pattern Formation Suggest So!