Best money market account rates for today, January 12, 2026 (Earn as much as 4.1% APY)

Top Money Market Account Rates: Where to Find the Best Offers

Looking for a place to grow your savings with a strong interest rate? Money market accounts (MMAs) are a smart option if you want both competitive returns and easy access to your funds. These accounts combine attractive rates with liquidity and flexibility, making them a popular choice for savers.

MMAs often outperform standard savings accounts in terms of interest earned. Many also allow you to write checks and use a debit card, giving you convenient access to your money. This makes them ideal for long-term savings that you may need to tap into for larger expenses or bills.

Current Leading Money Market Interest Rates

Although interest rates have declined in recent months, you can still find money market accounts offering over 4% APY.

Here are some of the most competitive money market rates available right now:

If you want to maximize the interest you earn on your savings, consider these top savings and money market account rates from our trusted partners.

Money Market Account Rates Over Time

Money market rates have seen considerable changes in recent years, largely influenced by shifts in the Federal Reserve’s target rate.

After the 2008 financial crisis, the Federal Reserve lowered the federal funds rate to near zero to help the economy recover, which resulted in MMA rates dropping to between 0.10% and 0.50%—with most accounts at the lower end.

As the economy improved, the Fed gradually increased rates, leading to better returns on MMAs and other savings products. However, the onset of the COVID-19 pandemic in 2020 caused another sharp economic downturn, prompting the Fed to cut rates back to near zero, which again pushed MMA rates down.

Beginning in 2022, the Fed responded to rising inflation with a series of significant rate hikes, causing deposit rates—including those for MMAs—to climb to historic highs. By late 2023, many accounts were offering 4% APY or more. The Fed started lowering rates again in late 2024, continuing into 2025, which has led to a gradual decrease in MMA rates.

As of 2026, money market rates remain elevated compared to historical averages, though they are trending downward. Online banks and credit unions are generally offering the most attractive rates.

Up Next

Key Factors to Evaluate When Selecting a Money Market Account

When choosing a money market account, don’t focus solely on the interest rate. Other important considerations include minimum balance requirements, potential fees, and withdrawal restrictions, all of which can affect your overall returns.

For instance, many MMAs require you to maintain a minimum balance—sometimes $5,000 or more—to qualify for the highest rates. Some accounts also charge monthly maintenance fees that could reduce your earnings.

Fortunately, there are MMAs available that offer strong rates without balance requirements, fees, or other restrictions. It’s wise to compare options before opening an account.

Additionally, make sure your account is protected by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA), which insure deposits up to $250,000 per depositor, per institution. While most MMAs are federally insured, it’s always best to confirm this for your chosen bank or credit union.

Further reading:

Frequently Asked Questions About Money Market Account Rates

What is the typical interest rate for a money market account?

According to the FDIC, the national average for money market account interest rates is 0.58%. However, the most competitive MMAs can offer around 4% APY, which is similar to the rates found on high-yield savings accounts.

How much interest can $50,000 earn in a money market account?

Your earnings on $50,000 in a money market account depend on the APY and how long you keep your funds deposited. For example, with a 4.5% APY, a $50,000 deposit would generate $2,303 in interest over one year.

Is it possible to earn 5% APY with a money market account?

Currently, no money market accounts are offering a 5% APY. However, some online banks provide high-yield savings accounts with rates at that level. It’s also worth checking with your local bank or credit union to see if they have any special offers that meet your needs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

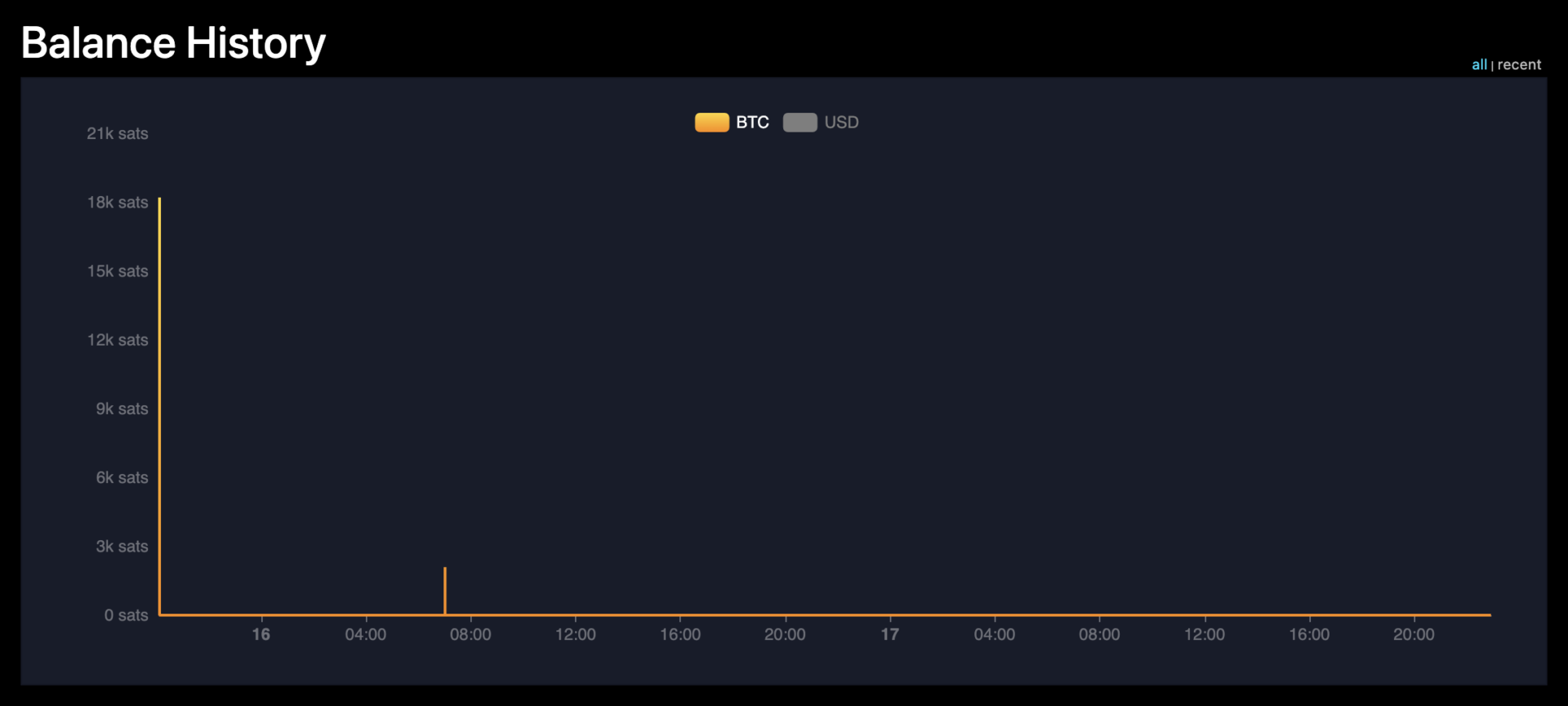

Bitcoin bots drain compromised wallet in RBF fee war

Cardano Rockets 10,654% in Derivatives Market Volume, Hidden Price Signal?

Donald Trump’s FED Statements Stifled the Uptrend Momentum of Bitcoin and Altcoins, But Why?