Chipotle Mexican Grill Earnings Outlook: Key Points to Watch

Overview of Chipotle Mexican Grill

Headquartered in Newport Beach, California, Chipotle Mexican Grill, Inc. (CMG) operates a global network of more than 3,800 company-owned restaurants. With a market value nearing $53 billion, Chipotle offers a menu featuring burritos, bowls, tacos, salads, kids’ options, chips, beverages, and convenient ordering through its app and website.

Upcoming Earnings and Analyst Expectations

Chipotle is preparing to announce its fiscal 2025 fourth-quarter results after the market closes on Tuesday, February 3. Analysts are predicting diluted earnings per share (EPS) of $0.24, which would be a 4% decrease compared to $0.25 in the same period last year. Despite this anticipated dip, Chipotle has consistently surpassed EPS forecasts in the last four quarters, highlighting its steady performance.

Related News from Barchart

Future Earnings Outlook

Looking beyond short-term challenges, analysts anticipate a return to earnings growth for Chipotle. Projections for fiscal 2025 suggest diluted EPS could reach $1.16, reflecting a 3.6% year-over-year increase. The outlook for fiscal 2026 is even more optimistic, with forecasts of $1.22 per share, a 5.2% rise from the previous year.

Stock Performance Compared to the Market

Chipotle’s share price has faced headwinds, dropping 30.8% over the past year. However, the stock has recovered 8.4% since the start of the year. In comparison, the S&P 500 Index ($SPX) has climbed 17.7% over the last 12 months and is up 1.8% year-to-date, widening the performance gap between Chipotle and the broader market.

When measured against industry peers, Chipotle also lags behind. The State Street Consumer Discretionary Select Sector SPDR ETF (XLY) advanced 11.6% in the past year and 4.2% year-to-date, further outpacing CMG’s returns.

Milestones and Global Expansion

On December 12, 2025, Chipotle’s stock rose 3.6% during the trading day as the company celebrated the opening of its 4,000th restaurant, located in Manhattan, Kansas—affectionately called the “Little Apple.”

Chipotle’s international footprint continues to grow, with over 100 locations outside the U.S. The company recently debuted its first Chipotlane outside North America in Kuwait and is planning to enter markets such as Mexico, South Korea, and Singapore, demonstrating a careful and scalable approach to global expansion.

Analyst Ratings and Consensus

As Chipotle’s international growth accelerates and its next earnings report approaches, analysts have maintained a “Moderate Buy” consensus on CMG shares for the past two months. Of the 35 analysts tracking the stock, 22 rate it as a “Strong Buy,” three recommend a “Moderate Buy,” and 10 advise holding the stock.

Price Targets and Disclosure

Analysts have set an average price target of $44.91 for CMG, indicating a potential 12% upside. The highest target on Wall Street stands at $70, which would represent a 74.5% increase from current levels.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

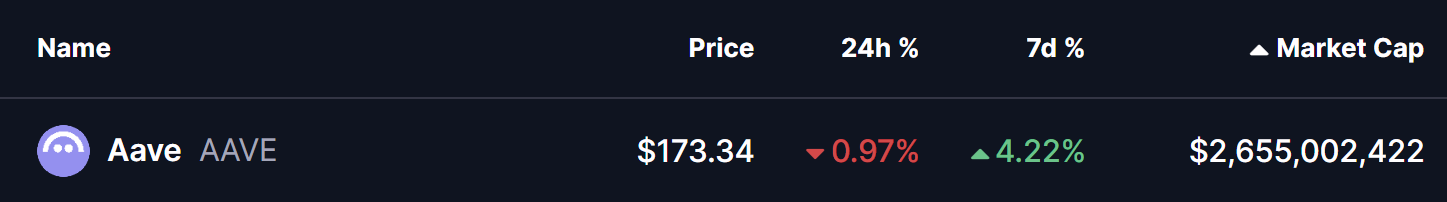

Is Aave (AAVE) Setting Up for a Potential Breakout Next Week? Key Emerging Pattern in Focus

Altcoin XRP Setting Up for the C Wave Push, Ripple’s Native Asset Prepares for Bullish Ascent

Sequoia to join GIC, Coatue in Anthropic investment, FT reports