AI-focused token NEAR$1.6979 climbed 5.7% following the U.S. market open at 2:30PM UTC, spiking to $1.73 before experiencing a wave of sell volume, taking price back down to $1.68.

The advance lacked the conviction-level volume typically seen in sustainable rallies. Market participants may now question whether the move signals genuine accumulation or fleeting retail interest.

The token's move came with a catch. NEAR underperformed the CD5 cryptocurrency benchmark, indicating the rally reflected idiosyncratic factors rather than sector-wide momentum.

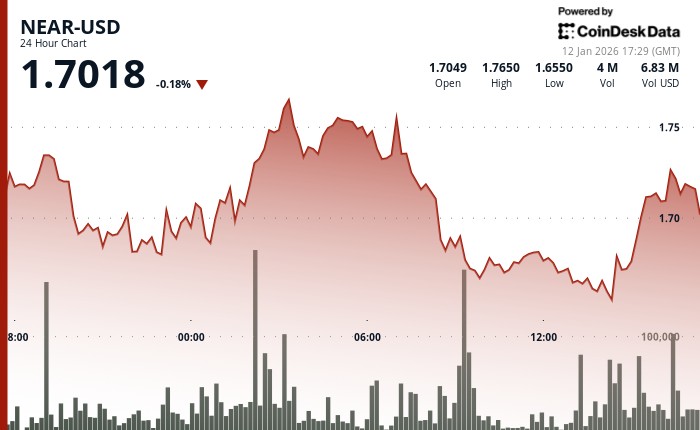

NEAR carved out a volatile $0.11 trading range between an intraday low of $1.6471 and a failed breakout peak of $1.7360. The session's most significant volume event hit at 14:00 UTC with 6.41 million tokens in activity—79% above the 24-hour simple moving average of 3.58 million. The surge marked a decisive reversal from session lows and established strong support at the $1.66-$1.67 level.

Technical levels became paramount as NEAR tested—and failed—to establish a new trading range above $1.72 in the absence of clear fundamental drivers. The 47% volume increase represents elevated retail interest rather than heavy institutional engagement.

Key technical levels signal range-bound consolidation for NEAR

Support/resistance structure:

- Primary support established at $1.66-$1.67 (14:00 UTC volume reversal zone).

- Immediate support at $1.710-$1.712 (session close area).

- Failed breakout resistance at $1.730-$1.736 (16:32 rejection level).

- Broader range cap at $1.74-$1.76 (multiple intraday rejections).

Volume analysis:

- 24-hour activity 46.98% above 30-day average (moderate elevation).

- Peak volume at 14:00 UTC: 6.41 million (79% above 24-hour SMA of 3.58 million).

- Breakout rejection volume at 16:33: 418,000 (368% above hourly average).

- Distribution phase at 16:34: 434K (sustained selling pressure).

Chart patterns:

- Range-bound consolidation with $0.11 total range (6.5% of price).

- Failed breakout above $1.72 resistance confirms continuation of consolidation.

- Higher lows formation post-14:00 UTC signals accumulation at lower bounds.

- Rejection candle at 16:32-16:33 confirms institutional resistance to higher prices.

Targets & risk/reward:

- Downside risk to $1.66-$1.67 support zone if consolidation breaks lower.

- Upside capped at $1.730-$1.736 until volume confirms above 6.5 million sustained.

- Range-trading opportunity between $1.67 support and $1.73 resistance.

- Breakout confirmation requires volume exceeding 80% above average with close above $1.74.

coindesk.com

coindesk.com