Crucial issues regarding wealth taxation may find answers this year — such as if affluent individuals relocate to escape these taxes

States Push for Higher Taxes on the Wealthy: What Lies Ahead?

States with Democratic majorities, such as California, are leading efforts to increase taxes on the nation’s wealthiest individuals. As these proposals gain traction, the coming years—especially 2026—could bring pivotal changes to how the ultra-rich are taxed in America.

Renewed Focus on Taxing the Wealthy

The debate over raising taxes on the top 1% has intensified with the new year. While discussions around taxing the rich are not new, experts like Jared Walczak from the Tax Foundation believe that 2026 could provide clearer answers to long-standing questions: Will voters support new taxes on the wealthy? How will high-net-worth individuals respond? And can states effectively tax wealth, not just income?

Key Developments Across the Country

- California: A proposed ballot measure would introduce a one-time 5% tax on residents with at least $1 billion in net worth. Most of the revenue would support Medicaid, with the remainder allocated to education and food assistance programs.

- Washington: Governor Bob Ferguson is advocating for increased income taxes on millionaires.

- New York City: Mayor Zohran Mamdani is pushing for higher taxes on the city’s wealthy to fund universal childcare, though state lawmakers’ approval is required.

- Rhode Island: Governor Dan McKee is reportedly considering additional taxes on millionaires.

- Michigan: There’s a movement to place a referendum on the November ballot that would add a 5% tax on couples earning at least $1 million, or individuals earning $500,000, with proceeds going to schools.

Political Landscape and Federal Context

While most of these initiatives are emerging in Democratic-leaning states, Republican-led states are moving in the opposite direction. In 2026, eight states are set to lower income tax rates for all residents, and Ohio will implement a flat tax. These states all supported Donald Trump in the 2024 election.

Recent federal tax legislation has also played a role, extending lower income and estate tax rates and providing significant benefits to high-income households. As a result, state governments are seeking new ways to raise revenue, particularly as federal support for programs like Medicaid is reduced.

Public Opinion: Will Voters Support Higher Taxes on the Rich?

Polls consistently show that many Americans believe the tax system is unfair, with a recent YouGov survey finding that 62% think billionaires pay too little in taxes. While Democrats are especially likely to hold this view, a substantial portion of Republicans agree. However, whether these opinions will translate into votes for higher taxes remains uncertain.

States are facing tighter budgets, and rising living costs are straining households. Meanwhile, stock markets continue to reach new highs, further increasing the wealth gap. According to Carl Davis of the Institute on Taxation and Economic Policy, the political climate is shifting, and there may be more momentum for tax reforms in the near future.

Will the Wealthy Relocate to Avoid New Taxes?

The proposed California Billionaire Tax Act would target individuals residing in the state as of January 1, 2026. This deadline has already prompted some high-profile moves, such as Thiel Capital opening a Miami office. Critics argue that such taxes could drive wealthy residents and capital out of state, but experts note that relocating is a complex decision influenced by more than just taxes—factors like lifestyle and family ties also play a significant role.

Research on the impact of taxes on migration is mixed. Some studies suggest that high earners are less likely to leave than commonly believed, while others indicate that estate taxes can influence relocation, especially among billionaires.

States like Florida and Texas, which have no income tax, continue to attract new residents, while California has seen the highest outmigration of do-it-yourself movers for several years. However, ultra-wealthy households are less likely to move themselves and may be influenced by a range of factors beyond tax policy.

Is Taxing Wealth Legal and Feasible?

Most current state proposals focus on increasing income taxes, but California’s plan would tax net worth, including unrealized gains. This approach would be unprecedented in the U.S. and is rare globally. Critics argue that such a tax could be unconstitutional, equating it to confiscation of property. Proponents counter that taxes on assets, like property and vehicles, are already common and that the income tax system has struggled to fairly tax the wealthy.

The Supreme Court recently declined to rule broadly on the constitutionality of taxing unrealized gains, leaving the issue unresolved. If California’s measure passes, legal challenges are expected, potentially reaching the U.S. Supreme Court by 2027.

Recent State Actions and Voter Sentiment

- Maryland and Minnesota have recently increased taxes on their wealthiest residents.

- Massachusetts voters approved a 4% surtax on million-dollar households in 2022, while California voters rejected a similar proposal that year.

Jared Walczak of the Tax Foundation notes that there may be a tendency to overestimate voters’ willingness to tax the wealthy. The outcome of these efforts in 2026 remains to be seen.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

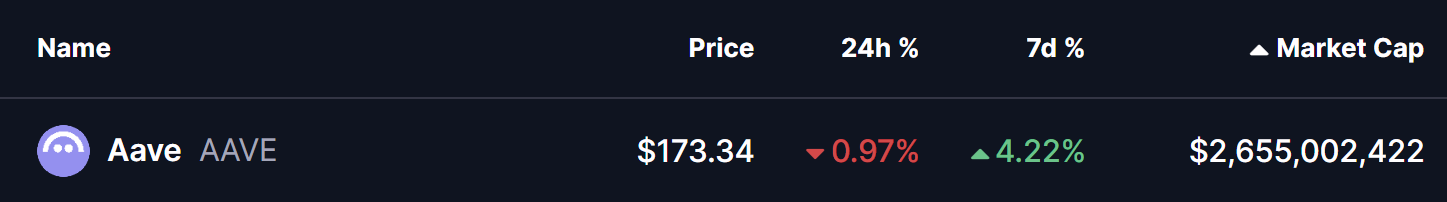

Is Aave (AAVE) Setting Up for a Potential Breakout Next Week? Key Emerging Pattern in Focus

Altcoin XRP Setting Up for the C Wave Push, Ripple’s Native Asset Prepares for Bullish Ascent

Sequoia to join GIC, Coatue in Anthropic investment, FT reports