Ripple coin (XRP) is nearing a key structural level at $2.06, taking a slightly wider downturn than the two largest crypto assets, Bitcoin (BTC) & Ethereum (ETH). Last Friday, Ripple Labs penned a letter directly addressing the current crypto market issues to the specialized Crypto Task Force of the United States Securities and Exchange Commission (SEC).

Decentralization Just Mixes Things Up, Says Ripple

In the letter, Ripple’s representatives discussed the rejection of the “decentralization” idea, when it comes to legal metrics for digital assets. Calling decentralization “not a binary state”, Ripple says the notion is introducing “intolerable uncertainty”. With new measures in place, the Congress might have read this right before refining the crypto legislation frame-work.

Moreover, the letter clearly states that “any framework that classifies asset as a security merely because the holder hopes for a “passive” price increase ignores the reality that speculation is a feature of all markets, security and non-security markets alike”. This alludes to the SEC’s initial charge on Ripple Labs for XRP sales as unregistered securities, which was solved just last year.

Ripple Rides For Notion Clarity, Crucial For RLUSD?

The fresh letter also touched on the subject of capital raising. For Ripple, the pending Clarity Act will be crucial in terms of adoption. The market-regulating legal framework makes Ripple’s own RLUSD stablecoin a compliant asset.

However, Ripple stresses that not every coin issuer sale qualifies as a capital raise, resulting in two extra problems for the participating investors. One of them is the “Zombie Promise”, when investors who have never embraced the technology are relying on promises made from primary-market participants years ago.

The other issue is the so-called ‘operational paralysis’, where the original issuer of the digital tokens is frozen out of normal commercial activity. The issuer holds & monetizes inventory, so the capital formation supply includes all the expenses, like paying vendors & issuing bonds or grants.

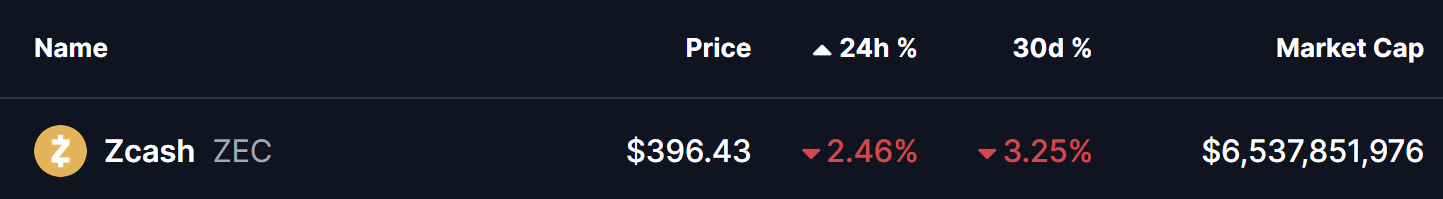

With the Clarity Act pending, Ripple’s remarks are bound to shape the future of crypto legislation. While the SEC’s Crypto Task Force hasn’t responded yet, the OG altcoin Ripple (XRP) stood at $2.07, still holding the aforementioned major structural support level.

People Also Ask:

Ripple argued the SEC is wrongly insisting XRP must be “sufficiently decentralized” under Howey test evolution, pointing out inconsistent application across other tokens and post-2018 changes.

Many see it as a feature, not bug—institutions and regulators prefer projects with identifiable control/responsibility (easier compliance, custody, KYC).

Yes—XRP maximalists and pure crypto ideologues hate it because it reinforces the “Ripplecoin” criticism. But price action cares more about utility/inflows than philosophical purity.

If SEC doubles down on “not decentralized = security forever,” it could delay ETF progress or trigger more selling. But current market reads it as pro-institutional tilt.