AUD/USD ticks down to near 0.6700 ahead of US inflation data

The AUD/USD pair trades marginally lower to near 0.6700 during the European trading session on Tuesday. The Aussie pair edges down as the US Dollar (USD) ticks higher slightly ahead of the United States (US) Consumer Price Index (CPI) data for December, which will be published at 13:30 GMT.

During the press time, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, edges up to near 99.00. The DXY corrected sharply on Monday from its monthly high of 99.26 after Federal Reserve (Fed) Chair Jerome Powell was charged with criminal charges over mismanaging funds allocated to the renovation of Washington’s headquarters.

As measured by the CPI, the US headline inflation is expected to have grown steadily by 2.7% Year-on-year (YoY). In the same period, the core inflation – which excludes volatile food and energy items – is seen accelerating to 2.7% from the prior reading of 2.6%. On a monthly basis, both the headline and the core CPI rose by 0.3%.

Signs of price pressures cooling down are expected to boost dovish speculation for the Fed’s monetary conditions in the near term. However, hot figures are unlikely to weigh on them significantly as officials have been more concerned about weak job market conditions.

Meanwhile, the Australian Dollar (AUD) trades broadly calm during European trading hours. Going forward, the major trigger for the Aussie dollar will be China’s Trade Balance data for December, which will be published on Wednesday. The data is expected to show that Imports by Beijing grew at a moderate pace of 0.9% against November’s reading of 1.9%. The impact of China’s international trade data remains significant for the Australian Dollar, given that the Australian economy relies heavily on its exports to Beijing.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Sequoia plans to fund Anthropic, defying the venture capital norm against supporting competitors: FT

Best Crypto to Buy: PEPE Consolidates, Etherna Pepe Stalls, While ZKP Targets 100x–10,000x

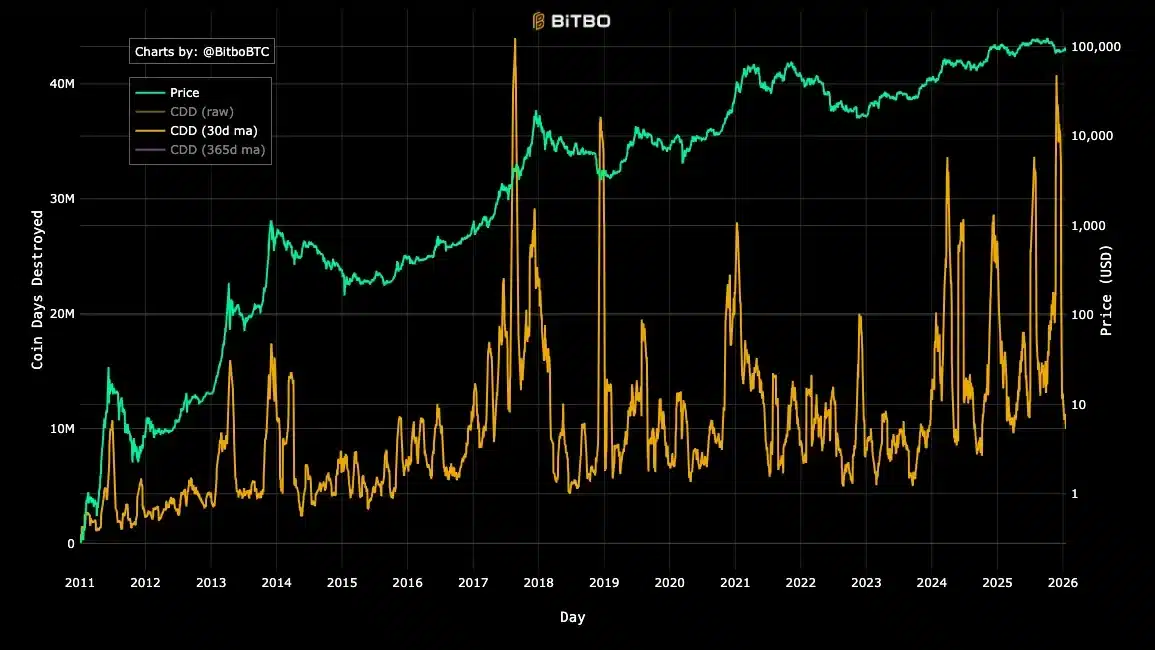

A 12-year Bitcoin OG is selling – But the market isn’t panicking