Bitcoin Volatility and Investment Strategy Remain Key Focus in 2026

- Bitcoin's 2026 price volatility (peaking at $93,000) prompts experts to emphasize long-term investment strategies over market timing.

- U.S. government consideration of

strategic reserves sparks debates about its geopolitical and financial system implications.- Enhanced security measures like cold storage and multi-signature wallets become standard for institutional Bitcoin holdings.

- Crypto industry faces regulatory tensions while

expansion and cross-chain innovations drive institutional adoption growth.Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

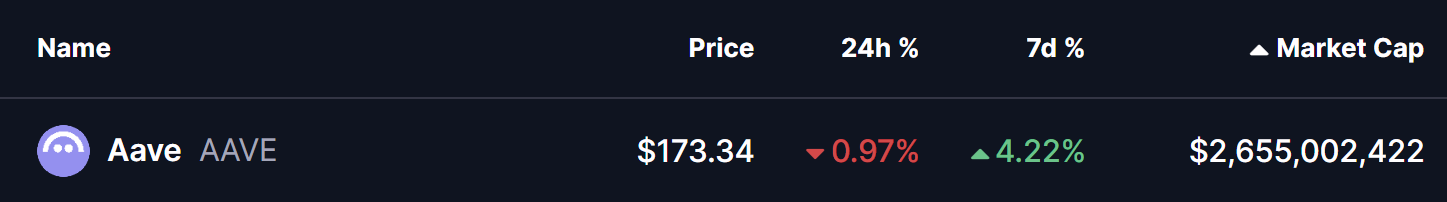

Is Aave (AAVE) Setting Up for a Potential Breakout Next Week? Key Emerging Pattern in Focus

Altcoin XRP Setting Up for the C Wave Push, Ripple’s Native Asset Prepares for Bullish Ascent

Sequoia to join GIC, Coatue in Anthropic investment, FT reports