Key Highlights

- Macro Catalyst: U.S. CPI data released Jan 13 cooled to 2.7% YoY, easing inflation fears and boosting “risk-on” sentiment for Bitcoin heading into mid-2026.

- Massive Whale Accumulation: Major exchanges and insiders have stacked over 71,000 BTC (~$6.45B) in recent sessions, with Binance and Coinbase leading the aggressive buy-side pressure.

- Technical Breakout: BTC has decisively cleared the $94,773 resistance of a massive Ascending Triangle pattern, flipping a long-term hurdle into a support zone.

- The $108K Target: Based on the “measured move” of the current triangle formation, the next major technical objective sits at $108,000, provided the $95K–$97K region holds on a retest.

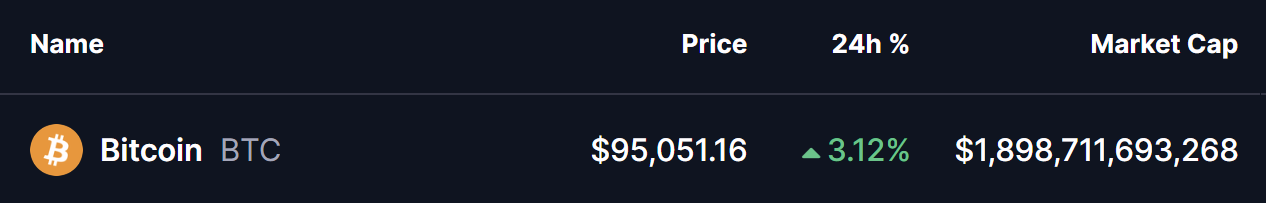

Bitcoin (BTC) is showing renewed strength on January 14, 2026, surging to a local high of around $96,495 after breaking out from key resistance levels. The asset is currently trading near $95,000, marking a solid ~3% gain in recent sessions amid broader market optimism. This rally follows the release of softer-than-feared U.S. inflation data and signs of aggressive accumulation by large players, fueling speculation about a push toward higher target like $108K.

Source: Coinmarketcap

Source: Coinmarketcap

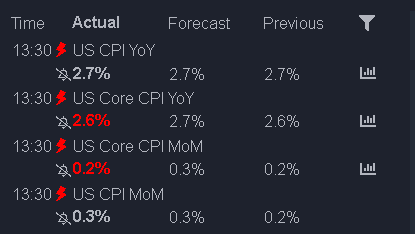

CPI Data Sparks Risk-On Sentiment

The U.S. Bureau of Labor Statistics released the December 2025 Consumer Price Index (CPI) on January 13, 2026. The headline CPI rose 0.3% month-over-month on a seasonally adjusted basis, with the 12-month increase at around 2.7% (in line with or cooler than some expectations amid ongoing tariff and economic pressures). Core CPI (excluding food and energy) climbed 0.2% monthly, up 2.6% year-over-year.

US CPI Data/Source: @camelfinance (X)

US CPI Data/Source: @camelfinance (X)

This print eased concerns about persistent inflation, boosting hopes for a dovish Federal Reserve stance in 2026 — potentially lower borrowing costs and more favorable conditions for risk assets like cryptocurrencies. The cooler data triggered a broad risk-on mood, with BTC benefiting alongside equities as investors rotated into higher-yield opportunities.

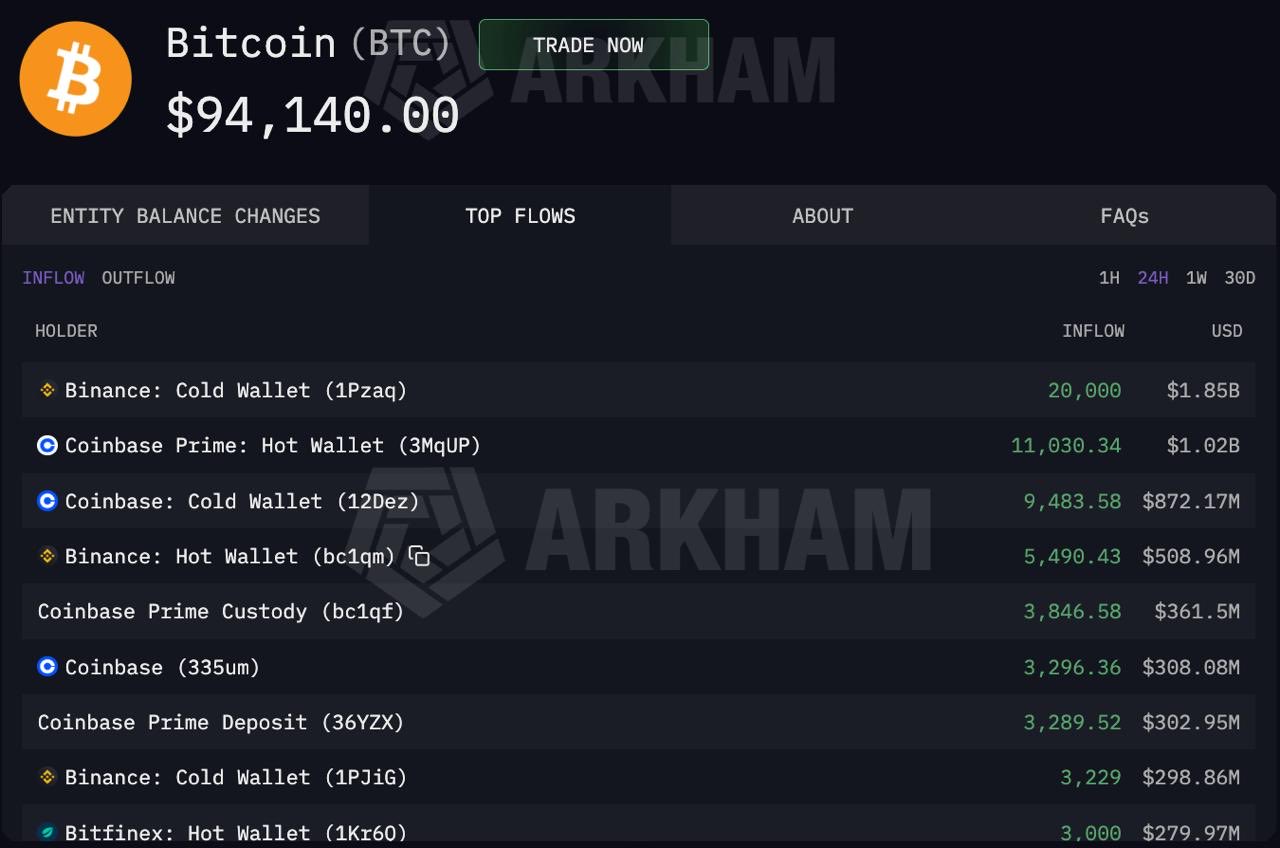

Heavy $BTC Accumulation:

On-chain metrics reveal aggressive buying by major exchanges and whales, creating significant supply pressure and supporting the upside momentum.Large players have been stacking BTC heavily:

- Binance: ~27,371 BTC accumulated

- Coinbase: ~22,892 BTC

- Kraken: ~3,508 BTC

- Bitfinex: ~3,000 BTC

- Insiders and whales: ~14,188 BTC

Source: @DeFiTracer (X)

Source: @DeFiTracer (X)

In total, this represents nearly $6 billion worth of Bitcoin accumulated in recent periods, highlighting strong conviction from deep-pocketed participants such as institutions, exchanges (often holding on behalf of clients), and high-net-worth entities. This accumulation contrasts with spot Bitcoin ETFs, which recorded $870 million in inflows last week, providing steady downside support.

Technical Breakout in Bitcoin (BTC)

The daily chart shows Bitcoin breaking out of an ascending triangle pattern — a bullish continuation formation characterized by higher lows and a flat upper resistance.

- The breakout occurred around $94,773, propelling BTC to the recent local high of $96,418.

- Price is now eyeing the 100-day moving average (MA) near $97,455 as the next immediate hurdle.

- A potential retest of breakout levels (around the green consolidation zone) could provide healthy support before any further upside.

- If momentum holds, the measured move from the ascending triangle projects toward the $108K target (dotted line on the chart).

Bitcoin (BTC) Daily Chart/Coinsprobe (Source: Tradingview)

Bitcoin (BTC) Daily Chart/Coinsprobe (Source: Tradingview)

What’s Next for Bitcoin (BTC)?

This combination — macro relief from softer CPI, heavy on-chain accumulation, and a clean technical breakout — creates a compelling bullish narrative. A sustained hold above $95K–$97K could open the door to $100K+ psychological resistance first, with $108K as a realistic measured target in the coming weeks/months if catalysts align.

Frequently Asked Questions (FAQ)

Why is Bitcoin (BTC) pumping today?

BTC is surging due to a combination of soft U.S. CPI data (2.7% YoY), which has fueled hopes for a Fed rate cut, and massive $6 billion on-chain accumulation by exchanges like Binance and Coinbase.

What is the $108K Bitcoin price target?

The $108,000 target is a “measured move” derived from a breakout of an ascending triangle pattern on the daily chart. Technical analysts see this as the next major resistance after the $100K psychological barrier.