Franklin Templeton amended two Western Asset institutional money market funds to plug directly into the emerging US stablecoin regime. This move to integrate tokenized cash infrastructure validates the long-term viability of the sector.

Franklin Templeton adapts for the stablecoin era

According to a recent release, the asset management giant is adapting two long-running Western Asset institutional funds so they can be used more directly in US GENIUS-aligned stablecoin reserve structures and blockchain-enabled distribution channels.

Importantly, these changes allow the funds to serve as regulated, government-backed collateral for payment stablecoins and other tokenized cash uses without altering their core regulatory status as SEC-registered 2a-7 MMFs.

This strategic move is designed to allow these funds to plug directly into tokenized cash infrastructure rather than forcing the firm to launch entirely new, untested crypto-native products. By retrofitting existing, trusted institutional vehicles for blockchain use, Franklin Templeton is accepting the mass adoption of stablecoins as a settlement layer.

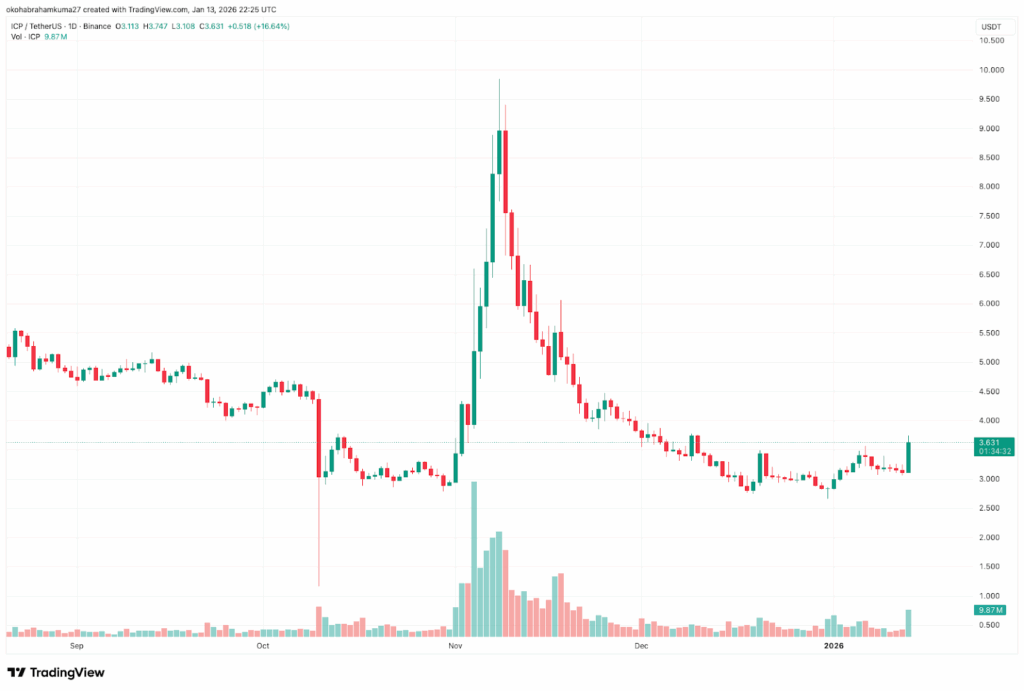

Internet Computer ($ICP) market outlook

Internet Computer recorded a massive increase in activity, with trading volume rising by 235% in the last 24 hours to over $213 million as of January 13th. The token has gained 2% over the past 7 days, outperforming the market.

Despite the volume explosion, the near-term outlook is mixed. The price prediction forecasts a 6% drop to $ 3.43 by mid-February 2026. The sentiment is neutral, and the Fear & Greed Index remains in fear territory at 26.

Render ($RENDER) price prediction

Render had a price decline of 5% in the last seven days and a 46% drop in trading volume over the last 24 hours as of January 13th. This retreat follows a strong run, indicating that traders are taking profits and reallocating capital elsewhere.

The price prediction for Render is optimistic for the medium term, projecting a 69% rise by April 2026. However, the high volatility of 27% makes it a bumpy ride for holders. With the sentiment currently neutral, Render is in a consolidation phase.

Final thoughts

FAQs

What is the significance of the Deepsnitch AI funding milestone?

The fact that Deepsnitch AI raised over $1M is a funding milestone that validates market demand for its AI tools.

What is the next target for DeepSnitch AI?

Now that Deepsnitch AI has raised over $1M, the next target is the January launch.