Flat cargo numbers mark a positive outcome for Port of Oakland amid an unpredictable year

Port of Oakland Maintains Steady Cargo Volumes Amid Global Trade Fluctuations

In December, the Port of Oakland processed 179,580 twenty-foot equivalent units (TEUs), representing a 1.7% decrease compared to the same month last year. This slight dip comes as cargo activity steadies despite unpredictable international trade dynamics.

The number of loaded containers reached 140,050 TEUs, marking a 3% reduction from December 2024. While imports of loaded containers dropped by 12.8%, exports saw a notable 10.9% increase.

Throughout 2025, Oakland and other West Coast ports outside Southern California encountered a range of obstacles. These included the repercussions of President Donald Trump’s turbulent tariff policies with China, evolving trade routes, and changes in ocean carrier services. Additionally, ports in western Canada—such as Vancouver and Prince Rupert—expanded rapidly by leveraging cross-border rail links to attract U.S.-bound intermodal cargo destined for the Midwest.

Empty container movements at Oakland totaled 39,530 TEUs in December, up 3.4% year-over-year. The port attributed this rise to typical end-of-year repositioning. Compared to November, December’s volumes edged up slightly, aligning with standard seasonal shipping trends.

“December’s results mirrored the industry’s broader volatility, with weaker import numbers but robust export performance,” commented Bryan Brandes, Maritime Director at the Port of Oakland. “These shifts are more about timing and operational adjustments than a fundamental change in demand.”

For the entirety of 2025, the port’s total container throughput remained nearly unchanged, down just 0.4% from the previous year at 2,253,976 TEUs. The port described this outcome as significant, given the ongoing policy and economic uncertainties.

Imports for the year slipped by 0.9%, while exports edged up by 0.1%, resulting in an almost even split between the two. Loaded containers made up about 77% of the total volume, consistent with recent trends.

“In a year marked by unpredictability, keeping operations stable was crucial,” Brandes added. “Our priority was to ensure reliable and efficient cargo movement for our customers, even as trade conditions evolved.”

This week, the port announced the arrival of two new ship-to-shore cranes at the TraPac terminal. Manufactured by Liebherr, these are the first European-built cranes of their kind to be installed at a U.S. West Coast port.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

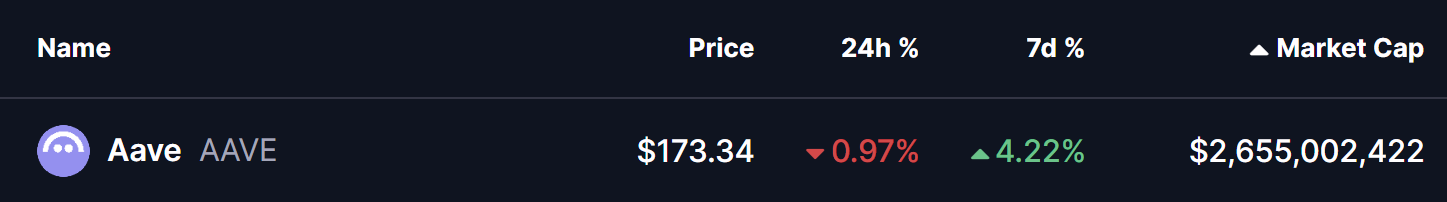

Is Aave (AAVE) Setting Up for a Potential Breakout Next Week? Key Emerging Pattern in Focus

Altcoin XRP Setting Up for the C Wave Push, Ripple’s Native Asset Prepares for Bullish Ascent

Sequoia to join GIC, Coatue in Anthropic investment, FT reports