- Binance Coin powers the Binance ecosystem with strong utility and long-term price growth.

- Ethereum supports smart contracts and decentralized applications with constant developer demand.

- Litecoin offers faster transactions, capped supply, and reliable long-term adoption.

January 2026 begins with investors paying closer attention to established crypto networks with proven utility. Market participants now focus less on short-term excitement and more on long-term value creation. Projects with clear use cases, active ecosystems, and strong adoption histories stand out. Three promising cryptos continue to show high potential due to real usage, durable demand, and consistent growth across multiple market cycles.

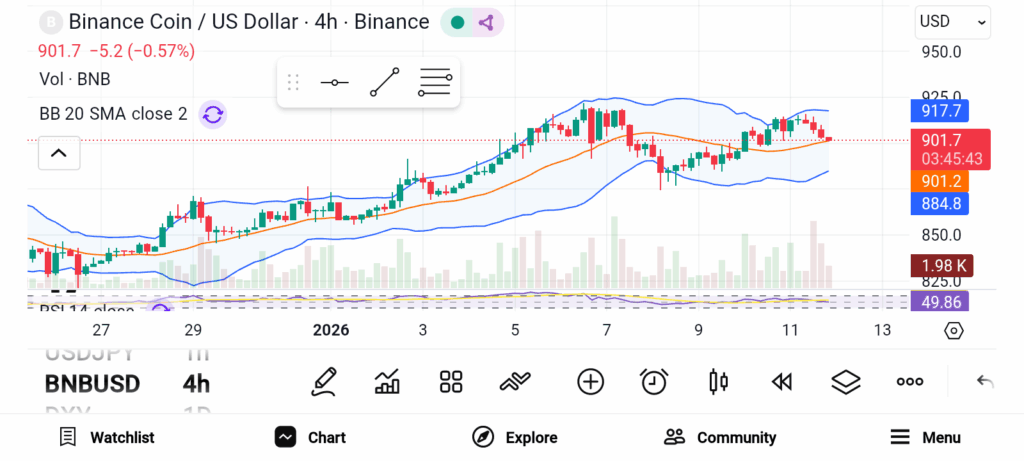

Binance Coin (BNB)

Source: Trading View

Source: Trading View

Binance Coin started as a simple tool for reducing trading fees on the Binance exchange. Over time, BNB expanded far beyond that original purpose. The token now supports payments, transactions, and decentralized applications across the Binance ecosystem. Traders who use BNB on Binance still receive trading fee discounts, which continues to drive steady demand. BNB also plays a central role on the BNB Smart Chain.

Users rely on BNB to pay transaction fees when interacting with smart contracts and decentralized applications. This function gives the token ongoing relevance beyond exchange activity. As more applications operate on the network, transactional demand remains consistent. Price history reflects long-term ecosystem growth. BNB traded near $0.12 during July 2017.

Ethereum (ETH)

Source: Trading View

Source: Trading View

Ethereum operates as a programmable blockchain designed for decentralized development. Vitalik Buterin created Ethereum to extend blockchain use beyond simple transfers. Developers now rely on Ethereum to build decentralized applications across many industries. These applications support finance, supply chains, gaming, and digital identity solutions.

Smart contracts form the foundation of Ethereum’s design. These contracts execute automatically once predefined conditions are met. Developers pay transaction costs using ETH, known as gas fees. Validators earn these fees by processing transactions and maintaining network security. This economic model keeps ETH in constant demand. Ethereum remains central to decentralized innovation. Thousands of applications continue running on the network.

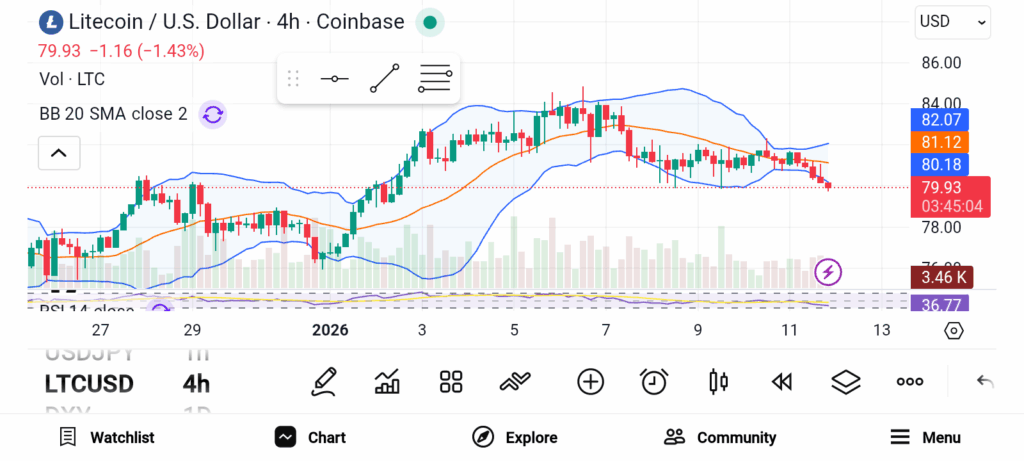

Litecoin (LTC)

Source: Trading View

Source: Trading View

Litecoin launched in 2011 under former Google engineer Charlie Lee. The project aims to complement Bitcoin rather than compete directly. Many market participants describe Litecoin as digital silver, while Bitcoin holds the digital gold narrative. This positioning supports Litecoin’s role as a payment-focused asset. Litecoin offers faster block times compared to Bitcoin. Blocks process every 2.5 minutes, while Bitcoin requires ten minutes. Faster confirmations support smoother transactions for everyday use.

The network uses proof-of-work consensus and follows scheduled halving events similar to Bitcoin.Supply mechanics also strengthen Litecoin’s long-term profile. Total supply remains capped at 84 million coins. Current circulation sits near 76.7 million LTC. Since April 2013, Litecoin price has increased by roughly 1,789 percent. That growth reflects steady adoption and consistent network reliability over time.

Three established cryptocurrencies show strong potential during January 2026. Binance Coin benefits from deep ecosystem utility and exceptional long-term growth. Ethereum continues powering decentralized development through smart contracts and network demand. Litecoin offers speed, scarcity, and reliability as a long-standing payment-focused blockchain.