News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 18) | Fidelity Solana Spot ETF Launches Tonight in U.S. Markets; Public Companies Net-Buy Over $847 Million in BTC Last Week; All Three Major U.S. Indexes Close Lower2Young Bitcoin holders panic sell 148K BTC as analysts call for sub-$90K BTC bottom3Ethereum Falls Under $3,100 Amid Spot ETF Outflows, Viewed as Riskier Than Bitcoin

Research Report|In-Depth Analysis and Market Cap of Monad (MON)

Bitget·2025/11/18 07:48

Is the crypto market bearish? See what industry insiders have to say

金色财经·2025/11/18 07:46

Whales make big bets, institutions deeply trapped, crypto market faces a cold wave

AICoin·2025/11/18 07:41

Crypto Projects Still Lining Up for Listing in This Bear Market

The next potential trading opportunity.

BlockBeats·2025/11/18 06:33

A whale who once made nearly 100 millions in profits shares: Why I no longer trade on HyperLiquid?

A mature financial system would never rely solely on "luck" and "hope" as its final safety net.

BlockBeats·2025/11/18 06:33

DappRadar, another tear of the era

"High value, low payment" is a problem that Web3 tool products have yet to solve.

ForesightNews 速递·2025/11/18 06:13

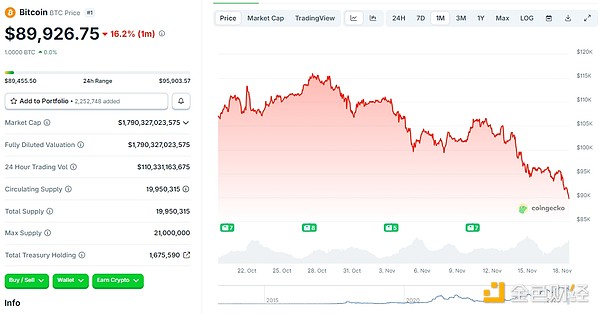

Bitcoin falls below the 90,000 mark—where is the market headed?

A quick overview of market outlook analyses from traders and industry experts.

ForesightNews 速递·2025/11/18 06:12

The crypto projects still in line to be listed during this bear market

BlockBeats·2025/11/18 05:16

Flash

- 08:32Current mainstream CEX and DEX funding rates indicate that the market has basically returned to neutral after being oversold.BlockBeats News, November 18, according to Coinglass data, the current funding rates on major CEX and DEX platforms show that after the recent sharp unilateral decline in the crypto market, although a new low was reached this morning since the start of this downturn, the overall bearish sentiment among participants has significantly weakened (on November 12, almost all funding rates were negative), and the funding rates for more asset trading pairs have returned to neutral. BlockBeats Note: Funding rates are fees set by cryptocurrency trading platforms to maintain the balance between contract prices and the prices of underlying assets, typically applied to perpetual contracts. It is a mechanism for the exchange of funds between long and short traders. The trading platform does not charge this fee; it is used to adjust the cost or profit of holding contracts for traders, so that contract prices remain close to the prices of the underlying assets. When the funding rate is 0.01%, it represents the benchmark rate. When the funding rate is greater than 0.01%, it indicates that the market is generally bullish. When the funding rate is less than 0.005%, it indicates that the market is generally bearish.

- 08:32Analyst: Nearly 40% of BTC holdings are currently in a loss, reaching the target level of the first round of declines in previous bear market cycles.BlockBeats News, November 18, on-chain data analyst Murphy posted on social media that the 7-day average of BTC's Percentage Supply in Profit (PSIP) has dropped below 70%, meaning that after this round of decline, nearly 30% of the entire chain's holdings are now in a loss position. If you exclude BTC that has not moved for a long time, lost coins, and addresses similar to Satoshi Nakamoto's, this proportion is expected to reach over 40%. Murphy added that in the past 10 years, during the first round of declines when the market cycle shifted from bull to bear, the PSIP would always reach the current level, followed by a rebound after a period of extreme sentiment pressure, as seen in both 2018 and 2020. In particular, 2020 also coincided with the 519 black swan event. However, even if a rebound occurs, it may not be able to reestablish an upward trend, as there are too many holders in the market waiting to exit during the rebound.

- 08:32Last week, the leading long positions that bought the dip in BTC and ETH were liquidated with a loss of $7.3 million, followed by opening $33 million in new ETH long positions.BlockBeats News, November 18, according to Coinbob Hot Address Monitor, in the past 4 hours, the whale (0x93c), who was the "largest BTC long position holder on Hyperliquid" last week, closed and stopped out of approximately $64 million worth of BTC long positions and $21.1 million worth of ETH long positions, recording a total loss of about $7.35 million. Afterwards, the whale used the remaining $1.3 million in the account to open a 25x leveraged ETH long position at an average price of $2,980, with a liquidation price of $2,919. Since November 12, this address has transferred about $8 million to Hyperliquid, and then repeatedly attempted to bottom fish ETH, making a small profit of $700,000. From November 13 to 14, the whale heavily opened long positions in BTC and ETH, once becoming the largest BTC long position holder on Hyperliquid.

![[Bitpush Daily News Selection] Strategy increased its holdings by purchasing 8,178 bitcoins last week at an average price of $102,171; CBOE will launch continuous futures contracts for bitcoin and ethereum on December 15; Federal Reserve Governor Waller: Supports risk-management rate cuts in December](https://img.bgstatic.com/multiLang/image/social/8ce218bf9e396bdadfada2b4ef95f3111763451361931.png)