News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 18) | Fidelity Solana Spot ETF Launches Tonight in U.S. Markets; Public Companies Net-Buy Over $847 Million in BTC Last Week; All Three Major U.S. Indexes Close Lower2Young Bitcoin holders panic sell 148K BTC as analysts call for sub-$90K BTC bottom3Ethereum Falls Under $3,100 Amid Spot ETF Outflows, Viewed as Riskier Than Bitcoin

Research Report|In-Depth Analysis and Market Cap of Monad (MON)

Bitget·2025/11/18 07:48

Is the crypto market bearish? See what industry insiders have to say

金色财经·2025/11/18 07:46

Whales make big bets, institutions deeply trapped, crypto market faces a cold wave

AICoin·2025/11/18 07:41

Crypto Projects Still Lining Up for Listing in This Bear Market

The next potential trading opportunity.

BlockBeats·2025/11/18 06:33

A whale who once made nearly 100 millions in profits shares: Why I no longer trade on HyperLiquid?

A mature financial system would never rely solely on "luck" and "hope" as its final safety net.

BlockBeats·2025/11/18 06:33

DappRadar, another tear of the era

"High value, low payment" is a problem that Web3 tool products have yet to solve.

ForesightNews 速递·2025/11/18 06:13

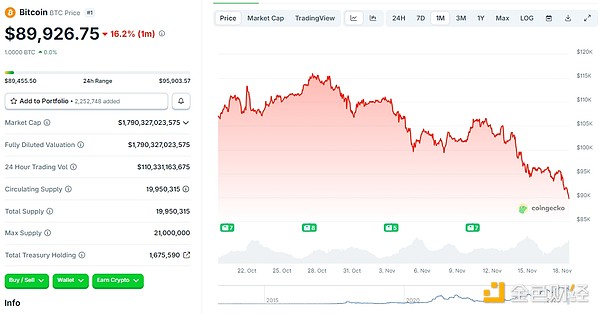

Bitcoin falls below the 90,000 mark—where is the market headed?

A quick overview of market outlook analyses from traders and industry experts.

ForesightNews 速递·2025/11/18 06:12

The crypto projects still in line to be listed during this bear market

BlockBeats·2025/11/18 05:16

Flash

- 08:59Stacks network activates Clarity 4 smart contract language, adding six new Bitcoin-native DeFi development featuresChainCatcher news, the SIP-033 and SIP-034 proposals have been officially activated at Bitcoin block height 923222, and the Bitcoin smart contract layer Stacks has simultaneously launched the Clarity 4 smart contract language. This upgrade introduces six core features for developers: on-chain contract code hash retrieval and verification, custom contract post-condition settings, simple value to ASCII string conversion, current block timestamp retrieval, secp256r1 signature verification (supporting native key integration), and a dimensional resource tenure extension mechanism. These features will lower the development threshold for native Bitcoin DeFi applications, help build safer and more flexible financial protocols, and further strengthen Stacks' positioning as the liquidity layer of the Bitcoin ecosystem. All Stacks transactions are settled on the Bitcoin chain and rely on the transfer proof mechanism to obtain Bitcoin network security guarantees.

- 08:44Wintermute: Macro backdrop remains positive, but BTC needs to regain momentum for the market to have a broad recovery foundationChainCatcher reported that Wintermute released a report stating that over the past week, the market mainly digested the sharp adjustment in rate cut expectations—the probability of a rate cut plummeted from 70% to 42% within a week, with the volatility amplified by a macro data vacuum. Powell's ambiguous stance on rate cuts forced the market to reassess the divergence among FOMC members, revealing that a consensus on rate cuts is far from being reached. Risk assets weakened in response, and the crypto market, as a sentiment indicator, was the first to bear the brunt. Among cross-asset performance, digital assets continued to lag at the bottom. This weakness is not a new phenomenon: since early summer, crypto assets have consistently underperformed the stock market, partly due to their negative bias relative to equities. What is unusual is that in this round of decline, both BTC and ETH underperformed the overall altcoin market. The reasons can be attributed to: altcoins have already been in a prolonged downtrend; certain segments such as privacy coins and fee-switch tokens still show localized resilience. Some of the pressure comes from whale position adjustments. Although there is a seasonal pattern of reductions from Q4 to January of the following year, this year it has clearly been brought forward, as many traders expect the four-year cycle theory to suggest that next year will enter a lull period. This consensus becomes self-fulfilling: preemptive risk management actions have intensified volatility. It should be clarified that this round of selling pressure is not supported by deteriorating fundamentals, but is purely a macro-driven adjustment led by the United States. Currently, the macro backdrop remains favorable, with global easing continuing, US QT nearing its end, fiscal stimulus channels active, and Q1 liquidity expected to improve. The key signal missing from the market is the stabilization of leading assets—unless BTC returns to the upper end of its volatility range, market breadth will be difficult to expand and narrative logic will remain short-lived. The current macro environment does not match the characteristics of a prolonged bear market. As policy and interest rate expectations become the main catalysts, once leading assets regain momentum, the market will have a broad foundation for recovery.

- 08:44Brazilian lawmaker proposes granting courts the power to freeze or confiscate cryptocurrencies of cybercrime suspectsChainCatcher reported that Brazilian federal deputy Chrisóstomo de Moura has proposed a bill aimed at granting courts the authority to freeze or confiscate the crypto assets of cybercrime suspects. The bill allows judges, when handling fraud crimes, to proactively or at the request of prosecutors take preventive measures, including freezing cryptocurrency wallets and traditional financial assets. The deputy stated that these preventive measures will help protect society and provide a powerful tool to combat fraud. The bill also proposes the establishment of a "National Fraud Victim Compensation Fund" to provide immediate assistance to victims, addressing the issue of slow civil compensation procedures. In addition, the deputy called for harsher penalties for cybercriminals, including preventive detention, and restricting citizens' access to cryptocurrency trading platforms used for criminal activities. The bill is currently under committee review, and it is expected that the final analysis will take some time to complete.

![[Bitpush Daily News Selection] Strategy increased its holdings by purchasing 8,178 bitcoins last week at an average price of $102,171; CBOE will launch continuous futures contracts for bitcoin and ethereum on December 15; Federal Reserve Governor Waller: Supports risk-management rate cuts in December](https://img.bgstatic.com/multiLang/image/social/8ce218bf9e396bdadfada2b4ef95f3111763451361931.png)