News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 11)|Trump Announces 100% Tariffs on China, Triggering Market Turmoil; Crypto Industry Liquidations Exceed $19.1 Billion in 24 Hours, Setting New Record.2Bitcoin slump may rebound up to 21% in 7 days if history repeats: Economist3US–China Tariff Fears Hit Bitcoin Treasury Stocks

Central Banks Stock Up On Gold, Bitcoin Gains Traction

Cointribune·2025/10/11 11:57

Central Bank Data Confirms Massive Crypto Usage In Russia

Cointribune·2025/10/11 11:57

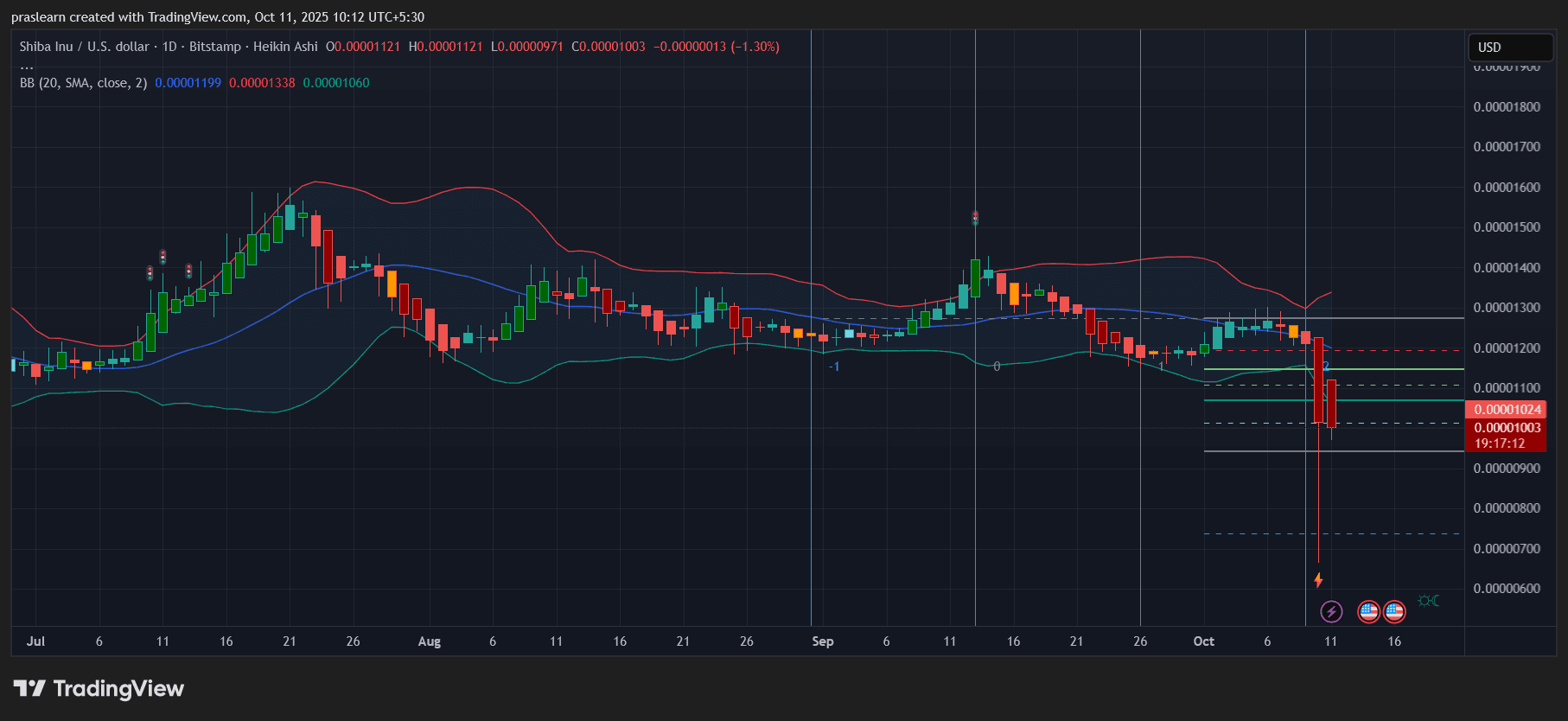

Will SHIB Price Crash to 0 After Trump’s 100% Tariff Threat?

Cryptoticker·2025/10/11 11:39

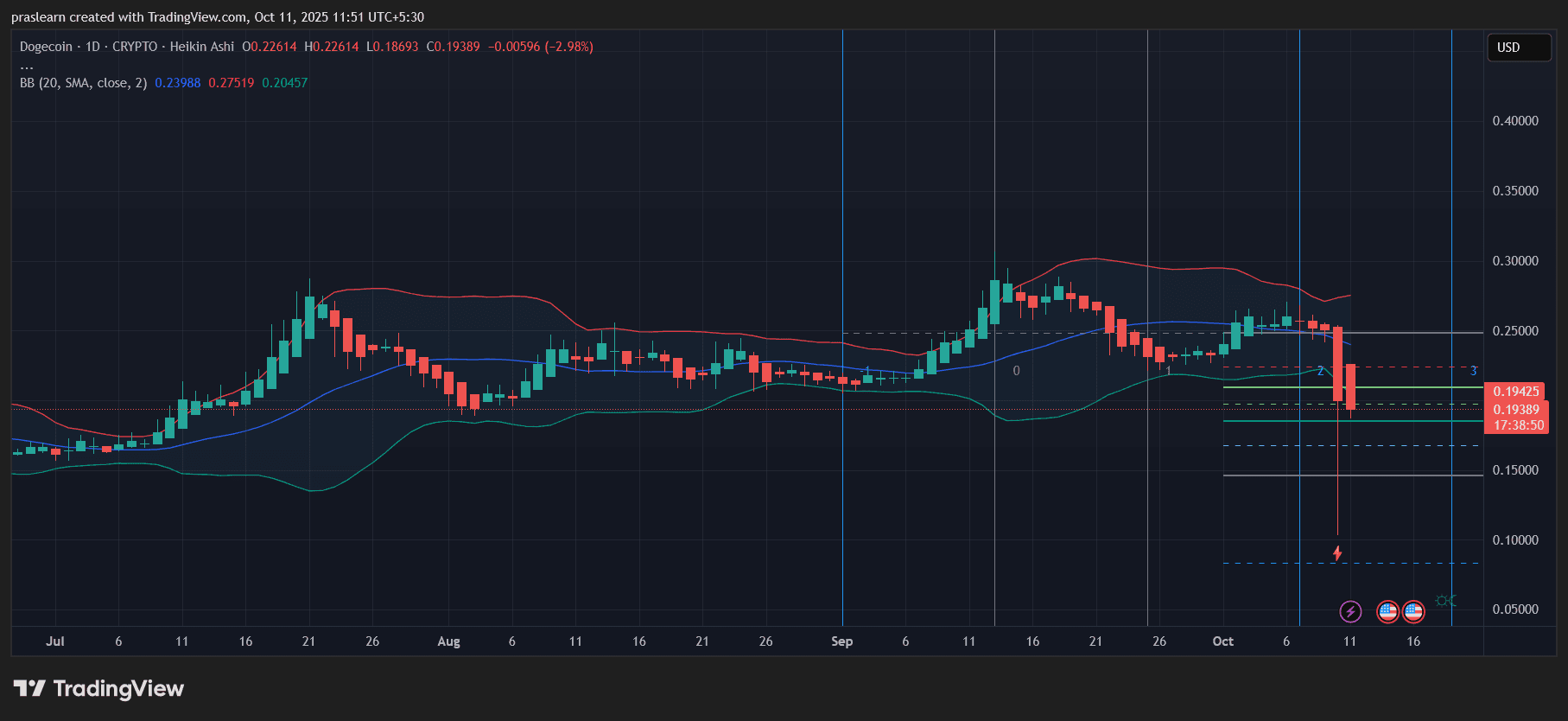

Trump’s 100% Tariffs: Is This the End for Dogecoin?

Cryptoticker·2025/10/11 11:39

BTC, ETH, XRP, SOL Face Slow Bottoming Process After $16B Liquidation Shock

Cointime·2025/10/11 11:36

Russia Acknowledges Crypto’s Popularity With Its Citizens as Central Bank Weighs Bank Involvement

Cointime·2025/10/11 11:36

Collection of Opinions: Tariffs, Whales, or Market Makers—Who Is the Culprit Behind Today’s Crypto Market Crash?

Although the market generally believes that Trump's tariff remarks have disturbed sentiment in the crypto market, the sudden plunge in altcoins was far greater than expected. What exactly triggered this unexpected collective drop in altcoins?

Chaincatcher·2025/10/11 10:46

Black Swan Spreads Its Wings: "10·11" Becomes the Most Terrifying "Liquidation Day" in Crypto History

Over 1.63 million people were liquidated in the market, and market sentiment shifted overnight from greed to fear.

ForesightNews 速递·2025/10/11 09:52

Flash

- 11:53"Calm Order King" Accurately Shorts BTC and SOL, Raking in $10 Million in 30 Days with a 100% Win Rate in the Past 7 DaysBlockBeats News, October 11 — According to on-chain AI analysis tool Coinbob, the address known as the "Calm Order King" (0x9b8…) has once again executed precise trades recently. Last night, this address opened new short positions in BTC and SOL, earning nearly $3 million in profit. Two hours ago, the SOL short position was fully closed to take profit, demonstrating an accurate grasp of market timing. Over the past 30 days, this trader has accumulated profits exceeding $10 million, strictly implementing take-profit and stop-loss strategies, with the maximum drawdown in the past two months consistently controlled within 23%. After each profitable trade, a portion of the funds is transferred to a spot account for isolation, effectively mitigating potential liquidation risks. It is worth noting that the "Calm Order King" started this month with a principal of $3 million. By capturing swing opportunities in major cryptocurrencies, the total account assets have now reached $14.349 million, delivering an astonishing return. This trader favors high-leverage positions in mainstream coins, achieving a 100% win rate over the past 7 days. In one particularly precise SOL short, a single trade yielded over $5.1 million in profit, making this address a focal point among active on-chain swing traders. BlockBeats reminds investors that volatility in the cryptocurrency market has increased significantly recently, and investors should pay attention to risk control.

- 11:53Four traders on Hyperliquid liquidated today with losses exceeding $10 millionBlockBeats News, October 11, according to monitoring by Lookonchain, during today's market crash, four traders on Hyperliquid were liquidated, each losing more than $10 million. • 0x1a67 lost $18.73 million, with the account completely wiped out; • 0x1d52 lost $16.43 million, with only $140 remaining; • 0x0a07 lost $15.69 million, with only $104 remaining; • 0xb2ca lost $13.72 million, with the account completely wiped out.

- 11:53Securitize is in merger talks with Cantor's SPAC for a public listing, with an expected valuation exceeding $1 billion.BlockBeats News, October 11, according to Bloomberg, the RWA tokenization platform Securitize, backed by BlackRock, is in talks with a special purpose acquisition company (SPAC) initiated by Cantor Fitzgerald LP regarding a potential public listing. Sources familiar with the matter revealed that the merger deal between Securitize and Cantor Equity Partners II Inc. would value the company at over $1 billion. However, negotiations are still ongoing, and Securitize may also choose to remain private.