News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 16)|SEC to Introduce Innovative Exemption Mechanism by End of 2025; Japan Plans Legislation to Ban Crypto Insider Trading; Aptos Partners with Reliance Jio to Launch Blockc2Chainlink holds 63% oracle market share as LINK price tests resistance3Top 3 Altcoins for November Gains: Experts Highlight ETH, ADA, and LINK

The XRP Price Roadmap To $8: How An Over 50% Bounce Could Materialize

CryptoNewsNet·2025/10/17 06:36

Is Solana Ready to Hit $260 Again After 33% Pullback?

CryptoNewsNet·2025/10/17 06:36

XRP Near Exhaustion Zone After 34% Holder Drawdown. Could Macro Easing Pump Demand?

CryptoNewsNet·2025/10/17 06:36

Algorand (ALGO) to See a Slight Dip Before a Rebound? This Bullish Fractal Setup Says Yes!

CoinsProbe·2025/10/17 06:27

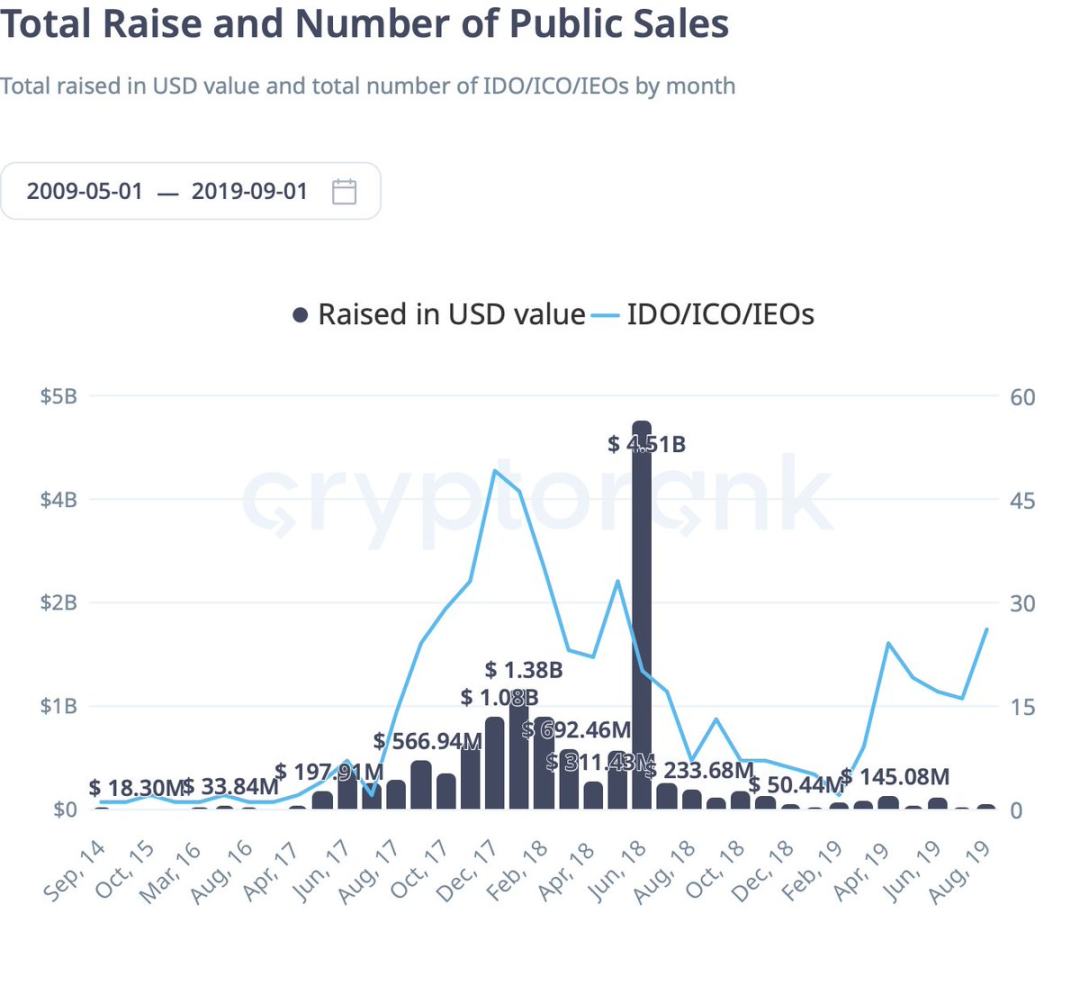

ICO Revival: Echo, Legion and Others Turn Speculation Frenzy into Structured Investment

In 2025, ICOs accounted for approximately one-fifth of all token sale trading volume.

深潮·2025/10/17 05:57

MegaETH Valuation Game: A Good Entry Opportunity or Approaching Risk?

The L2 project MegaETH, backed by Vitalik, is about to launch its public sale.

Chaincatcher·2025/10/17 04:52

The Manipulation Logic and Survival Strategies Behind the "Largest Liquidation in History"

BTC_Chopsticks·2025/10/17 04:43

This is not a bull market signal, but one of the most dangerous turning points in history.

BTC_Chopsticks·2025/10/17 04:42

Flash

- 06:35A whale was liquidated while going long on WBTC on Aave, incurring a loss of $1.5 million.According to Jinse Finance, monitored by PeckShieldAlert, as the price of bitcoin fell below $108,000, a whale wallet (0xbf2b..15bd) was liquidated on the Aave platform after going long on WBTC, resulting in a loss of $1.5 million.

- 06:34The whale who switched to long positions on ETH and BTC yesterday has now incurred an unrealized loss of $5.26 million.According to ChainCatcher, on-chain analyst @ai_9684xtpa has monitored that as ETH fell below $3,900 and BTC dropped below $108,000, the mysterious whale who reversed direction to go long on ETH and BTC has seen their floating loss expand to $5.26 million. However, as of now, this whale has not reduced their positions or cut losses, as their margin remains sufficient and there is still significant room before reaching the liquidation price.

- 06:15Institution: The decline in US Treasury yields may signal a major shift in market sentimentJinse Finance reported that Justin Low, an analyst at the US financial website investinglive, stated that all perspectives on gold have long been exhausted. There are no signs of a pullback in this round of the rally, and since the beginning of this week, gold prices have soared by more than $300, making the market exceptionally wild. Gold is expected to achieve a full five consecutive trading days of gains throughout the week. During the Asian session, gold prices fluctuated again, once falling back to $4,280. However, buying quickly surged in, pushing gold prices back to around $4,370. Trade tensions remain the focus of ongoing developments this week, but new trends are also emerging in the bond market. Earlier this week, the analyst warned that the market was at a critical turning point, and as trading enters the final day of the week, various signs are beginning to emerge. The yield on the 10-year US Treasury is attempting to break strongly below the 4% mark, which may signal a major shift in market sentiment. Therefore, as we enter the mid-to-late October trading period, it is crucial to be alert to fluctuations in other related assets in the market. (Golden Ten Data)