News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

After the meme craze fades, perhaps it's time to refocus on the prediction market.

This article analyzes the results of the Monad airdrop allocation and the community's reactions, pointing out that a large number of early testnet interaction users experienced a "reverse farming" situation, while most of the airdrop shares were distributed to broadly active on-chain users and specific community members. This has led to concerns about transparency and dissatisfaction within the community. The article concludes by suggesting that "reverse farmed" airdrop hunters shift their focus to exchange activities for future airdrop opportunities.

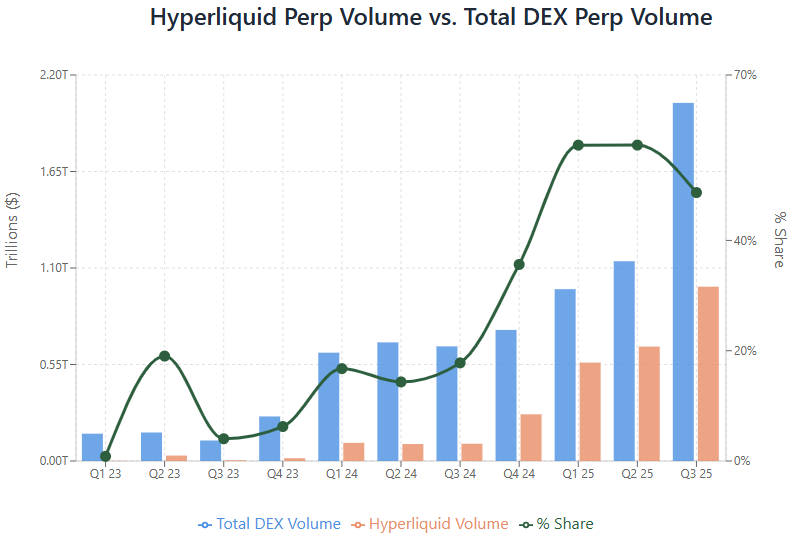

The grand vision of unified development across the entire financial sector on Hyperliquid has never been so clear.

The US and UK have jointly taken action against one of the largest investment fraud networks in history, seizing a record amount of funds.

- 10:02Polymarket market makers are expected to earn 0.2% of trading volume, with market maker earnings exceeding $20 million over the past year.BlockBeats News, October 15th, Buzzing founder Luke (@DeFiGuyLuke) revealed to BlockBeats two months ago: "Market makers on Polymarket should have earned at least $20 million in the past year." "We haven't compiled the latest data after a few months, but it's definitely more. Specifically regarding the profit model, based on market experience, a relatively stable expectation is: 0.2% of the trading volume." The original BlockBeats article "Those quietly profiting from arbitrage on Polymarket" disclosed that if you provide liquidity in a certain market and the monthly trading volume is $1 million (including both buy and sell orders you take), then your expected profit is approximately: $1 million × 0.2% = $2,000. This yield may not seem high, but the key is that it is relatively stable, unlike the volatility of speculative trading. Moreover, if you scale up to increase returns, then 10 markets would be $20,000, and 100 markets would be $200,000. If you add platform LP rewards and annualized holdings, the actual returns will be even higher. "But the main income still comes from the market-making spread and the rewards given by Polymarket, these two parts."

- 10:02Hyperliquid sees $19 million liquidation as whale Cyantarb "makes a comeback," depositing 2 million USDC againBlockBeats News, October 15, according to MLM monitoring, after losing about $19 million and being fully liquidated on Hyperliquid four days ago, Cyantarb has made a comeback—depositing $2 million USDC and resuming market-making activities. By historical trading volume, Cyantarb is the eighth largest account on Hyperliquid and was fully liquidated during the market crash—losing approximately $18 million to $19 million. This liquidation wiped out about $100 millions in notional positions, making it the largest account to be liquidated on Hyperliquid during the market crash.

- 10:02The top three earners on Polymarket have collectively garnered over $47 million in revenue.BlockBeats News, October 15th — According to data from polymarketanalytics, the top three earners on the platform have collectively made over $47 million in revenue, specifically: · Theo4, win rate 88.90%, earnings of $22.05 million; · Fredi9999, win rate 73.30%, earnings of $16.6 million; · Len9311238, win rate 100%, earnings of $8.7 million. BlockBeats original article "People Quietly Making Fortunes through Arbitrage on Polymarket" revealed that with ICE's strategic investment, Polymarket's liquidity, user base, and market depth are all growing rapidly. More capital inflows mean more trading opportunities; more retail participation means more market imbalances; more market types mean more arbitrage opportunities. For those who truly know how to make money on Polymarket, this is a golden era. Most people treat Polymarket as a casino, while smart money sees it as an arbitrage tool.

![[Bitpush Daily News Highlights] The US plans to confiscate 127,000 BTC, potentially increasing its bitcoin holdings to 324,000 BTC; Powell hints at possible rate cuts due to weak hiring and rising unemployment; Japan to introduce new regulations banning crypto insider trading; US Republicans propose a bill to codify Trump’s executive order allowing 401(k) investments in cryptocurrency and private equity.](https://img.bgstatic.com/multiLang/image/social/b0411719ec6c4657208c834dbbc069d31760470562725.png)