News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

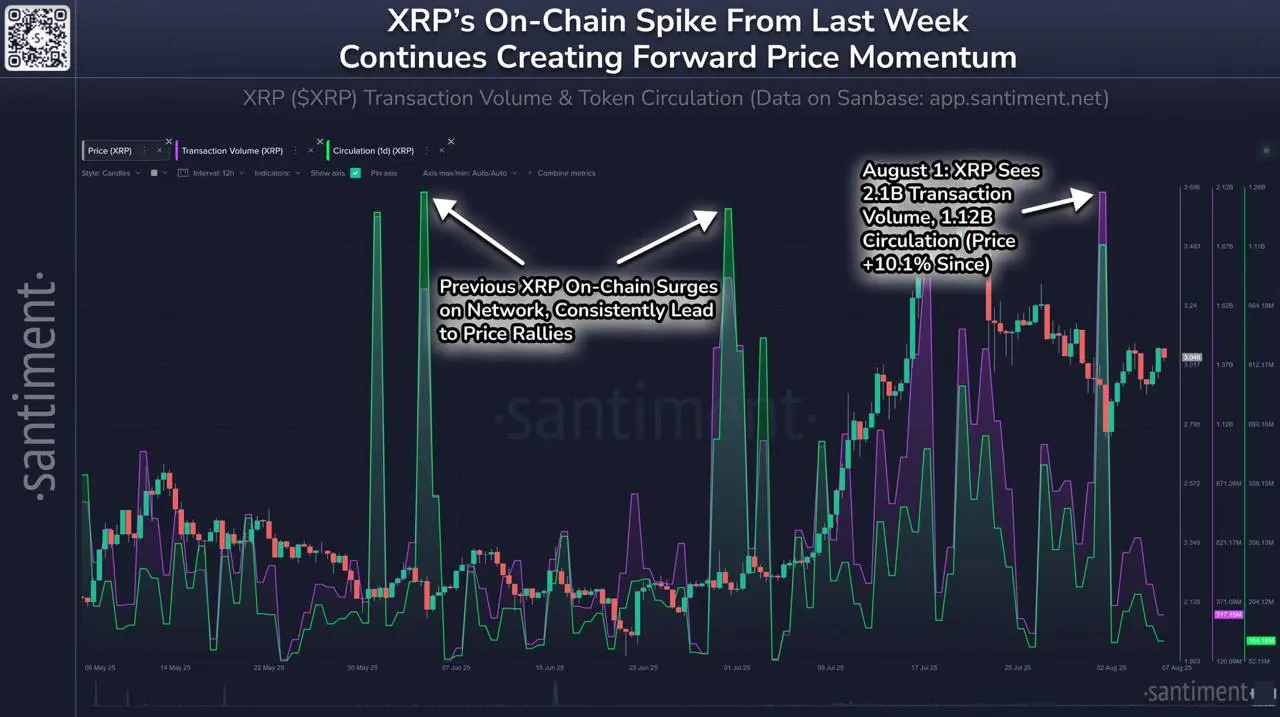

Share link:In this post: SEC has waived the “bad actor” designation for Ripple after the settlement of their 5-year dispute. The waiver means Ripple can now return to raising capital in the private markets. XRP has seen substantial gains, but analysts say there is more to come.

Share link:In this post: Microsoft has announced that it will discontinue its Lens application in the coming weeks. The company has released the timeline for the removal of the application from the iOS and Android app stores. Microsoft has urged users to switch to the Copilot artificial intelligence application.

Share link:In this post: A Colorado man has pleaded guilty to operating a multi-million-dollar fraudulent investment scheme. The suspect, Timothy McPhee, is also being charged with tax evasion and conspiracy to defraud the United States. McPhee is expected to be sentenced on October 23, facing up to 30 years in prison for his crimes.

Share link:In this post: Ethiopian Electric Power has announced plans to shut down all crypto mining operations in the country. According to the EEP, no new contracts will be taken, and all existing ones will be reconsidered. EEP wants to focus electricity on domestic consumers and strategic industries.

Quick Take Bitcoin rose above $121,000 while ether reached $4,300 late night Sunday, following Trump’s executive order on allowing 401(k) accounts to invest in crypto. Spot ETF flows and corporate crypto treasuries remain key drivers of the current market cycle, analysts said.

The DeFi TVL patterns are similar to the 2021 altseason, which sent Ethereum to its record high.

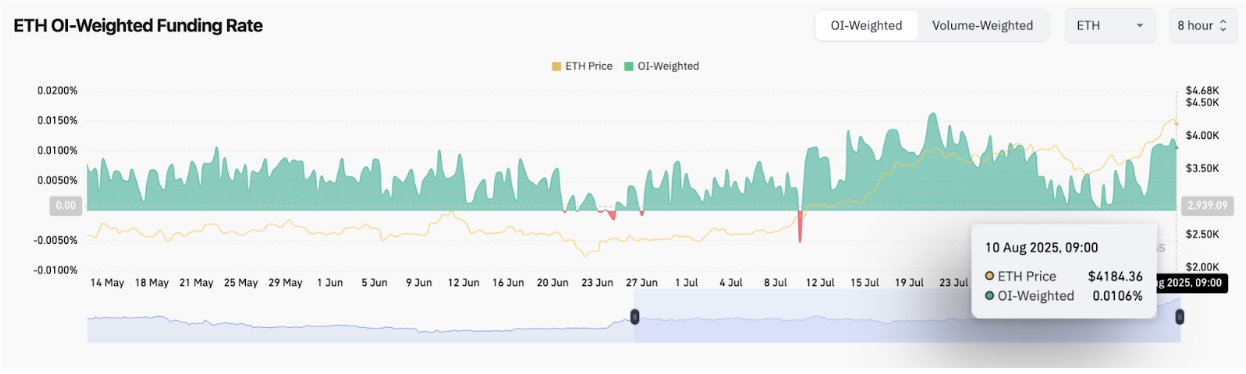

Ethereum price surged 6.5% to $4,330 on August 10 as Fundamental Global unveiled a $5B ETH treasury accumulation plan.

- 01:1410x Research: The crypto market may introduce a "circuit breaker" mechanism to cope with extreme volatilityAccording to ChainCatcher, a 10x Research report states that the recent crypto market crash has exposed deep-rooted issues in exchanges’ liquidation and risk control mechanisms, with some platforms profiting from the event while others lost hundreds of millions of dollars. The report points out that automated liquidation systems, designed to provide liquidity, actually amplified chaos during extreme market conditions, prompting institutions to re-examine their risk management frameworks. A new focal point of industry discussion is emerging—whether crypto exchanges should draw from traditional financial markets and introduce “circuit breakers” to limit extreme volatility. 10x Research notes that if implemented, this move could permanently alter the volatility structure and profit logic of the crypto market. The report also recalls that after Musk announced in 2021 that Tesla would stop accepting bitcoin payments, the market experienced political backlash triggered by leveraged liquidations. The far-reaching impact of the current crash may similarly reshape the structure of the crypto market.

- 01:12Lighter will distribute 250,000 points to compensate traders affected by the market crash.ChainCatcher News, perpetual contract trading platform Lighter has announced the distribution of 250,000 points as compensation to traders affected by the recent market crash. According to the official statement, the compensation will be executed in three categories: First, due to platform performance degradation before the market crash, traders suffered a cumulative loss of approximately 25 million USD. The platform will distribute 150,000 points and refund liquidation fees (paid in USDC); Second, during the market crash, LLP holders experienced an asset decline of about 5%. The platform will provide 25,000 points as compensation and further clarify the LLP liquidity mechanism in the technical documentation; Finally, about five hours after the market recovery, a database failure caused a short downtime of 4.5 hours, resulting in a loss of approximately 7 million USD. An additional 75,000 points will be distributed and the related liquidation fees will be refunded. In addition, Lighter stated that the second season of the points distribution event will take place every Friday starting from October 17, with the first round of airdrop totaling 600,000 points.

- 01:12Bloomberg Senior ETF Analyst: Solana Spot and Staking ETF’s Lower Fees Make It More CompetitiveChainCatcher news, Bloomberg Senior ETF Analyst Eric Balchunas posted on X that the spot Solana ETF fee rate is 30 basis points (bps), and the staking ETF fee rate is 28 basis points, with overall pricing being "reasonable and transparent." He pointed out that this lower fee rate will make the Solana ETF more attractive in competition with other funds and intermediary products. Previous news: VanEck updated its spot Solana ETF S-1 filing, with a management fee rate of 0.30%.