News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 13)|Portal to Bitcoin mainnet launch and $50M funding; BTC and ETH rebound in short term, over $8.5B liquidated in 24 hours; 2XRP Targets $5.25 After Holding Strong Near the $1.5 Assembly Zone3Clues of the "End of the Bull Market": The "Bull's Tail" Is the Fattest and Everyone Is Bullish

Ethereum Goes All-In to Defend Roman Storm in Landmark Legal Battle

Cointribune·2025/08/08 16:50

Near Protocol (NEAR) To Rise Higher? Key Emerging Fractal Setup Saying Yes!

CoinsProbe·2025/08/08 16:50

First Neiro on Ethereum (NEIRO) To Rise Higher? Key Harmonic Pattern Signals Potential Upside Move

CoinsProbe·2025/08/08 16:50

Render (RENDER) Soars Higher While Tracing a Familiar Pattern – What Could Come Next?

CoinsProbe·2025/08/08 16:50

Ethereum Price Prediction: Can BlackRock’s $103M Buy Push ETH to $4,000?

Cryptoticker·2025/08/08 16:40

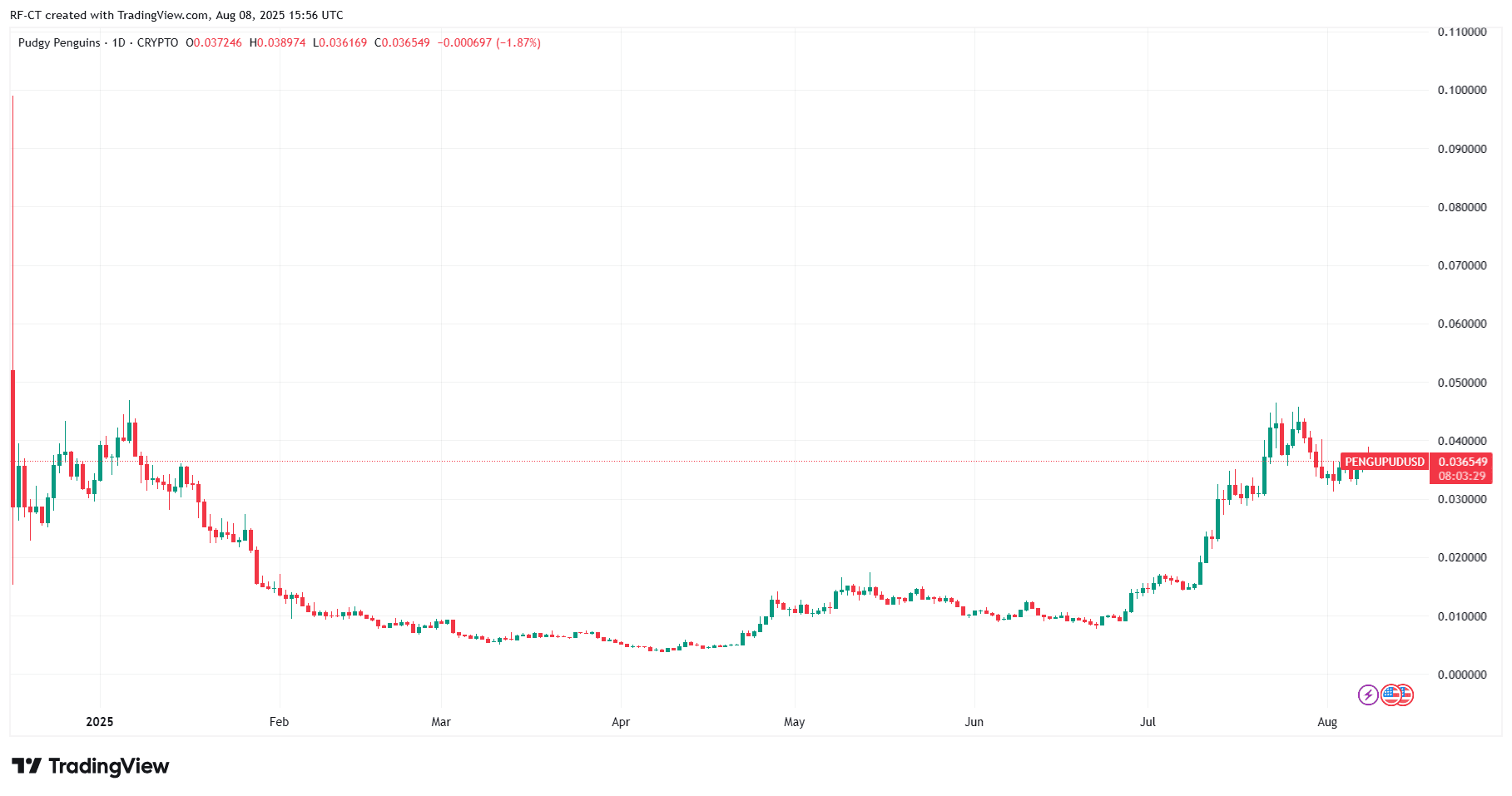

PENGU Surpasses BONK: Can Solana’s Meme Coin Star Break Into the Top 3 by 2025?

Cryptoticker·2025/08/08 16:40

Harvard Enters the Crypto Market With BlackRock’s Bitcoin ETF

Harvard University invested $116.6 million in BlackRock's Bitcoin ETF in Q2 2025, marking its largest Web3 commitment and surpassing Alphabet in portfolio size.

BeInCrypto·2025/08/08 16:37

Ethereum Treasury Companies Are a Better Buy Than US Spot Ether ETFs, Standard Chartered Says

Cointime·2025/08/08 16:25

Vitalik backs Ethereum treasury firms, but warns of overleverage

Cointime·2025/08/08 16:25

Chainlink Unveils LINK Reserve Strategy. Is a Supply Shock Incoming?

DailyCoin·2025/08/08 16:00

Flash

- 05:11Crypto mining company NetBrands to establish a $100 million digital asset treasuryOn October 13, it was reported that NetBrands, a cryptocurrency mining company currently listed on the US OTC market, announced the launch of a "tiered" digital asset treasury. This treasury will use BTC as a long-term reserve asset and will maximize the retention of mined bitcoin. It will also invest in ETH and AAVE, and explore obtaining additional returns such as staking with these two cryptocurrencies. The initial funding for this treasury is $10 million, with an overall target scale of $100 million.

- 04:40Data: Ethereum spot ETFs saw a net inflow of $488 million last week, with BlackRock's ETHA leading at a net inflow of $638 million.According to ChainCatcher, citing SoSoValue data, during last week's trading days (Eastern US time, October 6 to October 10), Ethereum spot ETFs saw a net inflow of $488 million for the week. The Ethereum spot ETF with the highest weekly net inflow last week was Blackrock's ETF ETHA, with a weekly net inflow of $638 million. The historical total net inflow for ETHA has reached $14.49 billion. The second highest was Grayscale's Ethereum Mini Trust ETF ETH, with a weekly net inflow of $11.75 million, and a historical total net inflow of $1.53 billion for ETH. The Ethereum spot ETF with the largest weekly net outflow last week was Fidelity's ETF FETH, with a weekly net outflow of $126 million. The historical total net inflow for FETH has reached $2.69 billion. As of press time, the total net asset value of Ethereum spot ETFs stands at $27.51 billion, with the ETF net asset ratio (market cap as a percentage of Ethereum's total market cap) at 5.89%. The historical cumulative net inflow has reached $14.91 billion.

- 04:39Monochrome spot Bitcoin ETF in Australia increases its BTC holdings to 1,078.According to an official announcement reported by Jinse Finance, the Australian Monochrome spot bitcoin ETF (IBTC) disclosed that as of October 10, its holdings had reached 1,078 bitcoins, with a market value exceeding 199 millions AUD.