News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- U.S. adoption of UCC Article 12 redefines digital asset collateral rules, prioritizing "control" (e.g., private key possession) over traditional filing for perfection. - Transition periods ended in key states (e.g., Delaware by July 2025), leaving lenders relying on legacy filings at risk of losing priority to control-based creditors. - 32 states have adopted the 2022 UCC amendments, but uneven implementation requires multi-jurisdictional compliance strategies, especially with non-adopting states like Ne

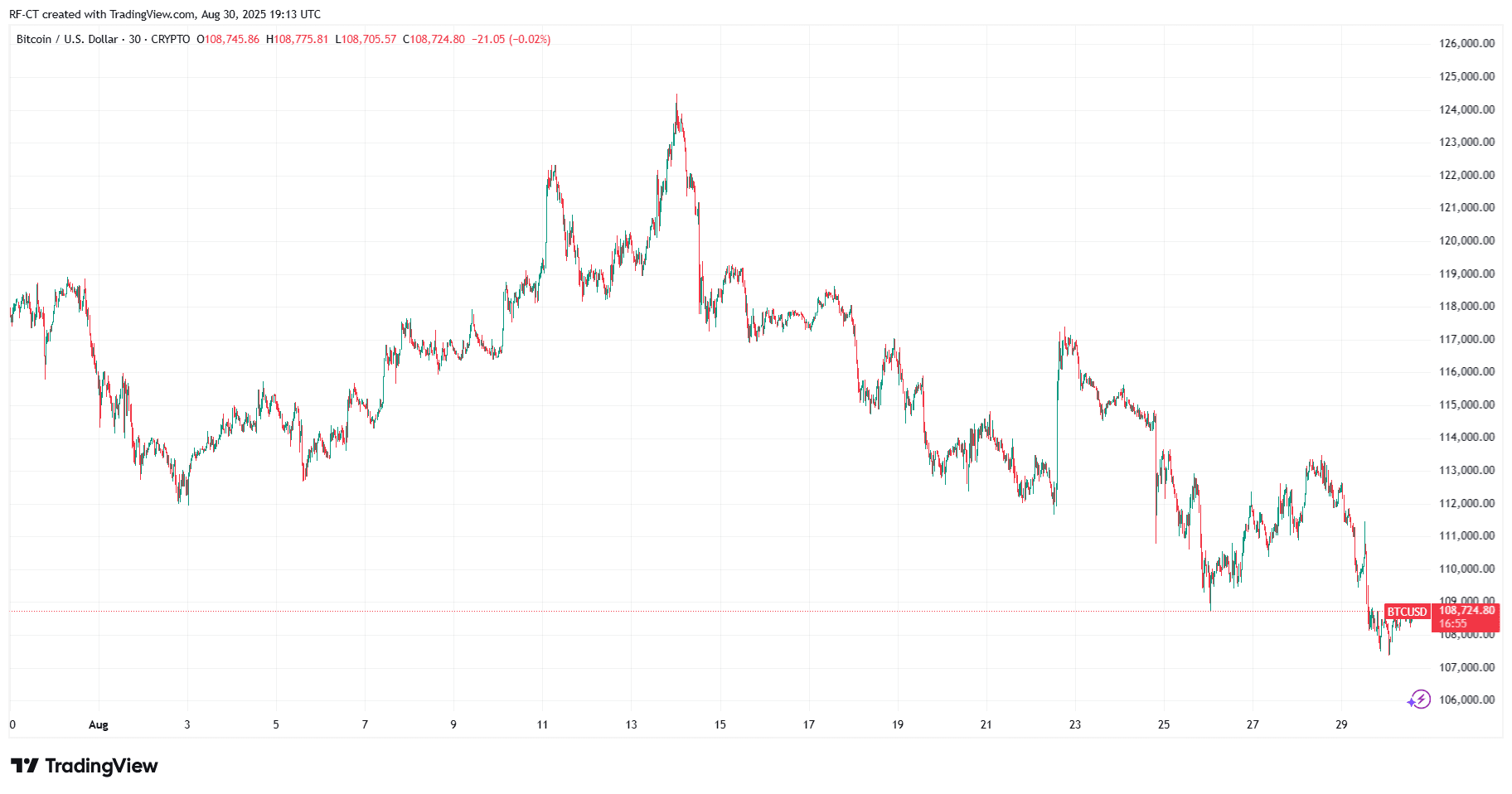

- Ethereum ETFs saw $164.6M net outflow on Aug 29, 2025—the largest since launch—driven by profit-taking amid inflation concerns and geopolitical risks. - Institutional capital temporarily shifted to Bitcoin ETFs as BlackRock/Fidelity injected $129M, reflecting Bitcoin's "safe haven" appeal during Fed rate delay uncertainty. - Ethereum's fundamentals remain strong: 71% YTD gains, 94% reduced Layer 2 fees post-Dencun/Pectra, and $223B DeFi TVL despite short-term outflows. - ETF inflows ($3.87B in August) ou

- 2025 crypto market splits between speculative meme coins (e.g., PEPE) and utility-driven projects (e.g., RTX) with real-world applications. - PEPE faces 30% 2026 growth forecasts but risks 50% short-term price drops, driven by social media sentiment and geopolitical volatility. - RTX targets 7,500% returns via low-cost remittances, institutional audits, and deflationary tokenomics, contrasting PEPE's lack of utility or governance. - Analysts highlight RTX's $19T market alignment and 0.1% fee model as sus

- BlockDAG (BDAG) raised $386M in presale, selling 25.5B tokens across 30 batches at $0.03 each, projecting 30x returns if token hits $1 post-launch. - Hybrid DAG-PoW architecture and EVM compatibility attracted 4,500 developers to build 300+ dApps, while 3M users mine via X1 app and 19,000 ASICs sold. - 25% referral rewards and Dashboard V4's real-time data drive community growth, contrasting bearish trends in SHIB/ARB and speculative hype in TAO/RNDR. - Analysts highlight BDAG's pre-mainnet infrastructur

- 10:14Bitget is launching the 6th Stock Token Zero Fee Trading Competition with a total prize pool of 30,000 BGB.BlockBeats News, December 16th, Bitget launched the 6th Stock Token Zero Fee Trading Competition. During the event, users will be ranked based on the cumulative trading volume of CRCLon/TSLAon/MUon and other coins. Users ranked Top 1-428 will each receive airdrops of 50-800 BGB. The detailed rules have been published on the Bitget official platform. Users can click the "Join Now" button to complete registration and participate in the event. The event will take place from 19:00 on December 16th to 23:59 on December 18th (UTC+8).

- 09:50A whale who used a looping loan to go long on ETH sold 10,000 ETH for approximately $29.15 million.According to Jinse Finance, as reported by Yujin, address 0xa339 was forced to sell 30,894 ETH in April due to a drop in ETH price to avoid liquidation, resulting in a loss of approximately $40 million. Later, when ETH stabilized, the whale bought back 19,973 ETH at $1,740, bringing its total holdings to about 50,000 ETH at an average price of $2,545. After holding for about eight months, this whale sold 10,000 ETH four hours ago at a price of $2,915, cashing out approximately $29.15 million and realizing a profit of about $3.7 million. Currently, the whale still holds around 40,600 ETH, with an unrealized profit of about $15 million, but this is still not enough to offset the losses from the forced sale at the beginning of the year.

- 09:49Whale 0xa339 sells 10,000 ETH for a profit of $3.7 millionAccording to Ember monitoring, whale 0xa339 sold 10,000 ETH (29.15 million USD) at a price of 2,915 USD four hours ago after holding for 8 months, realizing a profit of 3.7 million USD. This whale had previously suffered a loss of 40 million USD in April due to risk aversion and stop-loss selling, but later repurchased at 1,740 USD and held 50,000 ETH at an average price of 2,545 USD. Currently, this address still holds 40,600 ETH (119 million USD), with an unrealized profit of 15 million USD, but has not yet made up for the stop-loss loss from April. (Ember)