News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- TOKEN6900 emerges as SPX6900's successor in 2025, leveraging FOMO-driven liquidity and $3.1M presale success to target 1000x gains. - Investors shift capital from SPX6900 (down 45% in March 2025) to TOKEN6900's $0.0071 tokens, fueled by satirical branding and 33% APY staking rewards. - Market rotation reflects broader trend: meme coins with viral narratives outperform legacy projects as SPX6900 faces bearish momentum and whale liquidations. - TOKEN6900's 300% social media growth contrasts with S&P 500's

- Avalanche (AVAX) surges with 493% C-Chain throughput growth, 57% active address increase, and 42.7% lower fees post-upgrade. - U.S. government adopts AVAX for GDP data anchoring, while Grayscale files AVAX ETF to unlock institutional capital and global custodians expand AVAX integration. - AVAX consolidates at $23–$25 with $27–$28 breakout potential, supported by 68% historical success rate at resistance levels and $9.89B DeFi TVL growth. - Strategic entry points with 5% volatility buffer align with CLAR

- China launches yuan-backed stablecoin pilot in Hong Kong and Shanghai to challenge dollar-dominated global trade and payments. - State-backed stablecoins use blockchain for cross-border settlements, with strict 100% reserve requirements and real-time monitoring under new regulatory frameworks. - Private firms like Conflux and PetroChina drive adoption through high-speed blockchain platforms and energy trade applications in BRI regions. - Initiative aims to reduce reliance on SWIFT and U.S. dollar, potent

- Bitcoin broke below a key multiyear support trendline, triggering "fakeout" fears as prices rebounded from a seven-week low of $108,665 to $113,208. - Technical analysts highlight conflicting signals: bullish inverse head-and-shoulders patterns vs. bearish double-top warnings and Fibonacci retracement risks. - Institutional selling contrasts with retail buying pressure, stabilizing prices amid a Binance Fear & Greed Index of 45 (moderate anxiety). - $117,000–$118,000 is the next critical target, with pot

- Elon Musk's lawyer Alex Spiro will chair a $200M Dogecoin treasury company backed by Miami-based House of Doge. - The initiative aims to institutionalize Dogecoin's market presence through traditional stock market exposure and corporate legitimacy. - Dogecoin's value remains heavily influenced by Musk's public statements, with the treasury model following crypto trends seen in Bitcoin investments. - Critics warn of regulatory risks and market manipulation concerns despite the growing $132B crypto treasur

- Bitcoin shows triple on-chain signals (whale selling decline, HODL Waves accumulation, technical support) suggesting a potential 4% price surge to $119,000. - Whale Exchange ratio dropped to 0.43 (lowest in two weeks), indicating reduced large-holder selling pressure and retail buyer dominance. - Medium-term holders increased BTC holdings despite volatility, reinforcing confidence in long-term price resilience. - Technical analysis highlights $115,400 support and $119,700 resistance levels as critical fo

- SPX token fell 12% as whale selling and weak technical indicators dominate bearish sentiment. - Institutional accumulation at $1.15 suggests contrarian buying, contrasting with Bitcoin/Ethereum's stable treasury growth. - $1.15 support zone faces pressure from massive whale offloading, with historical RSI strategies showing 145% returns but 25% drawdowns. - Market hinges on whether institutional confidence can outweigh bearish momentum and validate $1.15 as a recovery catalyst.

- Wall Street Pepe (WEPE) redefines meme coins through dual-chain migration (Ethereum/Solana) and deflationary tokenomics, addressing volatility and utility gaps seen in Dogecoin and Shiba Inu. - Its cross-chain model burns Ethereum tokens with every Solana transaction, maintaining a fixed 200 billion supply and enabling 1:1 peg activation at $0.001 per token. - NFT integration grants governance rights and exclusive perks (e.g., Alpha Chat access), creating a flywheel effect that links NFT adoption to toke

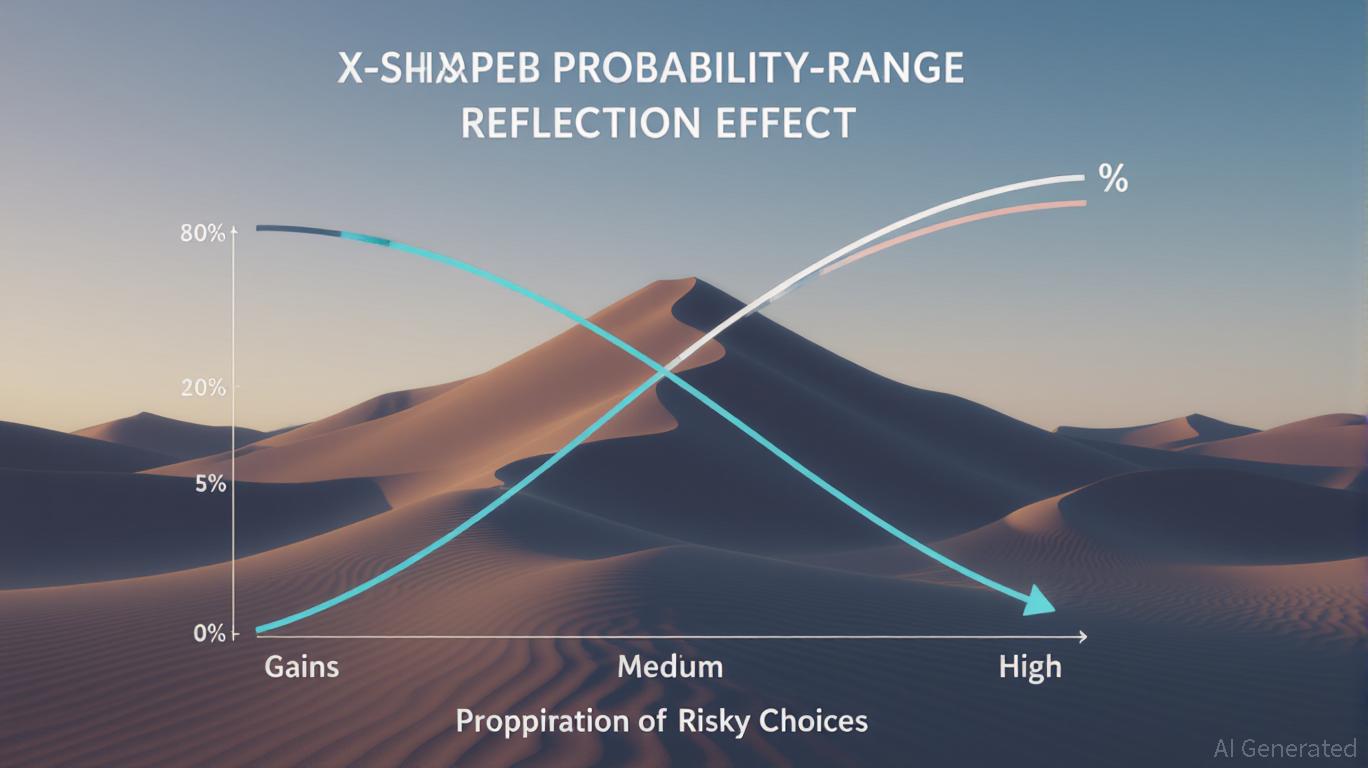

- The probability-range reflection effect (UXRP) explains how investors' risk preferences shift across six domains based on probability levels and gain/loss contexts. - Low-probability losses trigger risk-seeking behavior (e.g., distressed assets), while high-probability gains favor risk-averse choices (e.g., stable dividends). - Strategic allocations vary by scenario: defensive assets in stable markets, contrarian plays during downturns, and diversified hedging in uncertain conditions. - Domain-specific a

- Pepenode ($PEPENODE), a mine-to-earn meme coin, raises $500K in presale with whale support, offering hardwareless Ethereum-based mining via virtual nodes. - Users earn tokens through interactive node upgrades, with 70% token burn on upgrades creating deflationary scarcity and 2% referral rewards driving viral growth. - Positioned as a "next-gen Pepe coin," it combines gamification with utility, contrasting speculative meme coins by linking value to user activity and cross-token rewards. - With 14,854 pre

- 03:02RootData: LISTA will unlock tokens worth approximately $6.33 million in one weekAccording to ChainCatcher, citing token unlock data from the Web3 asset data platform RootData, Lista DAO (LISTA) will unlock approximately 38.44 million tokens, worth about $6.33 million, at 00:00 on December 20 (UTC+8).

- 02:10Vanguard executive: Bitcoin is a speculative asset, but may have practical applications during inflation or turmoilChainCatcher news, according to a report by Cointelegraph, John Ameriks, Global Head of Quantitative Equity at Vanguard, stated that bitcoin is purely a speculative asset, similar to collecting toys. Although John Ameriks expressed criticism, he also noted that in cases of high inflation in fiat currencies or political turmoil, this cryptocurrency could find real-world use cases beyond market speculation.

- 02:10A certain whale address spent 539.6 BNB to purchase 1.65 million RAVE tokens.According to ChainCatcher, monitored by Lookonchain, a whale address starting with 0x2ee6 spent 539.6 BNB (approximately $476,000) to purchase 1.65 million RAVE tokens 8 hours ago. The current value has reached $950,000, with an unrealized profit of over $474,000 and a return rate close to 100%. .