News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- Ethereum's dynamic deflationary model, driven by EIP-1559 and institutional buying, is challenging Bitcoin's dominance by creating engineered scarcity. - BitMine's weekly ETH purchases and staking strategy reduced supply by 45,300 ETH in Q2 2025, boosting staking yields and institutional confidence. - Ethereum ETFs attracted $9.4B in Q2 2025, outpacing Bitcoin, as institutions view ETH as a utility asset with compounding value. - Analysts project Ethereum's market cap to overtake Bitcoin by 2025, driven

- INJ surged 217.72% in 24 hours to $13.62 on Aug 28, 2025, followed by a 747.79% seven-day drop. - Analysts attribute volatility to on-chain activity, tokenomics changes, and shifting market sentiment. - Despite a 310.61% monthly gain, INJ fell 3063.2% annually, highlighting speculative momentum over intrinsic value. - Technical indicators confirm high volatility, with sharp spikes and reversals typical of leveraged crypto assets.

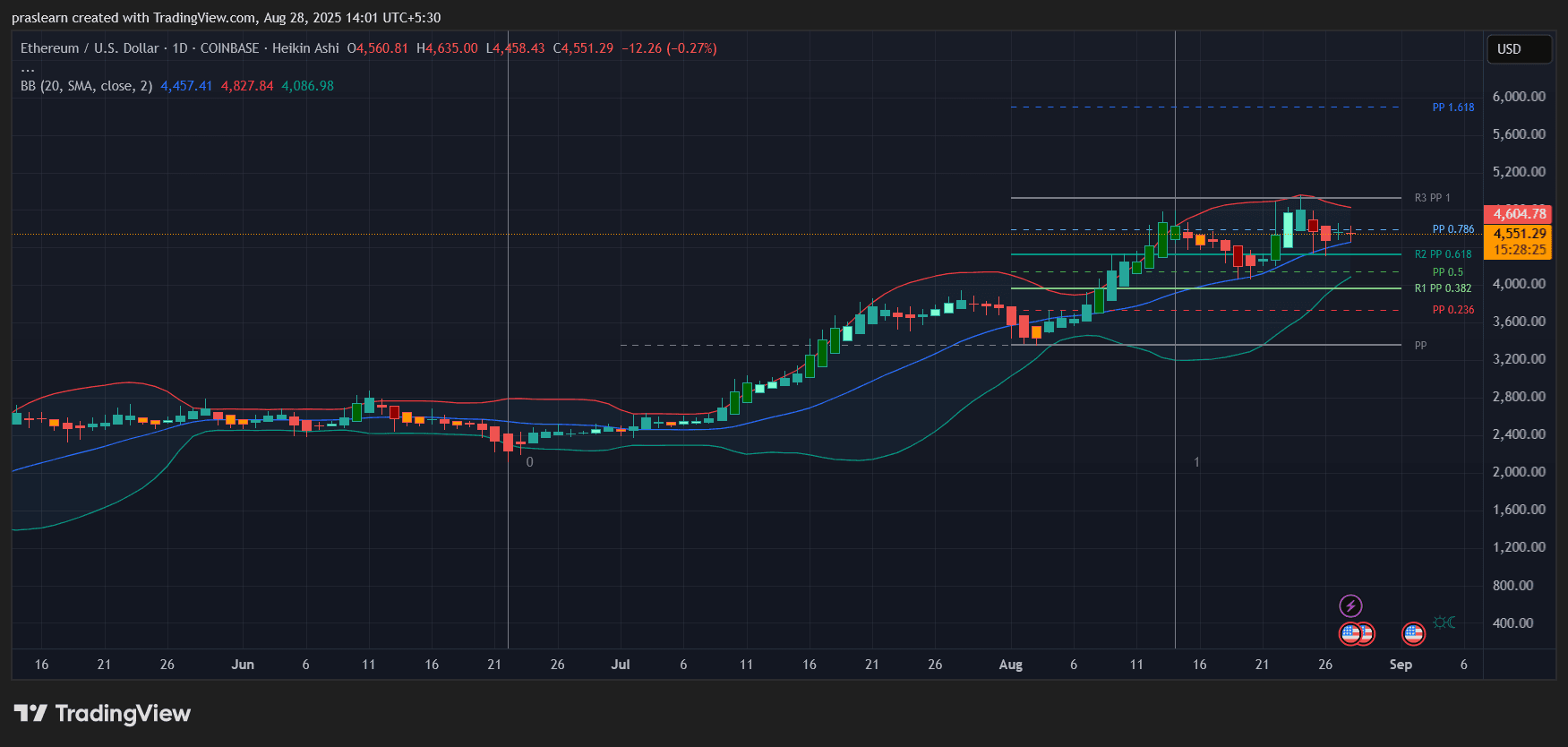

- Fed's dovish pivot boosts risk assets as rate cuts loom, with 50% chance of September 2025 easing. - Ethereum's 41% August surge and Dencun upgrades drive altcoin momentum, with S Coin (S) emerging as strategic play. - S Coin's $650M TVL surge, FeeM model, and Ethereum alignment position it for capital inflows amid macro-driven crypto reallocation. - Institutional ETFs holding 8% ETH supply and S Coin's $0.3173 price consolidation highlight market structure shifts. - Technical indicators suggest S Coin c

- Solana (SOL) surges past $208, hitting 13.8% weekly gains with $112.66B market cap and record $13.08B open interest. - Technical indicators (RSI 57.93, positive MACD) and DEX volume spikes ($7.1B) signal strong bullish momentum and ecosystem growth. - Robinhood micro futures and Pantera's $1.25B Solana-focused fund drive retail/institutional liquidity and price stability. - Bulls target $213-$250+ as key resistance, but risks include potential pullbacks below $200 and delayed SEC ETF approvals.