News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (7.28)|SharpLink Gaming Buys and Stakes Over 77,000 ETH; Ethereum Exit Queue Grows to 699.8K; Analysts Flag $STRK Sell-Off2Ethereum’s Price Surpasses $3,900, Flips Costco in Market Cap3Ethereum Foundation’s Pivotal $3.88M Transfer: Unpacking Its Significance

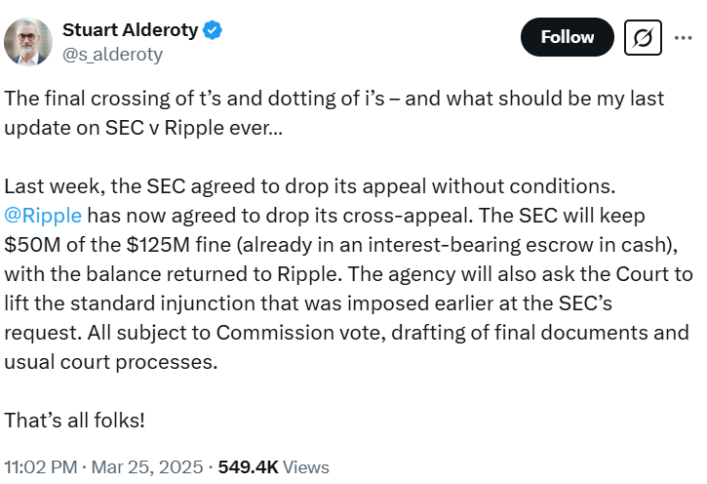

SEC vs Ripple Case Dropped Forever! Case settled for $50M

Cryptotimes·2025/03/26 09:11

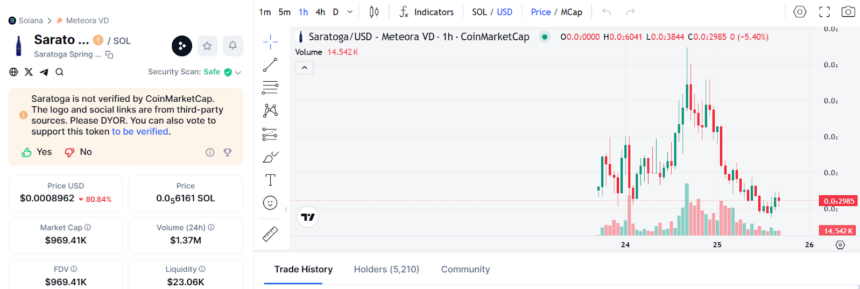

4AM Fitness Influencer Inspires Morning Routine Memecoin

Cryptotimes·2025/03/26 09:11

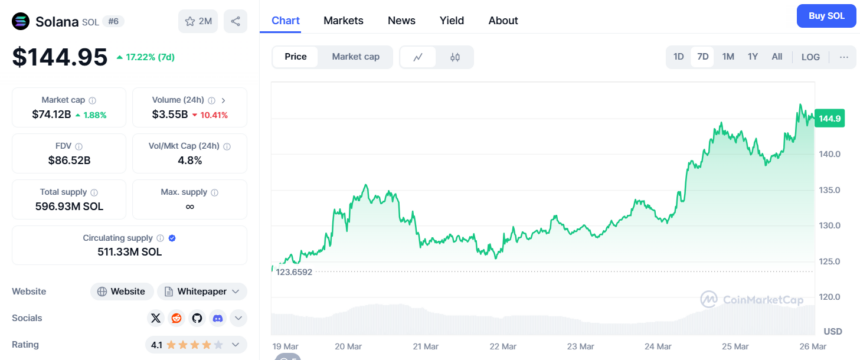

Fidelity Files For Spot Solana ETF with Cboe; SOL Price Pumps to $146

Cryptotimes·2025/03/26 09:11

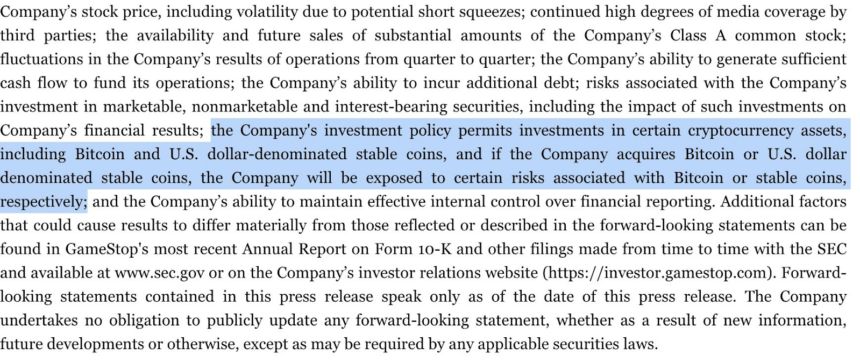

GameStop (GME) to Bet on Bitcoin: Board Approves For BTC Investment

Cryptotimes·2025/03/26 09:11

Celo Blockchain Joins Ethereum, Transits Into Layer 2 Network

Cryptotimes·2025/03/26 09:11

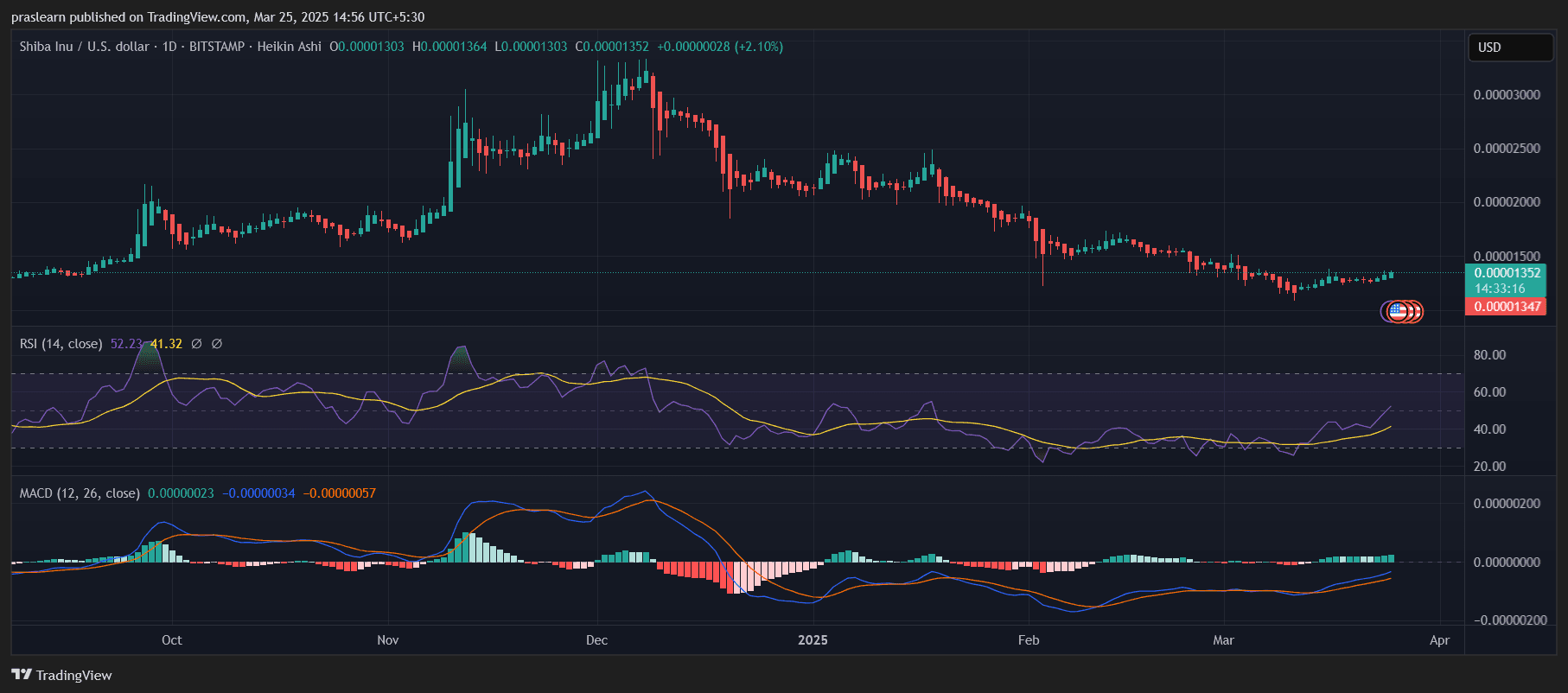

Shiba Inu (SHIB) Price Prediction: Is a Massive Surge Coming Soon?

Cryptoticker·2025/03/26 07:00

CME Group and Google Cloud Partner on Tokenization: A Game-Changer for the Future of Crypto?

Cryptoticker·2025/03/26 07:00

BlackRock NEWS: BUIDL Fund Live on Solana and Bitcoin ETP Launch in Europe

Cryptoticker·2025/03/26 07:00

Research Report | Particle Network Project Analysis & PARTI Market Valuation

远山洞见·2025/03/26 06:56

Flash

- 16:47Goldman Sachs Prime Brokerage Data: Hedge Funds Sell US Tech Stocks at Fastest Pace in a YearAccording to a report from Goldman Sachs’ prime brokerage division, as of the week ending July 25, hedge funds reduced their exposure to U.S. technology, media, and telecommunications (TMT) stocks at the fastest pace since July 2024, with long positions being sold off more rapidly than short positions were covered. The data shows that most TMT sub-sectors saw risk reduction, led by semiconductors and semiconductor equipment, software, information technology services, and media stocks. The tech sector is entering the peak of earnings season, with companies such as Amazon, Apple, Meta Platforms, and Microsoft scheduled to release their results this week. “The net exposure of the semiconductor and semiconductor equipment sector as a proportion of total U.S. prime brokerage client exposure remains near a five-year high, at the 94th percentile, while the net exposure of the software and services sector is near a five-year low, at the 2nd percentile,” wrote Vincent Lin, Co-Head of Prime Insights and Analytics at Goldman Sachs, in the report.

- 16:23Placeholder Ventures Partner: The Past Month Has Seen a Dramatic Shift in ETH Market SentimentAccording to Jinse Finance, Chris Burniske, partner at Placeholder Ventures, pointed out that over the past month, market sentiment surrounding ETH has undergone a dramatic shift, with ETH transforming from “unpopular” to the “market favorite.” Institutional investor activity is also rebounding, supporting a bullish outlook for ETH. For example, on-chain data shows that SharpLink Gaming recently added 77,210 ETH to its Ethereum treasury. Analyst “Wolf” outlined two possible price scenarios for ETH, predicting a “conservative” target of $8,000, while the “optimistic” scenario could see it reach $13,000 or even higher.

- 16:23ARK Invest Reaches Exclusive Staking Partnership with SOL StrategiesAccording to Jinse Finance, Cathie Wood’s ARK Invest has announced the selection of Canada’s SOL Strategies as the exclusive Solana staking partner for its “Digital Asset Fund.” Under the agreement, ARK Invest will migrate its validator node operations to SOL Strategies’ staking infrastructure.