News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (7.21)|WLFI Trading Approved, Public Companies Building LTC Treasuries, ETH Staking Ratio Rises to 29.15%2Arbitrum Hits $0.4778 and Targets $0.5479 as Channel Top Nears3Litecoin Price Eyeing Ultra Bullish Breakout As Whale Interests Peak

Top 9 Token Unlocks of the Week (February 24 – March 1)

Over $1.87 billion in crypto will be unlocked this week

CryptoRo·2025/02/24 14:44

Pendle Weekly Update: Last week's trading volume reached $7.11 billion, and the SONIC yield pool is about to launch

Last week, Pendle offered a stablecoin APY of up to 18%, with multiple new yield pools launched.

BlockBeats·2025/02/24 13:48

SHIB Sees Dramatic 79% Decline in Whale Moves Despite Year's 65% Gains

Yellow·2025/02/24 12:11

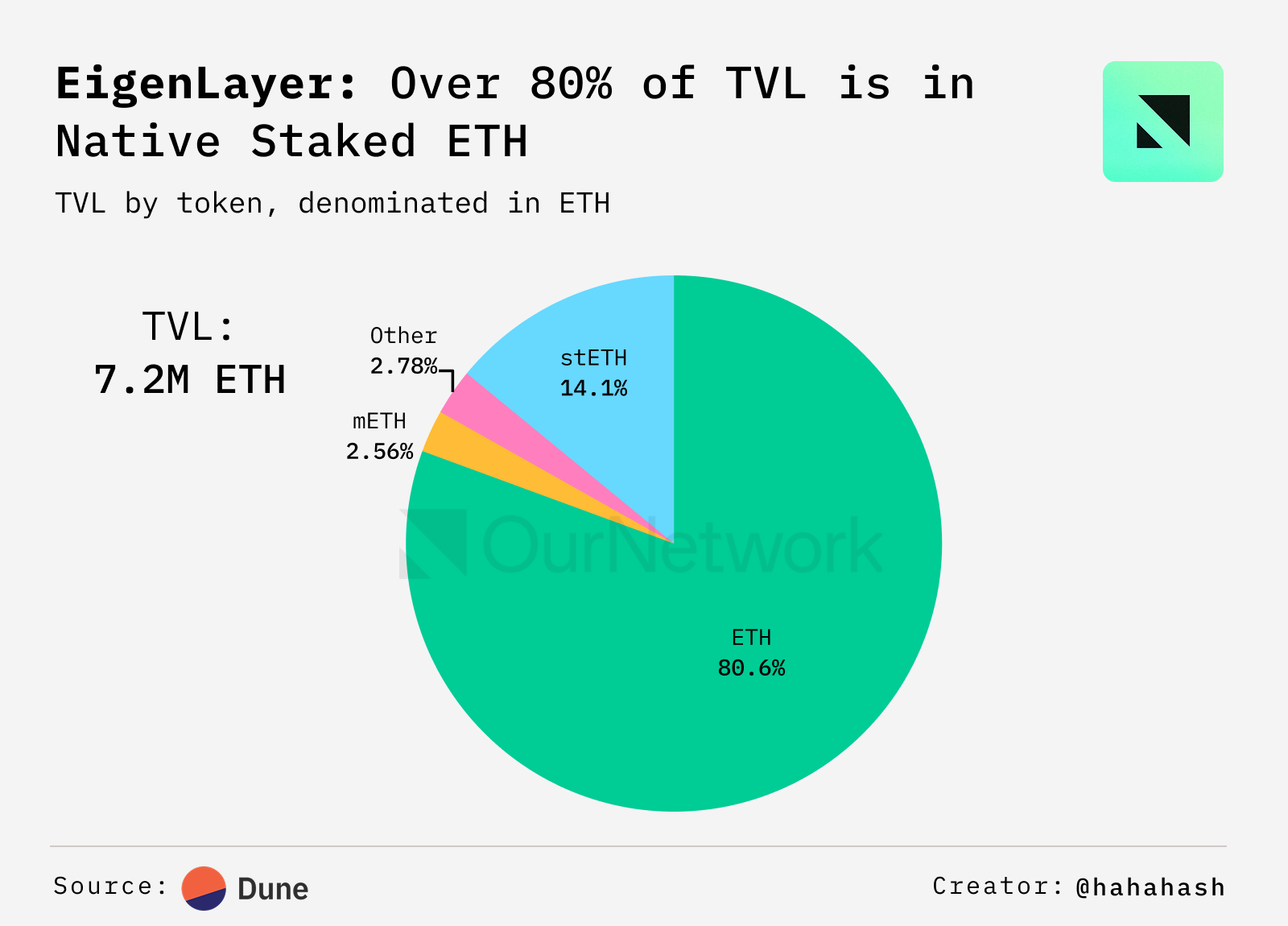

ON–315: Restaking

Cointime·2025/02/24 11:51

Hyperliquid (HYPE) Testing Crucial Support: What To Expect Ahead?

CoinsProbe·2025/02/24 09:44

Pi Network (PI) Made 150% Recovery – Can the Cup and Handle Pattern Trigger More Gains?

CoinsProbe·2025/02/24 09:44

$90K Bull market support retest? 5 Things to know in Bitcoin this week

Bitcoin traders worry over a return to BTC price-range lows as market inertia keeps bears in control heading into the monthly close.

Cointelegraph·2025/02/24 09:10

Research Report | Kaito Project Detailed Explanation & KAITO Market Value Analysis

远山洞见·2025/02/24 08:14

Bitget Daily Digest (February 24) | CEX hacked, Kanye West launched memecoin, $PI volume surpasses $BTC and $ETH

Bitget Research·2025/02/24 08:03

Cardano Price Prediction and the Rise of a New Altcoin in 2025

Cryptoticker·2025/02/24 03:00

Flash

- 06:42US Banking Groups Urge OCC to Halt Approval of Bank License Applications from Crypto Firms Like CircleAccording to ChainCatcher, citing a report from Cointelegraph, the American Bankers Association, together with several banks and credit union groups, sent a letter to the Office of the Comptroller of the Currency (OCC) on July 18, requesting a halt to the approval of banking license applications from crypto companies such as Circle and Ripple. The letter stated that the nationwide trust bank model proposed by these crypto companies represents a "fundamental departure" from the traditional policy framework, and that the related business plans lack sufficient public transparency, making it difficult for the public to assess them. The banking groups emphasized that digital asset custody should not be regarded as a traditional trust business, and that regulatory approval could lead to issues such as unfair capital requirements. In addition, Caitlin Long, founder of crypto bank Custodia, noted that this matter could trigger legal action and expressed concern that traditional banks might use trust licenses in the future to circumvent regulatory obligations.

- 06:42Data: BTC Surpasses 119,000 USDAccording to ChainCatcher, market data shows that BTC has surpassed $119,000 and is now trading at $119,026.86, marking a 1.02% increase over the past 24 hours.

- 06:31US Banking Lobby Groups Question Crypto Firms’ Applications for Banking LicensesAccording to a report by Jinse Finance, U.S. banking groups are urging the country's banking regulators to delay decisions on granting banking licenses to cryptocurrency companies until the details of these companies' plans are made more transparent. They claim that allowing these applications would represent a "fundamental departure" from existing policy. The American Bankers Association and other industry organizations representing banks and credit unions sent a letter to the Office of the Comptroller of the Currency (OCC) on Thursday, stating that approving national banking licenses for cryptocurrency companies—including stablecoin issuer Circle Internet Group and Ripple Labs—"would raise significant policy and procedural concerns." These groups argue: "There are major policy and legal questions as to whether the proposed business plans of the applicants involve the types of fiduciary activities performed by national trust banks." Circle, Ripple, and Fidelity Digital Assets are among the recent batch of cryptocurrency companies applying for banking licenses from the OCC. Obtaining these licenses would essentially allow them to become their own banks, enabling faster payment settlements and subjecting them to federal regulation, which would allow them to operate in all states across the U.S.