News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Official Trump (TRUMP) To Rise Higher? Key Harmonic Pattern Signals Potential Upside Move2AAVE To Rally Higher? Key Pattern Signals Potential Upside Move3Stellar XLM Flashes Mini Golden Cross. Bulls Eye $0.50 for Takeoff

Trump Pushes for Pentagon Budget Transparency with DOGE

Cryptotale·2025/02/08 03:21

Bitcoin traders eye ‘huge’ US jobs data as BTC price risks $95K dip

BTC price strength faces further risks as prediction markets see a giant beat on US January jobs.

Cointelegraph·2025/02/08 02:22

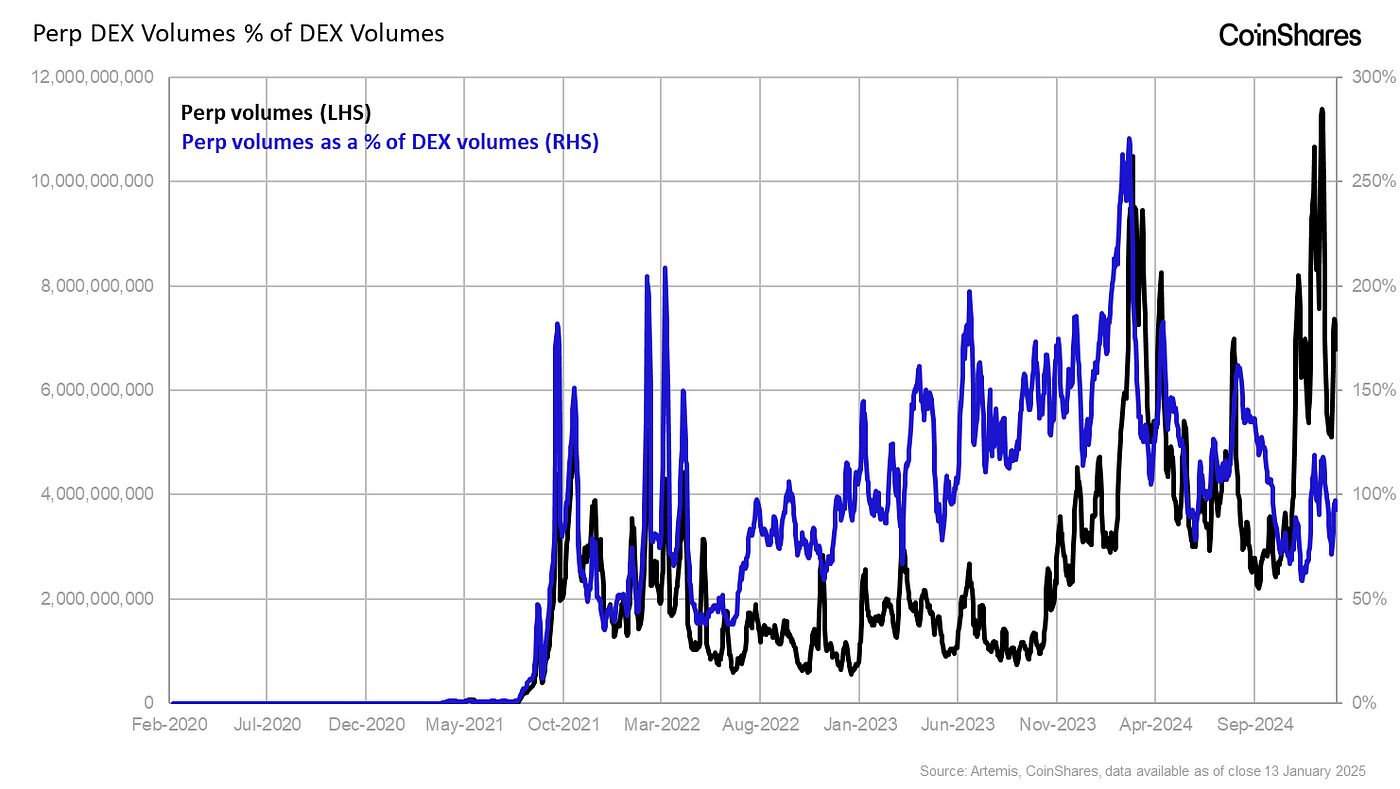

The Perpetual DEX Sector: A Great Leap Forward

Cointime·2025/02/08 01:18

Engage now, or forever hold your peace

Speakers at yesterday’s Ondo Summit in Manhattan urged the industry to engage with regulators as crypto policy efforts unfold

Blockworks·2025/02/07 23:11

ETH Price Outlook: Will Pectra Upgrade Reinstate Ethereum’s ‘Ultra Sound Money’ Status?

CryptoNewsFlash·2025/02/07 22:33

XRP Spot ETF on the Horizon? Experts Predict 80% Approval Odds in 2025

CryptoNewsFlash·2025/02/07 22:33

5 Best Cheap Cryptocurrencies to Buy Under 1 Dollar February 7 – IOTA, Athena, UXLINK

Insidebitcoin·2025/02/07 22:00

Bitcoin Gearing Up for Final Surge, Analyst Predicts Massive Rally

Cryptodnes·2025/02/07 20:00

Bitcoin May Drop to Below $90K Amid Continued Market Weakness

Cryptodnes·2025/02/07 20:00

Wall Street eyes significant upside for Strategy's stock as reserves near 500,000 BTC

Strategy reported a Q4 net loss of $670.8 million, largely due to a $1 billion impairment on its bitcoin holdings, while increasing its BTC reserves to a record 471,107 BTC.With a recent accounting change allowing unrealized bitcoin gains to be recognized, analysts suggest MSTR could be on track for S&P 500 inclusion.

The Block·2025/02/07 19:00

Flash

- 13:33DeFi Development Announces Launch of SOL Reserve Accelerator ProgramAccording to a report by Jinse Finance, DeFi Development Corp., a Nasdaq-listed Solana enterprise-grade reserve company, has announced the launch of its SOL Reserve Accelerator Program. As stated in the announcement released on Thursday, DeFi Development has officially introduced the DFDV Treasury Accelerator as part of its international expansion strategy, adopting a franchise model to support regional Solana reserve systems worldwide. The program is jointly supported by an exchange as well as crypto venture capital firms Pantera Capital, RK Capital, and Borderless Capital. They will help drive the implementation of new regional SOL reserve projects and provide potential investment, strategic guidance, and infrastructure support. Currently, the DFDV Treasury Accelerator is operating in five regions and is “continuously introducing new geographic areas on a weekly basis.”

- 12:51US-listed company Basel Medical Group has suspended its Bitcoin acquisition strategyAccording to ChainCatcher, as reported by Cointelegraph, US-listed company Basel Medical Group Ltd announced today that it has suspended its Bitcoin acquisition strategy, citing ongoing regulatory uncertainty surrounding digital assets in the United States.

- 12:32Commerzbank: Upcoming Japanese Election May Lead to Yen DepreciationAccording to a report by Jinse Finance, Commerzbank analyst Volkmar Baur stated that Japan's upcoming election could mark a turning point for the country and have a negative impact on the yen. Polls indicate that in Sunday’s House of Councillors election, the government risks losing its majority. He also noted that the possibility of a new election for the House of Representatives cannot be ruled out. This increases uncertainty over future fiscal policy and makes trade negotiations with the United States more challenging, “which will certainly weaken the yen.” Baur added that even if there are no changes, if the government introduces a new fiscal package in response to the election results but fails to address structural issues, the yen could still decline. (Jin10)