News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (7.14)|Bitwise Predicts Bitcoin Will Hit $200,000; Multiple Official Accounts Switch to Pudgy Penguin Profile Pics2Is SPX6900 (SPX) Gearing Up for a Major Rally? This Bullish Pattern Suggests It Might Be!3XRP Futures ETF: ProShares Unveils Historic Launch on July 18, 2025

Pepe Price Prediction: Key Levels to Watch Next Week

Cryptoticker·2025/01/11 10:47

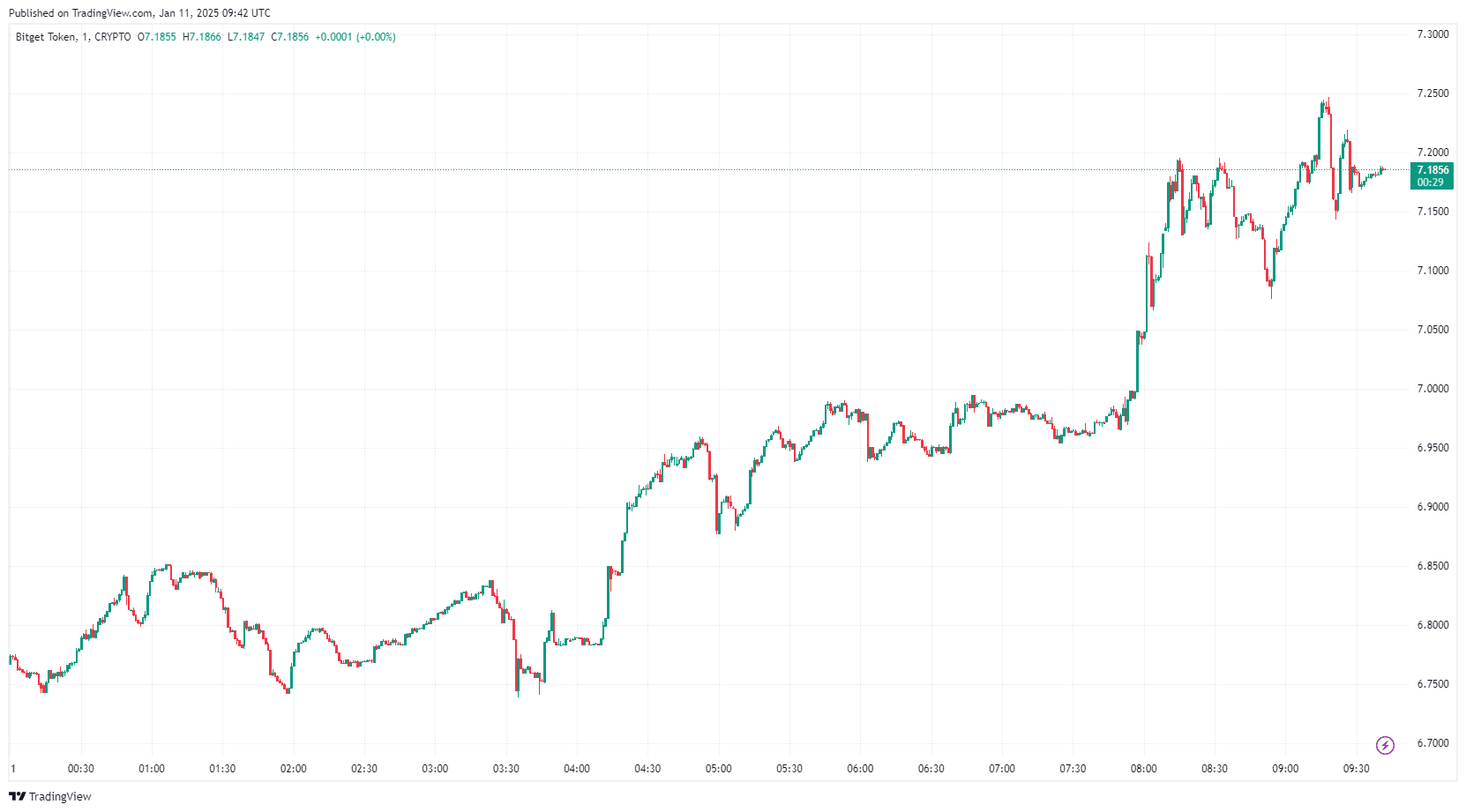

Bitget Token Price Surge amid Market Downturn: New 2025 BGB ATH?

Cryptoticker·2025/01/11 03:00

Bitcoin’s Resilience Above $94,000 May Indicate Potential for $100,000 Retest

Coinotag·2025/01/11 01:55

A comprehensive look at Pippin, which recently reached a market value of 200 million USD: An underrated dark horse in AI agent frameworks

Pippin aims to help developers and creators leverage advanced AI technology in a modular way.

Chaincatcher·2025/01/10 23:55

Best New Meme Coins with 1000X Potential: BTFD Coin’s Presale Rally Sparks Buzz While Pudgy Penguins and Osaka Protocol Thrive

CryptoNewsFlash·2025/01/10 22:33

Standard Chartered launches crypto custody services in Europe

Grafa·2025/01/10 22:10

72 hours after the market crash: Which on-chain tokens are rising against the trend?

Odaily·2025/01/10 18:55

Elon Musk’s Grok Says Cardano (ADA) Will Trade At This Price On January 31, 2025

Timestabloid·2025/01/10 18:01

Fantom (FTM) Climbs 3% While Whale Sell-Off Puts Recovery at Risk

Fantom struggles to recover from a 20% weekly drop despite a 3% daily gain. Weak whale activity and market trends weigh on recovery efforts.

BeInCrypto·2025/01/10 18:00

Flash

- 15:23Greeks.live: Most traders see $130,000 as the next key resistance level for BitcoinOdaily Planet Daily News: Greeks.live macro researcher Adam released a brief for the Chinese community, highlighting that the group generally holds a bullish outlook on the market. Bitcoin broke through $120,000 and continued to rise to $123,000. Traders believe that if there is another increase this week, it will signal a collective capitulation by the bears. Most traders are watching $130,000 as the next major resistance level, but there is disagreement about chasing the rally at this point, with some considering the risk too high to pursue further gains. The options settlement and delivery mechanism sparked in-depth discussion, focusing on how to achieve actual delivery through perpetual contracts after selling in-the-money call options, as well as the risk differences compared to settlement delivery. Cash-and-carry arbitrage strategies have become a hot topic. Currently, delivery contracts are trading at an 8% premium, and by buying spot while shorting delivery contracts, one can obtain a risk-free annualized return. The market is seeing a phenomenon of high leverage being aggressively pushed; for example, when Ethereum rises by 1%, open interest in contracts increases by $1 billion, with leverage levels surpassing the peak of the 2021 bull market.The English community brief notes that the group is bullish on ETH, with traders experiencing mixed results in options positions—put options have dropped by 50%, while call options have performed well. Notably, despite the upward momentum, market participants remain skeptical, and new short positions continue to be opened.

- 15:23Trader CryptoCapo: Bitcoin’s frenzy is already evident, a reversal is only a matter of time, and most altcoins are in a downtrendAccording to Odaily Planet Daily, trader CryptoCapo posted in his community: “Since the Middle East ceasefire on June 22, Bitcoin has continued to show strong momentum. Some altcoins have started to catch up, but most are still in a clear downtrend, forming a series of lower highs. Traditional markets, on the other hand, are showing signs of weakness and may be forming a top.The frenzy around Bitcoin is already apparent, and in my opinion, a reversal is only a matter of time.Currently, all my short positions are in a loss. Fortunately, I am using very low leverage, so to the disappointment of some, I have not been liquidated yet. Even if I do get liquidated, these positions represent only a small portion of my total net assets. They are positions I have built strategically to test my market judgment, and at the same time serve as a hedge against a possible 'black swan event'—even though this idea may sound crazy now, the possibility still exists.”

- 15:02[High-Frequency Trading Address with 81% Win Rate] Liquidated 16,677 ETH 50 Minutes AgoAccording to ChainCatcher, on-chain data analyst Yujin has monitored that the [Swing ETH and BTC 81% Win Rate Address] sold all its holdings of 16,677 ETH on-chain 50 minutes ago, exchanging them for 50.55 million USDT at a selling price of $3,051. This ETH was purchased by the address on May 31 with 43.36 million USDT at an average price of $2,606. Today, it was fully sold at $3,051, resulting in a profit of $7.42 million.