News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (7.14)|Bitwise Predicts Bitcoin Will Hit $200,000; Multiple Official Accounts Switch to Pudgy Penguin Profile Pics2BTC Dominance Hits 65% as Chart Repeats 2018 and 2021 Altcoin Setup3BlackRock Now Holds Over 2 Million ETH Through Its ETF

Bitcoin: the price of BTC is in a Limbo

CryptoNewsNet·2025/01/10 14:55

This XRP Metric Shows Price Drop Not Important

CryptoNewsNet·2025/01/10 14:55

Solana meme coin ai16z price rebounds: is this a dead cat bounce?

CryptoNewsNet·2025/01/10 14:55

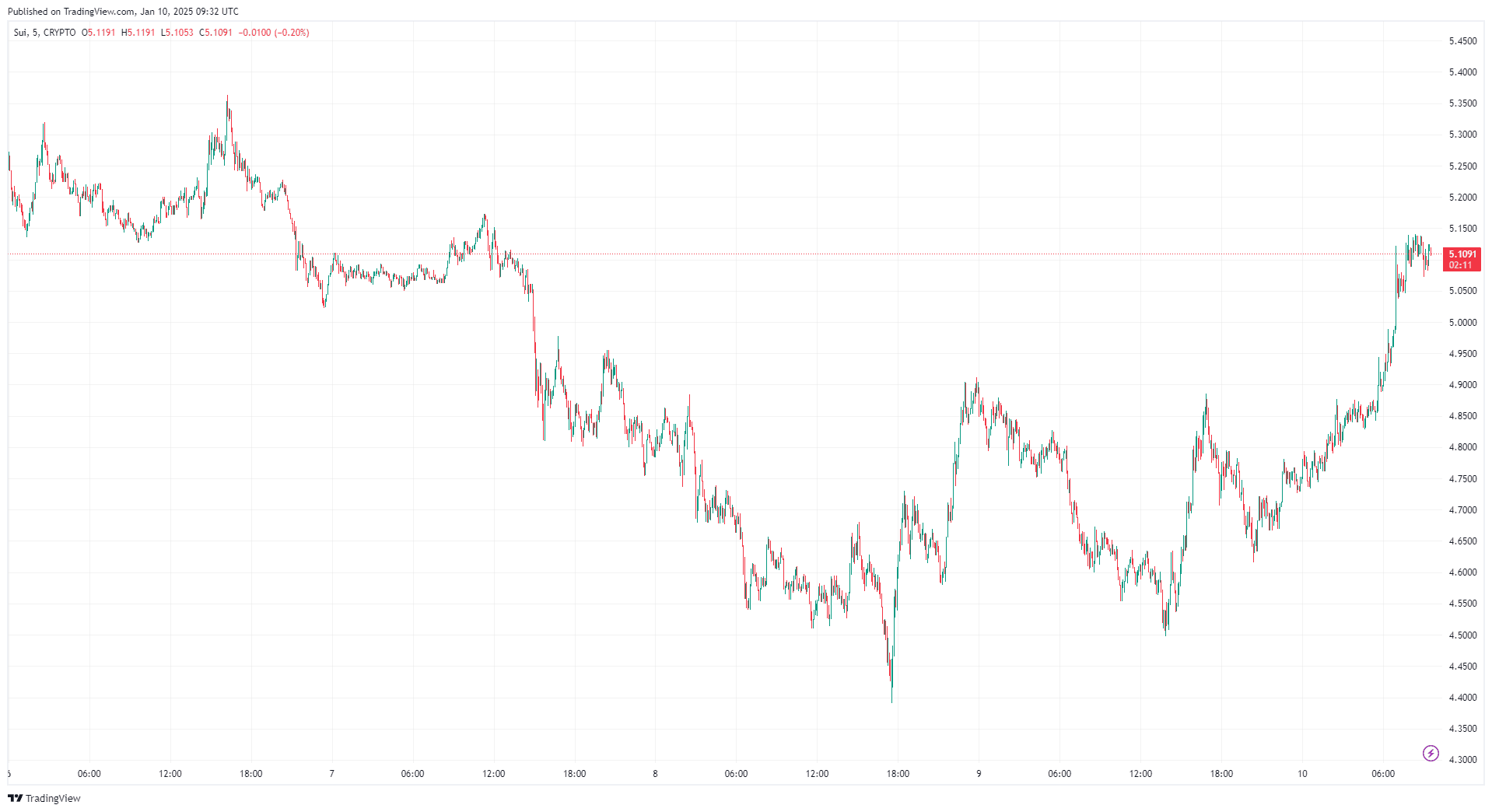

SUI Price Surge amid Market Downturn - What's Next?

CryptoNewsNet·2025/01/10 14:55

Top 10 Predictions for Crypto AI in 2025: Total Market Cap to Reach $150 Billion; 99% of AI Agents Will Vanish

An OpenAI IPO or a similar event could trigger a global AI frenzy. At the same time, Web2 capital has already started paying attention to decentralized AI infrastructure.

BlockBeats·2025/01/10 13:00

Shiba Inu's TREAT Token (TREAT): Empowering The Future Of The Shiba Inu Ecosystem

Bitget Academy·2025/01/10 11:25

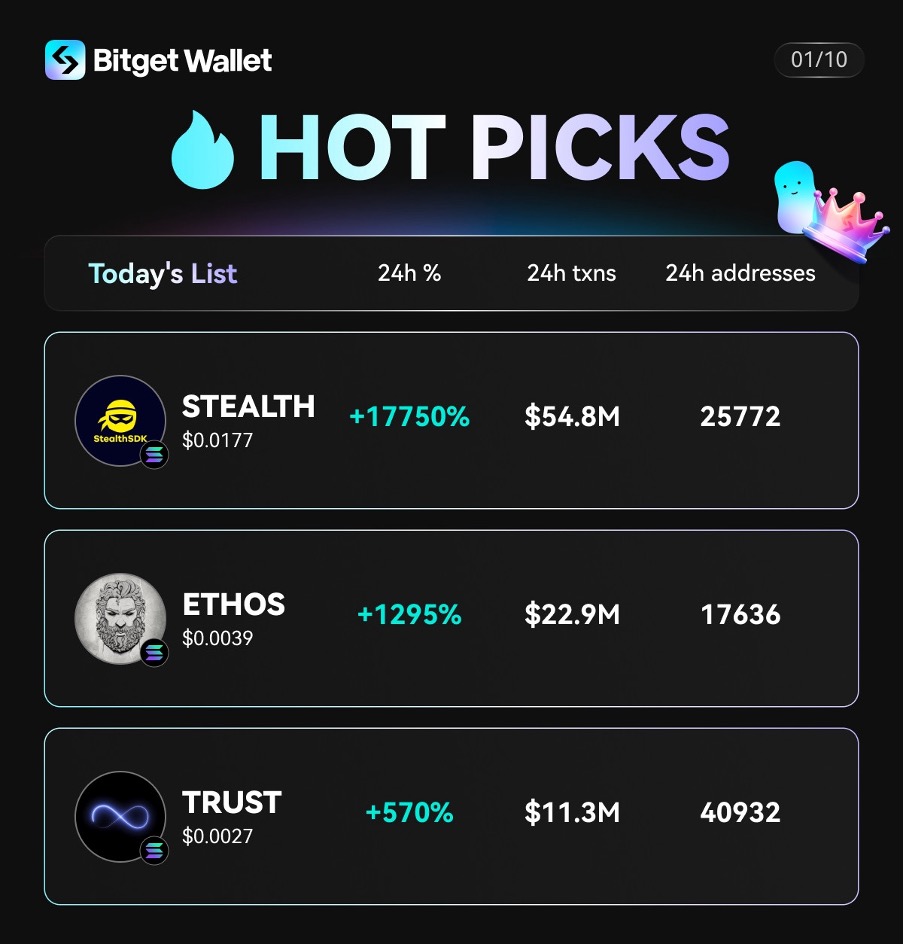

Today's popular MEME inventory

币币皆然 ·2025/01/10 10:19

Pippin: The Undervalued AI Agent Framework Dark Horse with a Quick $200M Valuation

Pippin aims to help developers and creators leverage advanced AI technology in a modular way.

BlockBeats·2025/01/10 09:17

What is Cookie DAO: A Comprehensive Guide to the Future of AI and Web3

What is Cookie DAO, the platform revolutionizing AI and Web3? Learn about its innovative features, how to use it, and what to expect from the $COOKIE token, including a price prediction and future growth potential.

Cryptoticker·2025/01/10 09:11

Is USD0 the next UST? Will USUAL holders need to panic?

USD0++ Depegging Event: Is a 1:1 Hard Peg Reasonable?

BlockBeats·2025/01/10 09:07

Flash

- 10:43Aave’s Net Deposits Surpass $50 Billion, Becoming the First DeFi Protocol to Reach This MilestoneOdaily Planet Daily reports that Aave’s net deposits have surpassed $50 billion, making it the first DeFi protocol to reach this scale. This figure represents the total collateralized assets across its 34 on-chain markets minus outstanding loans. According to Aave’s founder, an increasing number of traditional financial institutions are adopting Aave as lending infrastructure.This milestone also reflects the overall recovery trend in DeFi. Data shows that since December 2024, the total value locked (TVL) in the DeFi sector has approached $120 billion, with Ethereum-based lending dominating the market and locking over $63 billion. According to DefiLlama, Aave’s current TVL is around $29 billion, accounting for nearly half of the sector.It is reported that the Aave governance community is advancing several upgrade initiatives, including “Aave V4,” which aims to introduce account abstraction and native real-world asset vaults. There are also plans to support Bitcoin Layer2 assets and expand the GHO stablecoin to more blockchain platforms. (The Block)

- 10:43MyStonks Platform to Conduct On-Chain Dividend Snapshot for PG.M HoldersOdaily Planet Daily reports that the decentralized US stock token trading platform MyStonks has announced it will conduct an on-chain snapshot of all user accounts holding PG.M (Procter & Gamble US stock tokens) at market close on July 18. For every 1 PG.M token held, users will receive a dividend of 1.0568 USDT, which will be automatically distributed to MyStonks accounts on August 15, with no action required from users. This dividend corresponds to Procter & Gamble’s (NYSE: PG) regular quarterly dividend for the fourth quarter of fiscal year 2025. The MyStonks platform maps native US stock dividends to token holders proportionally, ensuring that on-chain users enjoy the same dividend rights as traditional shareholders. On-chain dividends not only allow users to access the benefits of leading global companies without geographic barriers, but also greatly enhance the transparency and efficiency of dividend distribution. Users do not need to go through complicated declarations or wait; the entire dividend process is automated and publicly verifiable, truly achieving equal rights and benefits with traditional shareholders and promoting the deep integration of traditional finance and the Web3 world.

- 10:43Hungary’s New Crypto Law Takes Effect, Illegal Transactions Could Lead to Up to 8 Years in PrisonOdaily Planet Daily – Hungary has officially implemented new cryptocurrency legislation as of July 1, prohibiting any unlicensed digital asset trading activities. Individuals using unlicensed crypto services may face up to 2 years in prison; for single transactions exceeding 50 million forints (approximately $140,000), the sentence can be up to 3 years, and for amounts over 500 million forints, up to 5 years. Unlicensed service providers may face up to 8 years in prison.It is reported that fintech platform Revolut has announced the suspension of its cryptocurrency services in Hungary. Local media noted that around 500,000 Hungarians have invested in crypto assets through legal income, but the details of regulatory enforcement remain unclear.