News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Applies Brakes to Trade War, US Stocks Rebound; Storage Stocks Continue to Rise to New Highs; Musk Pushes for SpaceX Listing in July (January 22, 2026)2Stablecoins Are Quietly Taking Off with Credit Cards3BitGo IPO on the Brink: Can the Crypto Custody Giant Recreate Circle's Epic Surge?

Crypto Market Legislation Moves to Senate Agriculture Committee for Review as Banking Panel Faces Setbacks

101 finance·2026/01/22 03:54

YouTube Plans AI Expansion in 2026 While Promising Crackdown on ‘AI Slop’

Decrypt·2026/01/22 03:51

White House Crypto Czar says banks and crypto will merge into one industry

Cointelegraph·2026/01/22 03:24

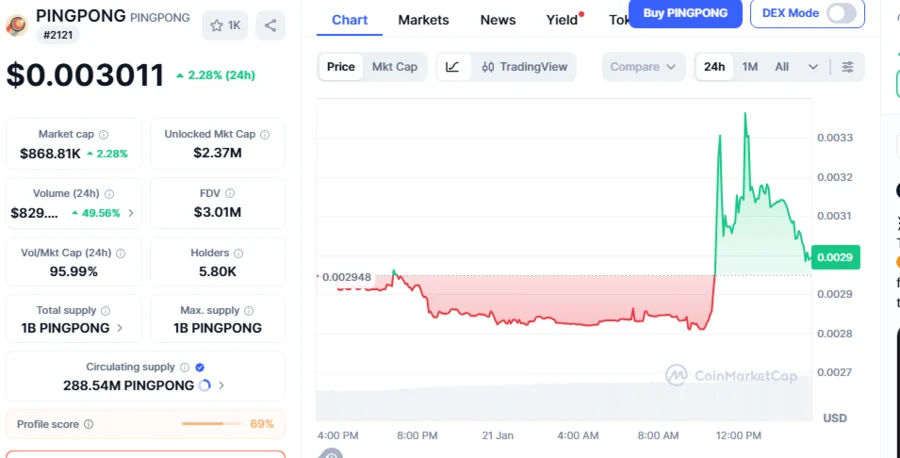

PINGPONG Ready to Explode To $0.00800: DePIN Token on the Verge of a Breakout as Analyst Eyes 143% Spike

BlockchainReporter·2026/01/22 03:03

Kinder Morgan Achieves Highest Profits as Rising LNG Demand Drives Pipeline Expansion

101 finance·2026/01/22 03:00

Flash

03:54

Space public fundraising sparks controversy: $2.5 million target oversubscribed by 8 times, team attempts to retain $10 million in fundsBlockBeats News, January 22, the decentralized leveraged prediction market Space has sparked controversy in the market during its latest ICO round. The project initially disclosed a fundraising target of $2.5 million, but the actual amount raised reached as high as $20 million. The project team later responded that $2.5 million was a "soft cap" rather than a "hard cap," and that this description is in line with industry practices for Launchpads, thus allowing for an expanded fundraising scale when market demand is strong. The team stated that $2.5 million would only support "a few months of initial development" and would not be sufficient to support the construction of a multi-year leveraged prediction market infrastructure. According to the team’s disclosure, they plan to retain about $13 million in excess funds at an approximately $69 million FDV (fully diluted valuation), with the remaining funds to be used for liquidity, ecosystem, and market-related purposes. However, this explanation did not quell doubts. Ethos CEO Serpin Taxt stated that the project's act of "nominally raising $2.5 million, actually raising $20 million, and retaining about $14 million" constitutes malicious behavior, comparing it to the previously controversial Trove project. Community discussions believe that this incident once again exposes structural issues in some current ICOs regarding information disclosure, fundraising cap design, and transparency in fund usage.

03:48

"God of War" achieved 11 consecutive winning swing trades in BTC today, earning $19,000 in profit.BlockBeats News, January 22, according to monitoring, "Bai Sheng Zhan Shen" conducted 11 swing BTC trades today, maintaining a perfect winning record and accumulating a profit of $19,000. This address has completed 202 trades, with only 5 trades recording a total loss of $5,195.36, while the remaining 197 trades were all closed with profits, bringing the total account profit to $388,500.

03:39

Mezo launches BTC native DeFi protocol, introduces ve mechanism and opens MEZO airdrop registrationPANews, January 22 – According to an official announcement from Mezo, the project has officially launched a decentralized lending layer centered on BTC, supporting BTC-collateralized lending, stablecoin issuance, and an on-chain circular economy. Mezo adopts a dual-token mechanism: users can lock BTC to obtain veBTC and earn BTC fees generated from on-chain activities, while locking MEZO tokens can amplify BTC returns up to 5 times and participate in governance of incentive directions. The total supply of MEZO is 1 billion, with 40% allocated to the community. The airdrop targets wallets with historical lending activity on platforms such as Aave, MakerDAO, and Compound. Users can check their airdrop eligibility and pre-deposit via bankfree.mezo.org, with current annualized yields reaching up to approximately 34%.

News