News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Applies Brakes to Trade War, US Stocks Rebound; Storage Stocks Continue to Rise to New Highs; Musk Pushes for SpaceX Listing in July (January 22, 2026)2Stablecoins Are Quietly Taking Off with Credit Cards3BitGo IPO on the Brink: Can the Crypto Custody Giant Recreate Circle's Epic Surge?

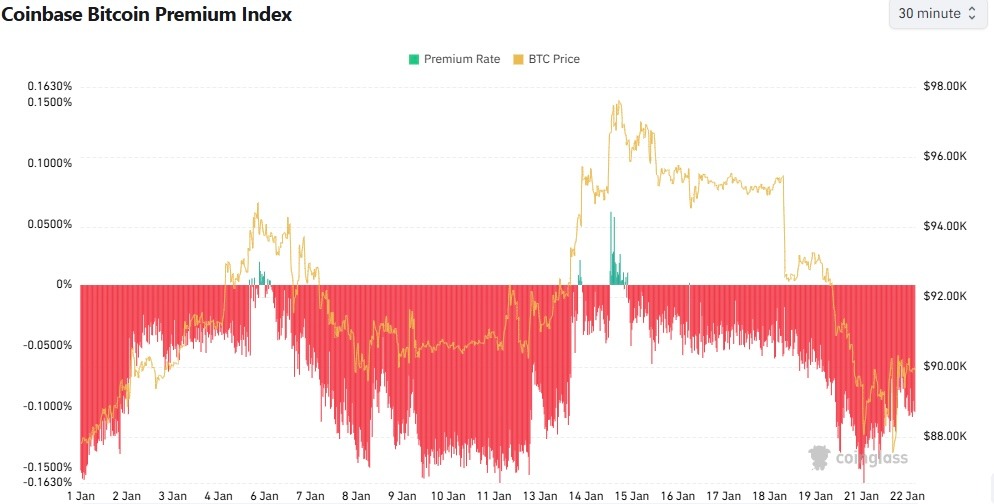

Crypto Rebounds as Trump Cancels Europe Tariffs, BTC Reclaims $90K

CoinEdition·2026/01/22 07:51

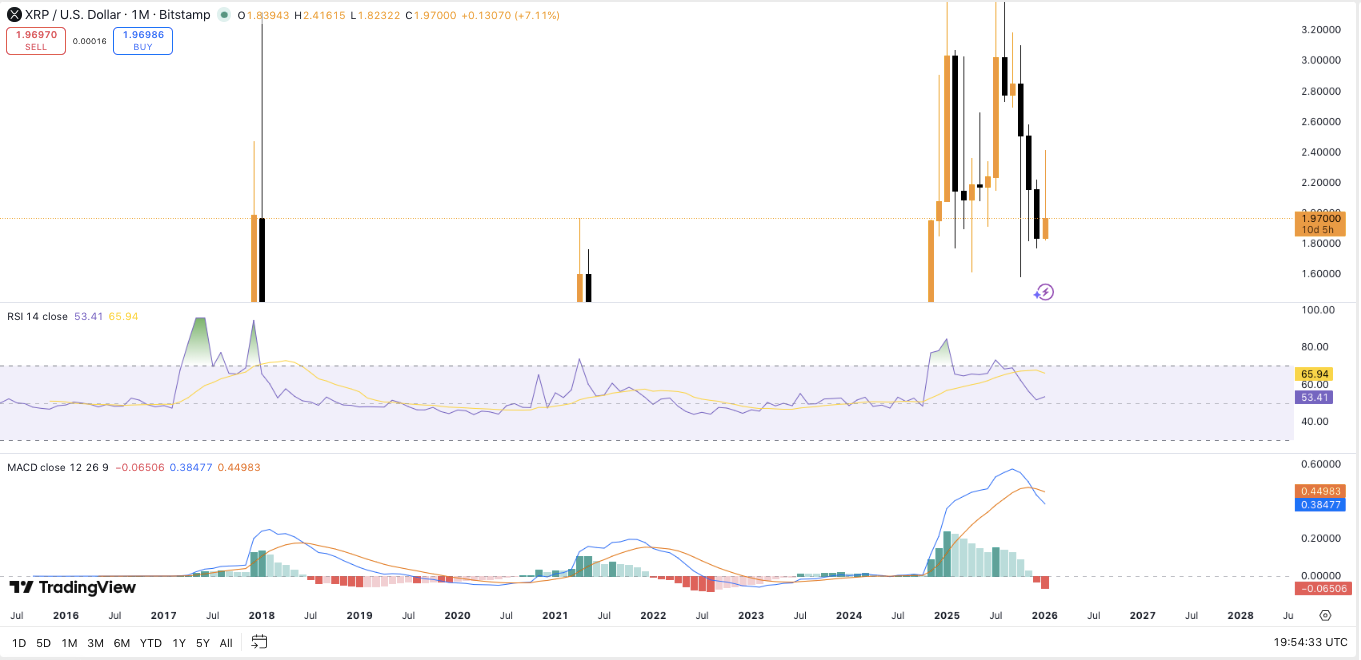

Glassnode Flags XRP Pattern Linked To Past 68 % Crash

Cointribune·2026/01/22 07:18

U.S. Treasury Buys Back $2.8 Billion in Debt Securities

Coinpedia·2026/01/22 06:48

XRP Monthly Candle Turns Bearish as Bulls Defend $1.90

CoinEdition·2026/01/22 06:15

Fed Faces $6.6 Trillion Challenge: Crucial Trial for the Incoming Chair

101 finance·2026/01/22 06:00

Cryptocurrency Money Laundering: Shocking $17M Scheme for Chinese Fraud Ring Exposed

Bitcoinworld·2026/01/22 05:57

Flash

07:57

Analyst: Against the backdrop of escalating macroeconomic uncertainty, institutional investors are tightening their risk exposureBlockBeats News, January 22nd, according to The Block, the US Bitcoin Spot ETF saw a net outflow of $7.087 billion yesterday, marking the largest single-day outflow in nearly two months, while the Ethereum ETF saw a net outflow of $2.869 billion. Against the backdrop of increasing macroeconomic uncertainty, institutional investors further reduced their risk exposure.

BTC Markets crypto analyst Rachael Lucas said that Wednesday's outflows looked more like typical "risk-off" behavior. She pointed out that when the macro environment turns unfavorable, such as rising interest rates, escalating geopolitical risks, or sudden market volatility, institutional investors tend to withdraw funds from high beta assets first. This is not a signal of structural weakness, but rather institutions tightening their risk exposure ahead of uncertainty, not necessarily abandoning the asset class of cryptocurrencies.

07:54

「On-Chain Gold's Biggest Short」 Cuts Losses on Gold Short Position, Still Faces $460,000 Unrealized LossBlockBeats News, January 22nd, according to HyperInsight monitoring, the "On-Chain Gold Maximalist" trader (0xfc667) has cut losses and reduced the short position on gold, currently shorting 2198.09 PAXG gold tokens at 5x leverage (approximately $10.65 million), with an average entry price of $4634.92, and a per-token unrealized loss of $460,000.

In addition, the address has also opened a high-leverage short position on a basket of altcoins while simultaneously hedging with a 20x leveraged long position on 32.09 BTC, with a total account unrealized gain of $1.177 million.

07:42

ING: Inflation May Reshape Bank of Japan's Rate Hike PlansAccording to Odaily, Japan's CPI data will be released ahead of Friday's interest rate decision, and it is expected that the data will show a significant decline in the inflation rate for December. Analysts at ING stated that if inflation eases, it may prompt the Bank of Japan to reconsider its future rate hike plans. "Strong wage growth and government support measures will keep the core inflation rate above 2%. Once the Bank of Japan confirms that the core inflation rate will remain above 2% and higher than the overall inflation rate, it is likely to take its next step sometime in the second half of 2026." (Golden Ten Data)

News