News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Applies Brakes to Trade War, US Stocks Rebound; Storage Stocks Continue to Rise to New Highs; Musk Pushes for SpaceX Listing in July (January 22, 2026)2Stablecoins Are Quietly Taking Off with Credit Cards3BitGo IPO on the Brink: Can the Crypto Custody Giant Recreate Circle's Epic Surge?

Inside the Steve Aoki Arena: How a New PvP Game Is Redefining Live Crypto Competition

BlockchainReporter·2026/01/22 09:42

Track Crypto Positions with CoinStats’ Real-Time Platform Integration

Cointurk·2026/01/22 09:39

New research projects U.S. inflation resurgence, challenging bitcoin bulls' disinflation bets

101 finance·2026/01/22 09:21

XRP Dives into Extreme Fear, but It’s Good

Coinspeaker·2026/01/22 09:06

Srinivasan: Crypto as a Backup When Institutions Fail

CoinEdition·2026/01/22 09:00

Concero and Nomis Collaborate to Transform Online Identity and Cross-Chain Reputation

BlockchainReporter·2026/01/22 09:00

Toilet manufacturer Toto sees unexpected share surge amid AI boom

101 finance·2026/01/22 08:51

U.S. Treasury Enhances Market Strategy with Bond Buyback

Cointurk·2026/01/22 08:39

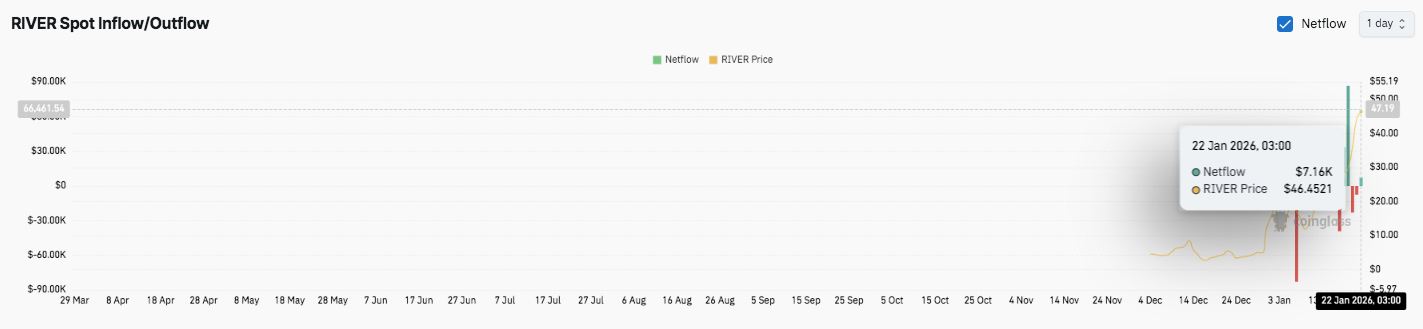

River Price Prediction: RIVER Retreats From Highs as Open Interest Hits New Peak

CoinEdition·2026/01/22 08:36

Flash

09:53

Analysis suggests bitcoin price may face risk of prolonged consolidationAnalysis institutions such as Glassnode have pointed out that the current price structure of bitcoin is rather fragile and may enter a prolonged consolidation phase. At present, bitcoin's price is confined within a wide range between the short-term holders' cost basis of $98,400 and the realized market value of $81,100. If key support levels are not effectively reclaimed, the market may see a repeat of the long-term consolidation pattern observed in the first quarter of 2022. On-chain data shows that there is a dense supply zone above $100,000, and persistent selling pressure may limit price breakthroughs at the $98,400 and $100,000 levels. The risk indicator has risen to 21, approaching the high-risk zone, indicating that the current macro environment carries significant risk. In addition, spot bitcoin ETFs have seen net outflows for three consecutive days, with a single-day outflow of $708.7 million on Wednesday—the largest single-day outflow in two months and the fifth largest since their launch in January 2024. Analysts believe this reflects institutions significantly reducing their risk exposure. If the $84,000 support level is lost, the price may decline further.

09:50

South Korean prosecutors lost a large sum of seized Bitcoin, with losses potentially reaching $48 million. according to Ohmynews, that the Gwangju District Prosecutors' Office in South Korea recently discovered the loss of a large amount of Bitcoin related to criminal cases during a routine inspection of seized assets, with estimated losses amounting to hundreds of billions of Korean won (the report mentioned internal rumors of about 70 billion won, approximately 48 million US dollars).

It is reported that the prosecution stored Bitcoin-related passwords and other information on a mobile storage device, and the loss may have been caused by mistakenly accessing a so-called "scam website" during the inspection. The official response from the Gwangju District Prosecutors' Office to this matter was "unable to confirm." The prosecution has now launched an internal investigation into the matter.

09:43

South Korean prosecutors lose large amount of seized Bitcoin, losses may reach $48 millionPANews, January 22 – According to Ohmynews, during a routine inspection of seized assets, the Gwangju District Prosecutors' Office in South Korea discovered that a large amount of bitcoin related to criminal cases had gone missing from its custody. The estimated loss amounts to tens of billions of Korean won (the report mentions internal rumors of about 70 billion won, approximately $48 million). It is reported that the prosecution stored bitcoin-related passwords and other information on portable storage devices, and the loss may have occurred during the inspection process due to mistakenly accessing so-called "scam websites." The official response from the Gwangju District Prosecutors' Office was "unable to confirm." The prosecution has now launched an internal investigation into the matter.

News