Altcoin Listed on Major Exchanges Announces Significant Investment: Falling Price Drops Further

Grass (GRASS), the Decentralized Physical Infrastructure Network (DePIN) project operating within the Solana ecosystem, raised $10 million in a bridge investment round led by Polychain Capital and Tribe Capital. The investment primarily consisted of token purchases.

Grass has previously closed both a seed and Series A funding round. The project aims to allow users to sell their idle internet bandwidth, allowing data to be shared under user control rather than being collected by large corporations for profit.

Grass co-founder Andrej Radonjic said in a statement, “Grass is a piece of technology that gives companies access to data at an unprecedented scale. The possibilities that can be built upon it are virtually endless. We plan to develop new solutions, especially around live context.”

According to Radonjic, AI companies currently scrape data to train their models, often using search engines. However, this method is limited by scalability and access barriers. Grass offers an alternative infrastructure that provides internet-scale data access.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

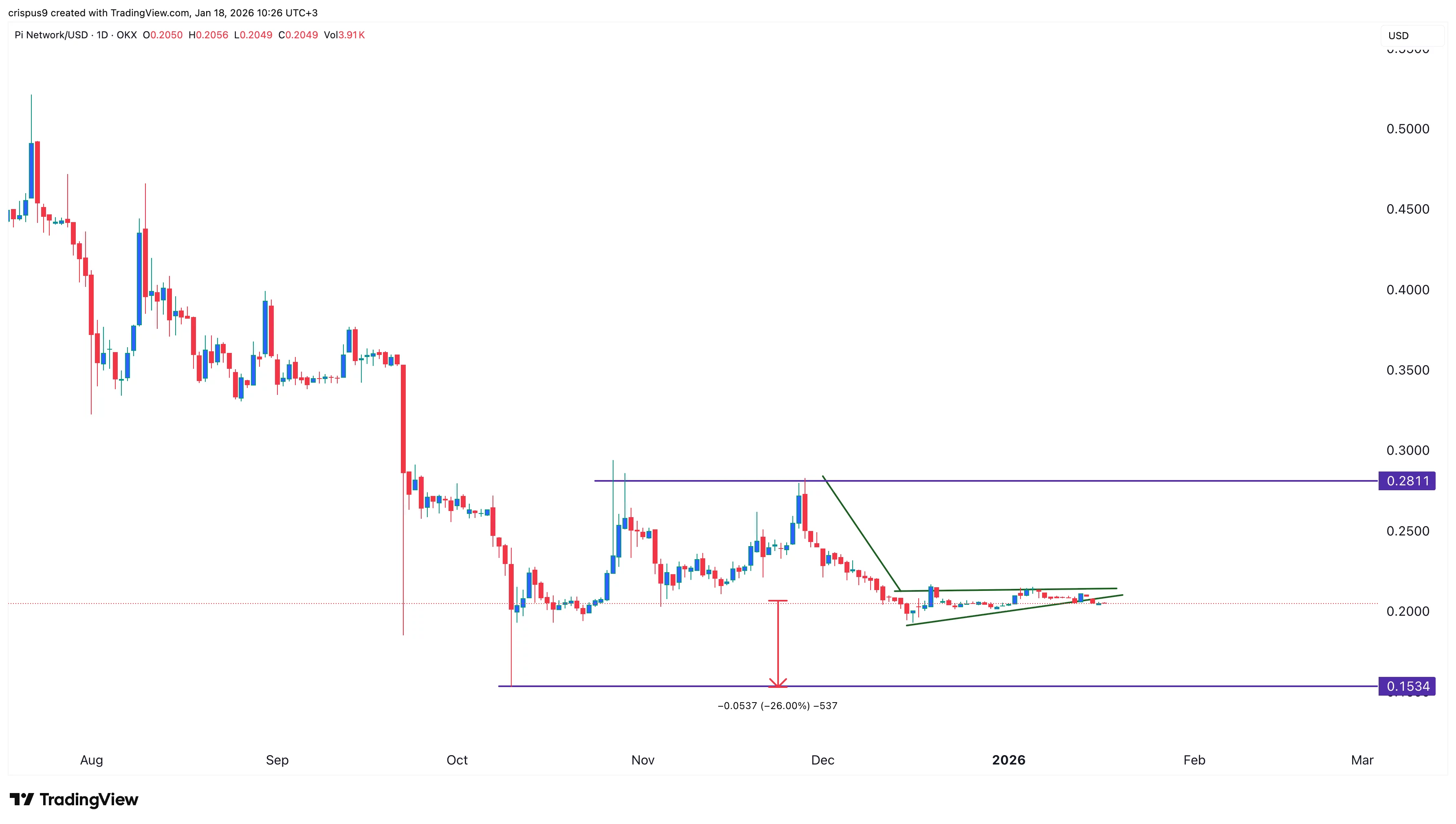

Pi Network price remains calm: will it rebound or crash?

Outrageous levels of student debt are putting immense pressure on the UK’s economy

MetYa Taps Catto Verse to Integrate AI-Led Meme Intelligence to Crypto Industry

Ethereum (ETH) Price Prediction: Could Bulls Trigger a Breakout Above $4,000 Next Week?