Worldcoin Rises 6% While Celo Falls Over 3%

- Worldcoin market surge contrasts with Celo’s decline.

- Worldcoin climbs over 6% today.

- Celo experiences 3.53% trading drop.

WLD increased by 6.45% while CELO decreased by 3.53% amidst market fluctuations. WLD’s rise is supported by its addition to Kraken’s margin trading, while CELO’s decline aligns with overall altcoin softness without specific catalysts.

The day’s market activity prompts attention toward Worldcoin’s continuing upward trajectory, drawing interest from traders and analysts, while Celo’s decline reflects broader altcoin market challenges.

Worldcoin’s Market Impact

Worldcoin soared nearly 6.45%, maintaining the momentum with prices between $1.24 and $1.32. Market enthusiasm was further fueled by Kraken’s recent addition of WLD to margin trading, potentially increasing investor interest.

Kraken, Official Announcement: “Kraken Adds WLD Margin Trading (7 October 2025) – 3x leverage for WLD/USD pairs amid broader platform upgrades.”

While Worldcoin leadership , including Sam Altman and project executives, have not commented on the rise, the latest focuses remain on ecosystem growth and technological enhancements. Plans for ongoing development initiatives continue as usual for both Worldcoin and Celo.

Market Reactions and Future Prospects

Worldcoin’s recent surge signifies positive sentiment and regulatory stability in the sector, impacting the cryptocurrency’s perceived value amongst traders. However, Celo’s decline aligns with a general downturn in altcoin activities, raising concerns within its community.

Possible outcomes include further strategic partnerships, platform enhancements, and increased market involvement for Worldcoin. Celo’s prospects hinge on circumventing altcoin softness and tapping into innovative solutions to regain momentum. Historical data suggests such fluctuations are typical, caused by broader market movements.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

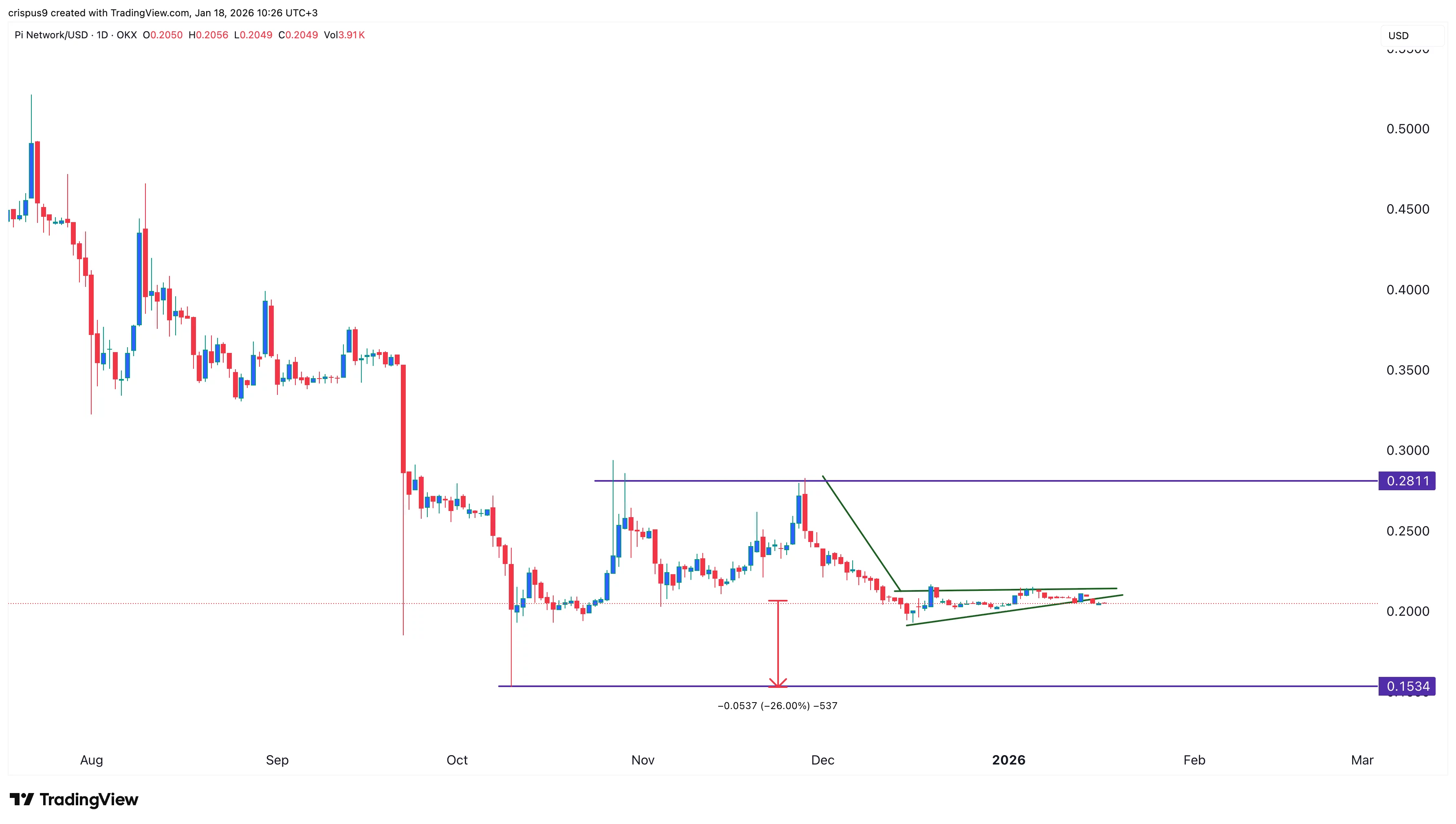

Pi Network price remains calm: will it rebound or crash?

Outrageous levels of student debt are putting immense pressure on the UK’s economy

MetYa Taps Catto Verse to Integrate AI-Led Meme Intelligence to Crypto Industry

Ethereum (ETH) Price Prediction: Could Bulls Trigger a Breakout Above $4,000 Next Week?