Paradigm leads $6 million seed round for Harmonic, aiming to help Solana reach Nasdaq speed

Quick Take Harmonic, a Solana infrastructure startup developing an open block-building system, has raised $6 million in a seed funding round led by Paradigm. Harmonic says it is the first startup to allow Solana validators to source blocks from multiple competing builders in real time, unlocking greater speed for the blockchain.

Harmonic, a Solana infrastructure startup developing an open block-building system, has raised $6 million in a seed funding round led by Paradigm.

The round also includes an angel round from undisclosed "key Solana stakeholders," Harmonic co-founder Jakob Povšič, who is also co-founder of crypto-native research and development firm Temporal, told The Block. Povšič declined to disclose the timing of the fundraise, the round's structure, valuation, Harmonic's business model, or whether any investors took board seats in advisory or directorial roles.

What is Harmonic?

Harmonic says it is Solana’s first open block-building system that allows validators to source blocks from multiple competing builders in real time, unlocking greater speed and efficiency for the network.

In Solana's existing architecture , each validator takes turns as a leader, building and proposing blocks during their assigned slot. While efficient, this design concentrates block-level control in one operator at a time, prioritizing weighted stake over performance, according to Harmonic. The startup said it replaces that bottleneck with a coordinated aggregation layer that routes builder proposals to validators in real time, introducing structured block propagation similar to a high-frequency trading order router.

"In practice, Harmonic auctions blocks from a variety of block builders on the network, including Jito, Temporal, Jito BAM, and Paladin," Povšič said. "Validators then receive the best blocks based on the criteria they set. For example, a validator might prefer blocks without toxic [maximal extractable value], while another might focus on maximizing revenue. Harmonic's open marketplace makes this flexibility possible while maintaining Solana’s high speed and throughput."

Nasdaq speed to Solana?

Povšič described Harmonic as bringing Nasdaq-style block routing to crypto. "Harmonic brings Solana closer to being the onchain Nasdaq," he said.

For Solana to reach 1 million transactions per second, it needs healthy competition and tools focused on improving the network, he noted.

"Harmonic complements upcoming network upgrades, such as higher compute limits and can enforce ACE [application-controlled execution], which gives smart contracts programmable control over trade ordering and settlement," Povšič said.

Povšič further said that Harmonic’s infrastructure will help Solana outcompete centralized exchanges and popular perpetual futures venues. Meanwhile, Harmonic said leading ecosystem participants have already switched to its system, but Povšič declined to name them.

"Harmonic’s open aggregation model transforms Solana’s block production into a continuously optimized and competitive marketplace," said Frankie, investing and research partner at Paradigm. "The result is exchange-grade performance capable of approaching Nasdaq speed in both reliability and throughput."

Harmonic has a core team of about 10 members based in New York City, Povšič said, declining to comment on hiring or growth plans.

The Funding newsletter: Stay on top of the latest crypto VC funding and M&A deals, news, and trends with my free bi-monthly newsletter, The Funding. Sign up here !

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Top 10 DeFAI Projects: $PAAL and $SWARMS Leads the Pack by Social Activity

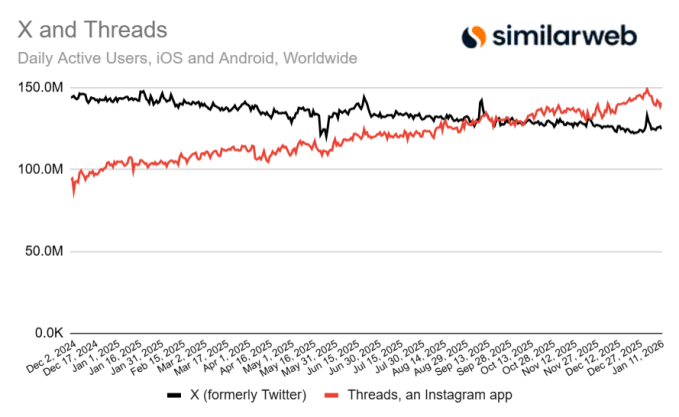

Threads surpasses X in daily mobile user count, according to recent data

ConocoPhillips Offers a 3.42% Yearly Dividend, Yet Selling Puts Could Earn Investors 1.5% Each Month