Changpeng Zhao Burns $490K in Meme Coins

- Changpeng Zhao burned $490,000 of unsolicited meme coins.

- Action emphasizes transparency in managing public donation addresses.

- Event led to speculative trading activity in the crypto market.

Changpeng Zhao (CZ) burned $490,000 in unsolicited meme coins from his donation wallet, including QUQ, SIREN, and BNBCARD. Sentiments varied, some praised his transparent handling while others speculated on market implications for reduced supply.

Changpeng Zhao, former CEO of Binance, announced via Twitter/X the burn of $490,000 worth of unsolicited meme coins from his publicly disclosed donation address.

CZ’s move underscores transparency and deliberate management of unsolicited coins in the crypto world. The burn highlights accountability for public addresses.

Binance Founder Takes Bold Action

Changpeng Zhao, Binance founder, took bold action by burning unsolicited meme coins after receiving them at his designated BNB-only donation address. The burn affected QUQ, SIREN, and BNBCARD, collectively worth approximately $490,000, and was publicly disclosed via social media, generating considerable attention from the crypto community.

Commitment to Wallet Hygiene

CZ’s decision to burn these assets rather than hold or sell reflects a commitment to wallet hygiene and transparent asset management. His statement implied future market actions if unsolicited tokens are received, indicating possible market sales to mitigate unwanted token accumulation.

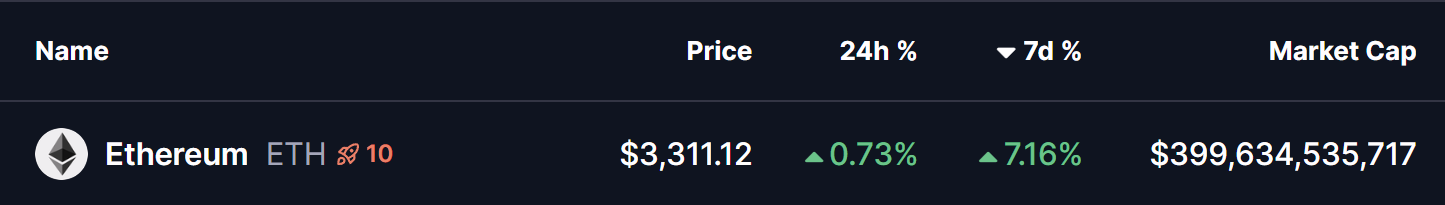

This occurrence primarily impacted meme coins on the Binance Smart Chain. Major cryptocurrencies like ETH and BTC were unaffected directly, though QUQ, SIREN, and BNBCARD experienced speculative trading activity. No official statements from regulators have been made regarding this action.

The event reduced the supply of the affected meme coins, leading to potential short-term trading fluctuations as the market absorbed the news. Historically, similar actions have generated considerable trading activities, with traders reacting to reduced token availability, momentarily affecting liquidity.

Previous wallet cleanses by Zhao and other high-profile figures in the crypto space suggest industry leaders are increasingly addressing unsolicited token influxes through public and transparent means. Whether future burns will involve similar tokens remains a question of market readiness and evolving industry norms.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum (ETH) Price Prediction: Could Bulls Trigger a Breakout Above $4,000 Next Week?

SHIB Holds Steady Despite Surging Burn Activity – Rebound Next?

With $100M Backing the Live ZKP Presale Auction, Early Buyers Are Aiming for 1,000x to 10,000x Gains

Hyperliquid ($HYPE) Leads Top Derivatives Projects by Social Activity