Japanese Bitcoin Company Metaplanet Says 0.2% of Japan Now Owns Its Shares

Japan’s growing enthusiasm for digital assets just hit a remarkable milestone. Metaplanet Inc., a publicly listed bitcoin treasury company, has revealed that nearly 0.2% of Japan’s population are now shareholders of the firm. The statement from CEO Simon Gerovich signals how quickly bitcoin-related companies are entering the mainstream investment mindset in Japan.

The announcement comes as Japan continues to emerge as one of Asia’s most crypto-friendly economies. Once considered a conservative financial market, the country now finds itself at the center of innovation in digital finance. Metaplanet’s bold bitcoin-centric model represents a cultural shift , where traditional investors are beginning to see bitcoin as more than a speculative asset, but a foundation for corporate and personal wealth.

This new wave of interest underscores the rapid Japan bitcoin adoption curve that has been unfolding since 2024. Retail investors, once cautious, are now seeking exposure through regulated and publicly listed firms like Metaplanet, marking a decisive step toward mass-market acceptance.

JUST IN: 🇯🇵 Japanese Bitcoin treasury company Metaplanet CEO says, “Almost 0.2% of all Japanese are now shareholders of the company.”

Japan is embracing Bitcoin 🚀 pic.twitter.com/fb50utSdiQ

Why 0.2% of Japanese Investors Are Joining Metaplanet

First, Metaplanet’s listing on Japan’s stock exchange made it easy for ordinary investors to participate in a bitcoin-focused company without directly buying crypto. Many Japanese prefer this indirect method of Japan bitcoin adoption because it offers transparency, compliance, and reduced exposure to the complexities of crypto wallets and exchanges.

Second, the company’s messaging, positioning bitcoin as the cornerstone of a long-term corporate reserve, has resonated deeply with young professionals and tech-savvy investors. They view Metaplanet’s stock as a safer gateway into the digital asset ecosystem.

Third, Metaplanet’s public communications have consistently emphasized education and transparency, building trust among new investors. Its regular reports about Metaplanet shareholders and bitcoin accumulation provide reassurance that the company’s focus is long-term and strategic rather than speculative.

The Rise of Japan’s Corporate Bitcoin Strategy

Metaplanet’s actions have sparked conversations across Japan’s financial and tech sectors. This is about whether other corporations might follow a similar corporate bitcoin strategy. By holding bitcoin as part of their balance sheets, companies can potentially protect themselves from fiat currency fluctuations while aligning with global digital asset trends.

This transition is true of Metaplanet alone. Japan has increased regulatory clarity, financial literacy, and overall support for innovation, providing favorable conditions for bitcoin initiatives. The government has maintained a steady movement toward licensing exchanges, monitoring adherence to rules and laws, and as a result, building a level of trust for potential investors that may not have otherwise engaged in cryptocurrency efforts.

The company’s strategy has also drawn international attention. With analysts calling it one of the most ambitious bitcoin accumulation programs outside the United States. If Metaplanet continues to expand its treasury and retail base, Japan could emerge as a model for how a regulated market integrates digital assets into mainstream corporate finance.

What’s Next for Metaplanet and Japan’s Bitcoin Future

Metaplanet’s growing popularity among Japanese investors could inspire other companies to explore bitcoin-backed treasury strategies. If more firms follow, Japan might soon see a wave of corporate bitcoin strategy adoption , positioning the country as a global leader in digital finance integration.

This moment reflects more than just investment enthusiasm. It captures a national shift in how Japan views value, technology, and financial sovereignty. With nearly 0.2% of Japanese citizens now invested in Metaplanet, the nation’s path toward broader bitcoin acceptance appears more inevitable than ever.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Outrageous levels of student debt are putting immense pressure on the UK’s economy

MetYa Taps Catto Verse to Integrate AI-Led Meme Intelligence to Crypto Industry

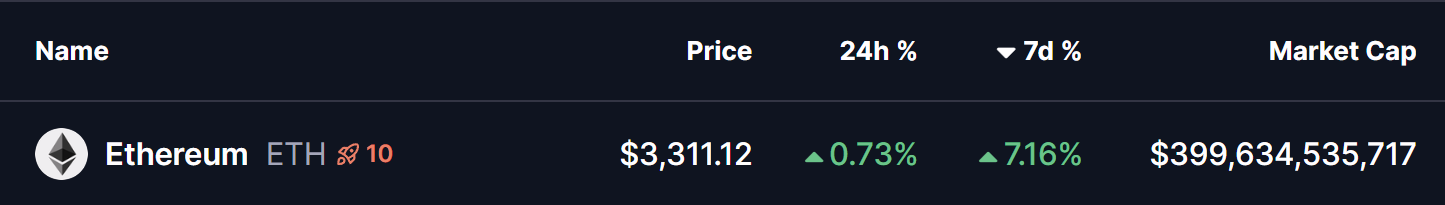

Ethereum (ETH) Price Prediction: Could Bulls Trigger a Breakout Above $4,000 Next Week?

SHIB Holds Steady Despite Surging Burn Activity – Rebound Next?