Date: Wed, Nov 12, 2025 | 05:40 PM GMT

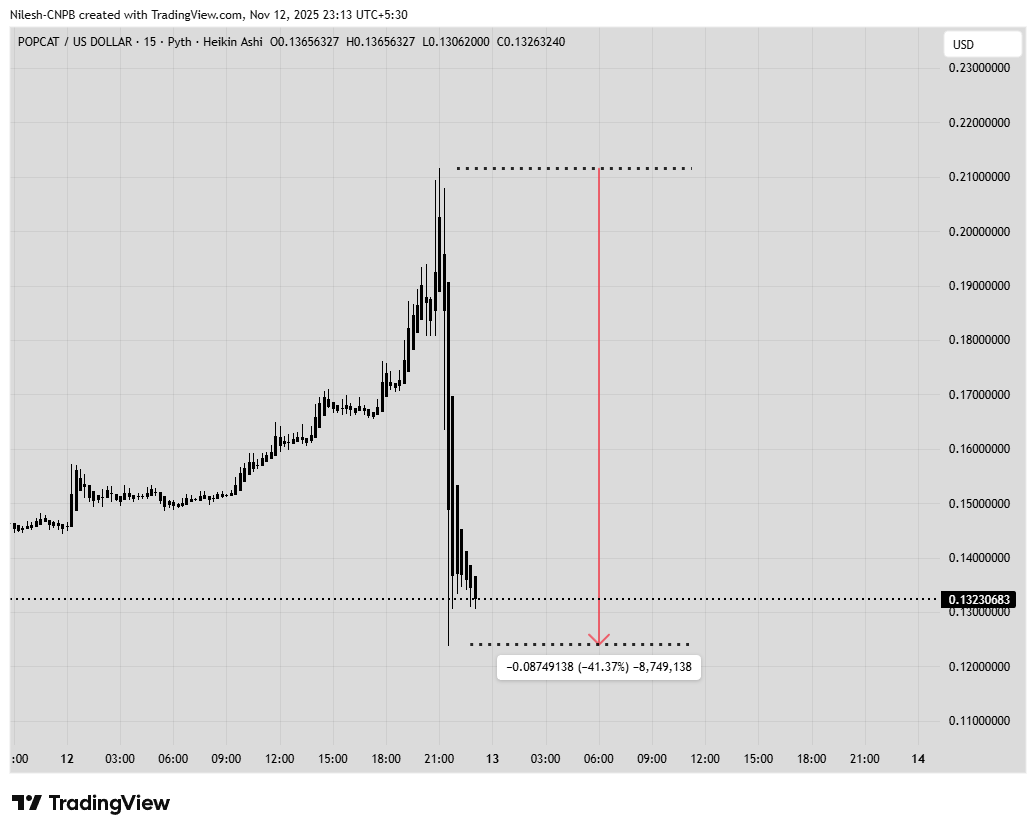

In the past few hours, Popcat (POPCAT) — the Solana-based token inspired by the viral “popping cat” meme — has experienced a brutal 40% crash, tumbling from $0.21 to a low of $0.1237.

POPCAT 15MIN Chart/Coinsprobe (Source: Tradingview)

POPCAT 15MIN Chart/Coinsprobe (Source: Tradingview)

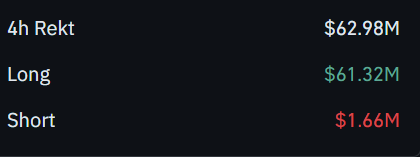

The sudden sell-off has triggered more than $61.32 million in long liquidations across major exchanges in the last four hours, sending shockwaves through the traders and wiping out a wave of leveraged positions in the process.

Source: Coinglass

Source: Coinglass

The Crash Setup

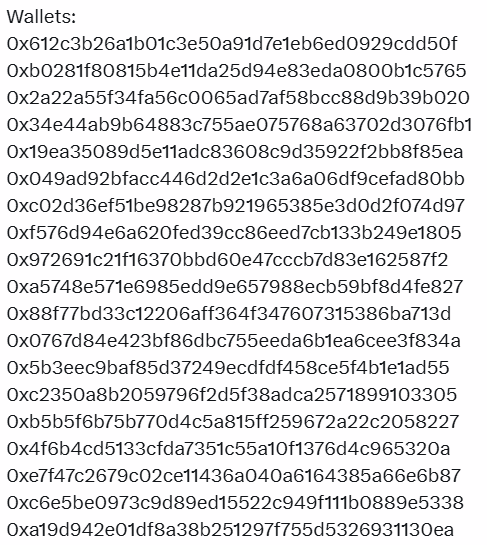

According to insights shared by @mlmabc on X, roughly 13 hours before the crash, an unknown trader withdrew $3 million USDC from OKX and distributed the funds across 19 wallets, suggesting a large coordinated move.

Source: @mlmabc (X)

Source: @mlmabc (X)

By 14:45 UTC, the trader began aggressively longing POPCAT, placing roughly $20 million worth of buy orders near the $0.21 level. With heavy leverage — estimated around 10× — the combined long exposure eventually ballooned to nearly $30 million across those wallets.

To support the price, the trader also set up an enormous buy wall worth eight figures — a large pending buy order placed just below the market to create the illusion of strong demand at $0.21. Such buy walls often provide psychological support, encouraging other traders to buy or hold.

The Collapse

However, once the trader removed that buy wall, the illusion of demand instantly disappeared. With no visible support left on the order book, selling pressure surged, and POPCAT’s price collapsed within seconds.

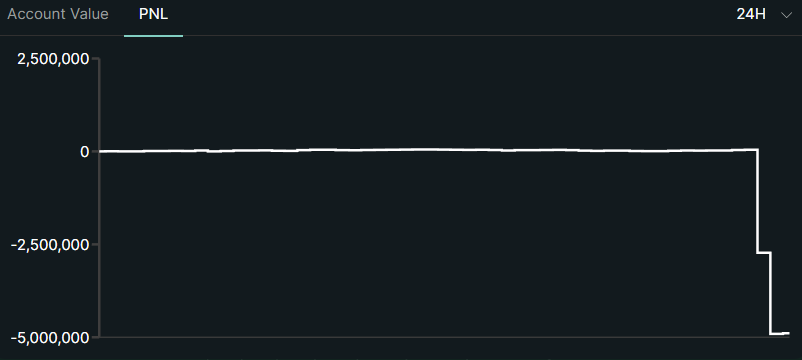

The trader’s entire $20–30 million leveraged position was liquidated almost instantly, forcing Hyperliquid’s liquidity provider (HLP) to take over the massive position. POPCAT continued to dump further, resulting in an additional $4.9 million loss for HLP before Hyperliquid manually closed the trade.

HLP Vault Data/Source: hyperliquid

HLP Vault Data/Source: hyperliquid

At the time of writing, POPCAT is struggling to stabilize near $0.13, down around 40% in the past 24 hours, as traders closely monitor one of the most dramatic liquidation events in recent meme coin history.