- PENGU surged 13%, becoming one of the top-performing memecoins alongside PEPE.

- Breakout supported by strong volume, momentum shift, and accumulation from long-term holders.

- The Memecoin sector shows early recovery, but BTC weakness could still reverse gains.

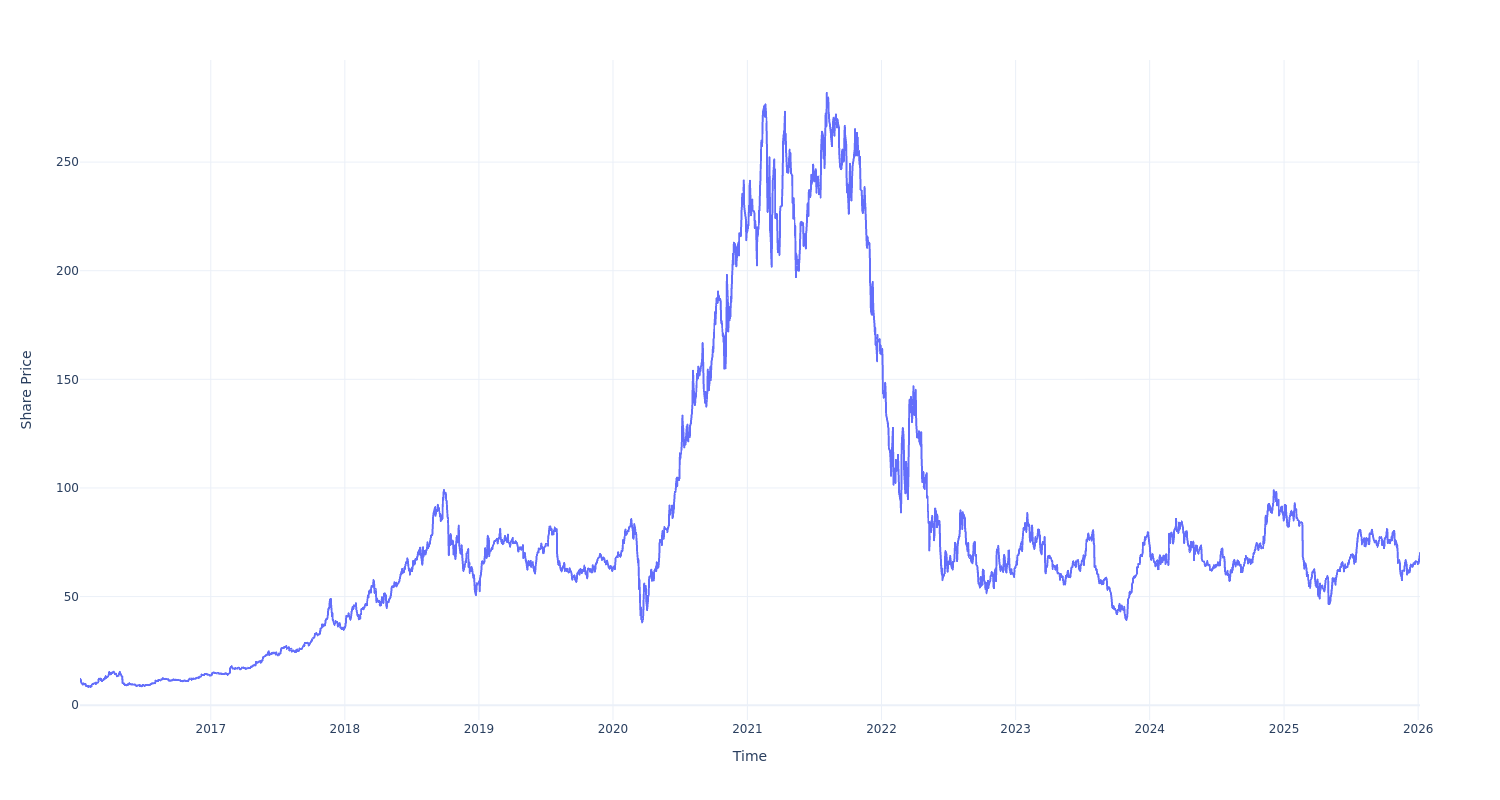

Pudgy Penguins — PENGU, has captured trader attention with a sudden surge of more than 13% in just 24 hours. This impressive move placed the memecoin among the top daily performers, trailing only PEPE, and highlighted renewed enthusiasm in the memecoin sector. The timing of the breakout is notable, arriving as the broader cryptocurrency market recovered after a challenging Q4 in 2025. Momentum returned sharply, surprising those who had been sidelined, and sparked questions about whether early 2026 could signal a broader trend reversal for meme-driven assets.

PENGU Breakout Hints at Renewed Risk Appetite

Pudgy Penguins had traded within a tight range for weeks, bouncing between $0.008547 and $0.009646 since mid-December. This prolonged sideways movement suggested that sellers were tiring while buyers were quietly accumulating. Eventually, buying pressure overcame resistance, pushing the price above the consolidation zone and signaling a structural shift. The breakout appeared robust, with the Momentum indicator flipping from negative to positive, indicating that short-term buyers had regained control.

On Balance Volume (OBV) reinforced the bullish narrative. The OBV climbed above $36 billion, reflecting strong capital inflows and suggesting that new money was entering the memecoin. Liquidation data also supported the strength of the move, with short positions worth roughly $265,000 wiped out, while long liquidations remained minimal.

Such imbalances often fuel continuation moves and point to trader conviction rather than fleeting speculation. Confirmed trading volume on major exchanges added credibility, showing that both spot and futures markets were actively participating in the rally.

Memecoins Respond Faster Than Broader the Altcoin Market

On-chain activity offers further insight. Dune Analytics data shows that sales among PENGU holders slowed dramatically, dropping to 878 from previous highs of 39,160. This indicates that accumulation has replaced distribution, reducing capital outflows and supporting upward pressure. Interestingly, the memecoin sector has responded faster than broader altcoins during this early rebound.

MacroCRG reported an 11% surge in meme assets overall, while larger, capped altcoins underperformed, signaling rotation toward more speculative, high-volatility tokens. Bitcoin weakness still poses a risk to the rally. Another sudden drop in BTC could quickly reverse gains, given memecoins’ historically sharp reactions to market swings. However, if the current momentum holds, early-year price action may set the stage for larger gains as Q1 unfolds.

The movements of PENGU and PEPE suggest that traders are ready to chase strength, potentially fueling renewed optimism in a sector that often leads during initial recoveries. Bears remain present beneath the surface, but the current bullish pressure gives traders reason for cautious optimism.