One of the “Big Four” Companies Decides to Invest in Cryptocurrency – A Historic Event

According to the Financial Times, with the Donald Trump administration in the US adopting a more positive approach towards digital assets, PricewaterhouseCoopers (PwC), one of the “Big Four” auditing firms, has decided to increase its investments in the cryptocurrency sector.

The company has made a strategic shift in this area, where it had maintained a cautious approach for many years.

PwC US President Paul Griggs stated in an interview that this transformation began last year. According to Griggs, the appointment of crypto-friendly regulators in the US and Congress’s adoption of new legislation covering digital assets, particularly stablecoins, were decisive factors in shaping PwC’s approach.

Griggs stated that the regulatory framework, particularly the GENIUS Act and stablecoins, would increase confidence in the market, saying, “The regulatory details for stablecoins will strengthen confidence in these products and asset class. Asset tokenization will inevitably continue to evolve, and PwC needs to be a part of this ecosystem.”

This new development reveals that the Trump administration’s steps towards cryptocurrency policies have encouraged even established and large-scale companies that previously stayed away from the digital asset market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Australia’s CPI inflation rate is anticipated to ease in November

Stablecoin Market Tops $317 Billion as USDT Tightens Its Grip in Early 2026

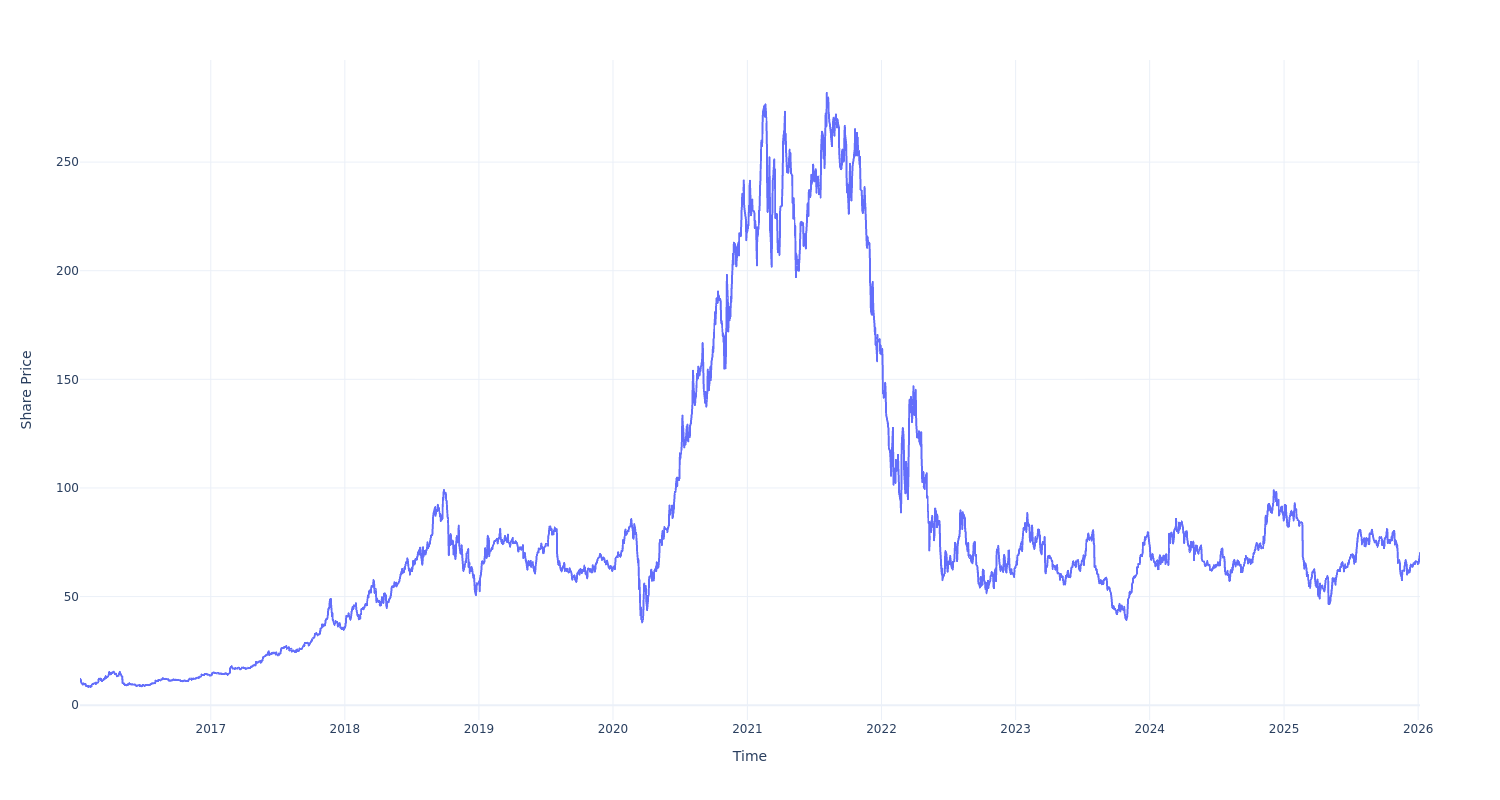

Here's What $100 Invested in Block a Decade Ago Would Amount to Now

The Subtle Ways Inflation Continues to Impact Your Finances