PwC embraces crypto as US regulations ease under Trump administration

Big Four accounting firm PwC is moving into the crypto space after years of maintaining a cautious distance, supported by a pro-crypto environment fostered by the Donald Trump administration.

- PwC is now engaging with crypto clients across audit and consulting, amidst a more favorable US policy stance.

- The firm has advised companies on using stablecoins and tokenization to improve operational efficiency.

“We are never going to lean into a business that we haven’t equipped ourselves to deliver. Over the last 10 to 12 months, as we’ve taken on more opportunities in that digital assets arena, we’ve bolstered our resource pool inside and outside,” PwC U.S. Senior Partner and CEO Paul Griggs told the Financial Times.

According to Griggs, the Trump administration’s embrace of cryptocurrencies has reassured blue-chip businesses that previously hesitated to get involved, many of which had been sidelined due to the regulatory uncertainty.

“Whether we are doing work in the audit space or doing work in the consulting arena, we do all the above in crypto. We see more and more opportunities coming our way,” he added.

Trump’s crypto focus supported PwC’s move

Historically, PwC and other major accounting firms maintained a conservative posture, largely due to the regulatory grey area that made risk assessment and compliance a complicated undertaking.

Before Trump’s reelection, the crypto industry faced constant resistance from Washington, often marked by aggressive enforcement actions against digital asset firms. But that changed after the introduction of clearer regulations, such as the GENIUS Act and the subsequent dropping of several high-profile cases, which were largely perceived as a regulatory nod to the legitimacy of the sector.

For PwC, these moves triggered its strategic reversal, and the firm has since been actively pitching companies on how they can use crypto technologies, such as stablecoins, to improve operational efficiency.

“The GENIUS Act and the regulatory rulemaking around stablecoin I expect will create more conviction around leaning into that product and that asset class,” Griggs said.

“The tokenisation of things will certainly continue to evolve as well. PwC has to be in that ecosystem.”

The firm, which has taken on crypto clientele like bitcoin miner Mara Holdings, has also been recruiting senior talent such as Cheryl Lesnik, who returned to PwC after spending three years focused exclusively on crypto clients.

Other firms like KPMG and Deloitte have also made similar moves over the past year, which goes to show that digital assets are steadily becoming part of mainstream finance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Altcoins Season 2026 Looms: 5 Undervalued Tokens That Could Deliver Explosive 50x Gains

Australia’s CPI inflation rate is anticipated to ease in November

Stablecoin Market Tops $317 Billion as USDT Tightens Its Grip in Early 2026

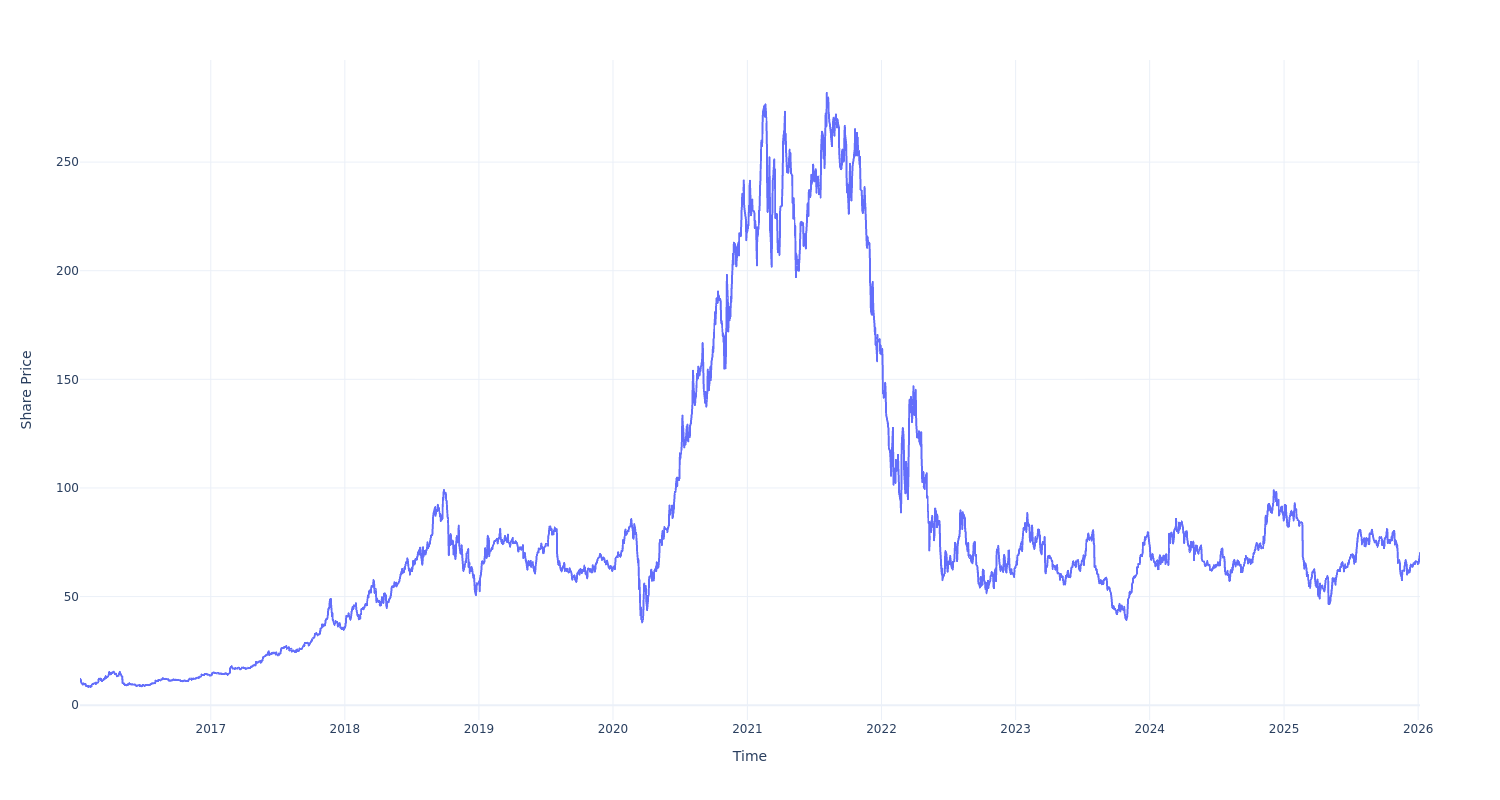

Here's What $100 Invested in Block a Decade Ago Would Amount to Now